Question

Deep Water Experts Company want to expand its retail business into the GCC countries. Before doing that, it needs to have clear picture about companys

Deep Water Experts Company want to expand its retail business into the GCC countries. Before doing that, it needs to have clear picture about companys current situation as well as its strengths and weaknesses, to determine whether the company is ready for this ambitious plan. That is why you have to conduct analysis of companys financial ratios.

You are requested to do following things:

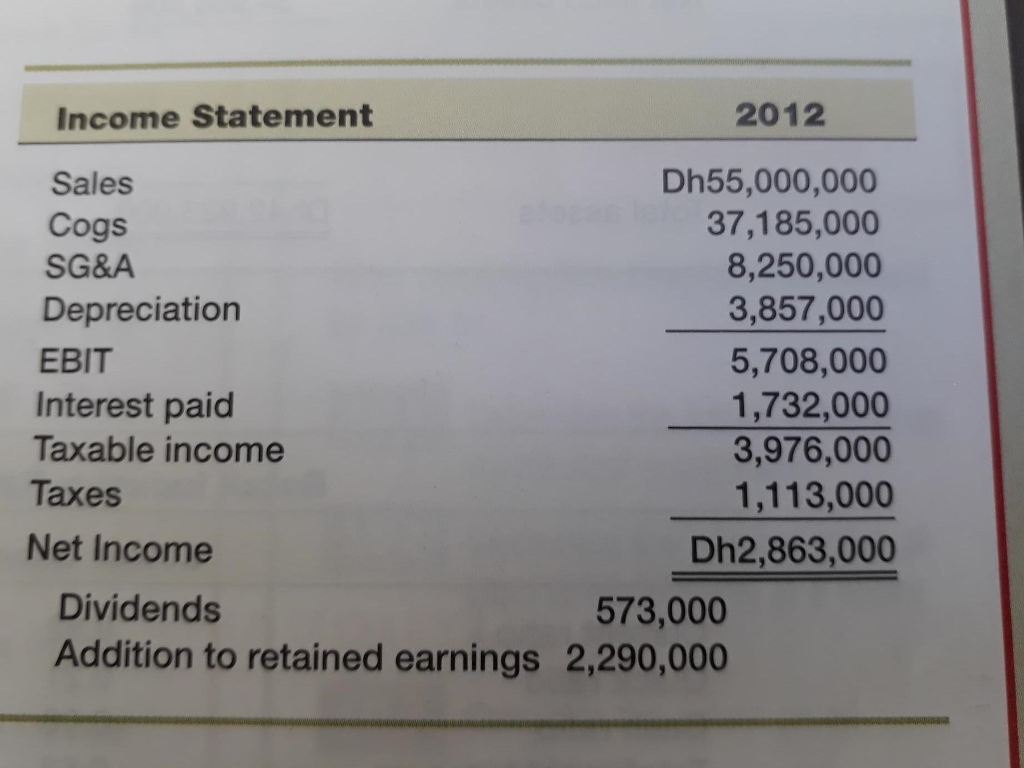

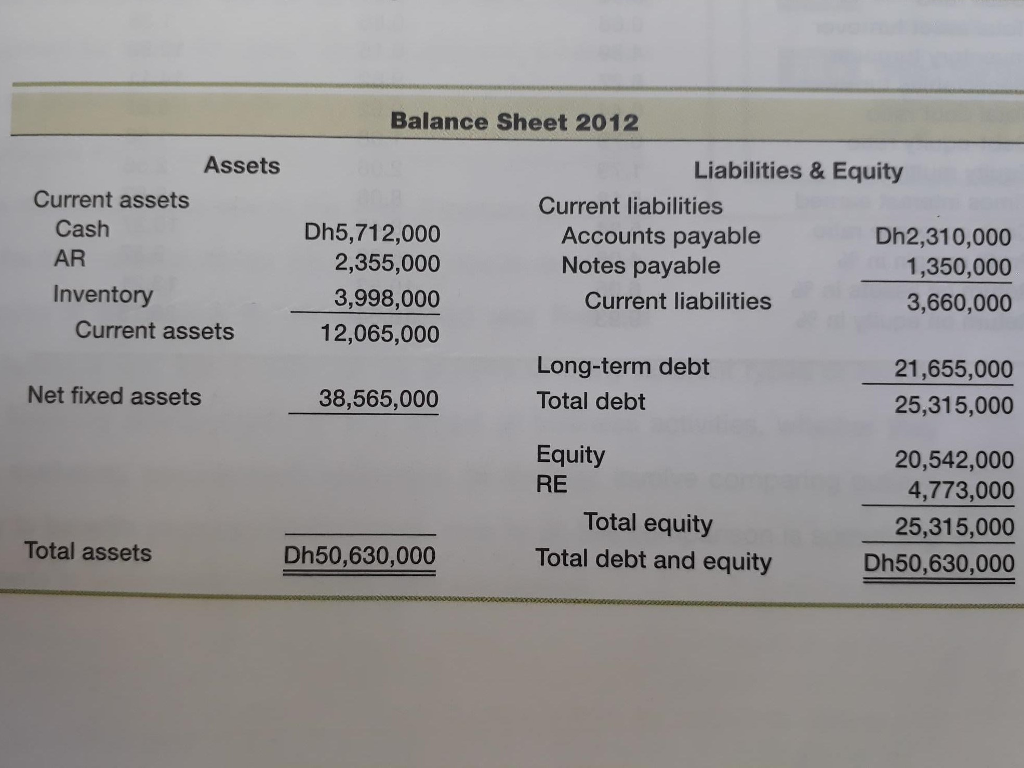

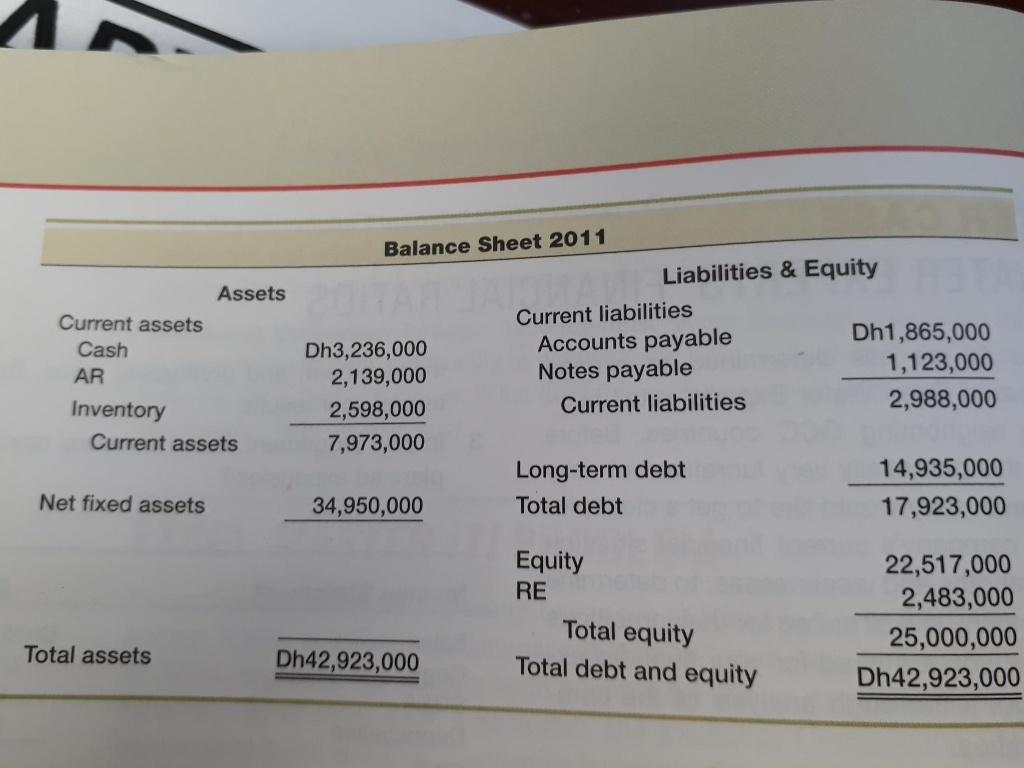

1. Compute deep water experts financial ratios for 2011 and 2012. briefly interpret the change in the company liquidity, leverage , assets managment , profitability ratios

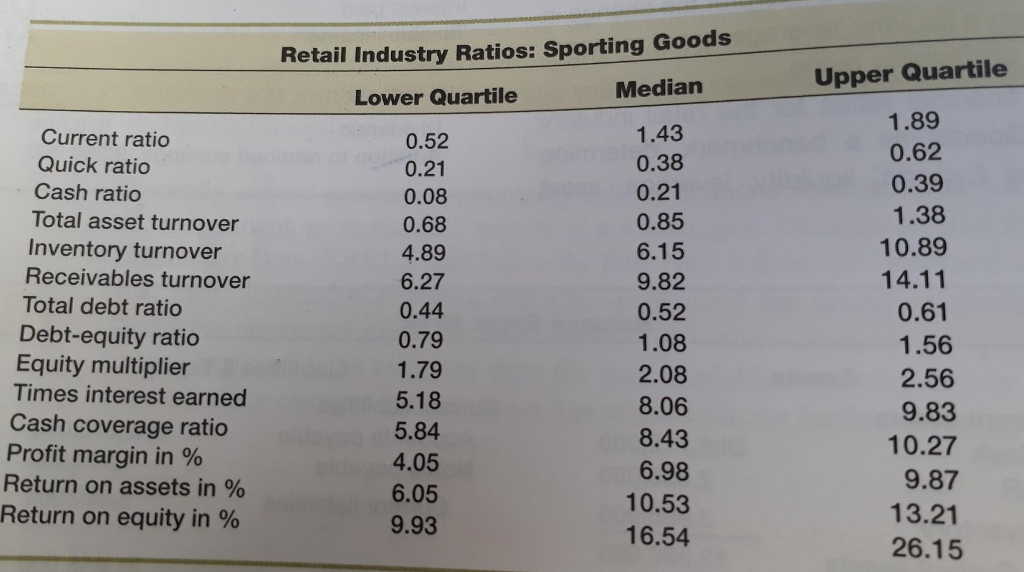

2. Using the financial ratios for the retail industry (sporting goods) as a benchmark , determine deep water experts liquidity , leverage , assets managment and profitability ratio. briefly interpret your result .

3. Based on your judgment and prior analysis, Is the company ready for the planned expansion or not?

there is no income statement for 2011

Retail Industry Ratios: Sporting Goods Upper Quartile Median Lower Quartile 1.43 0.38 0.21 0.85 6.15 9.82 0.52 1.08 2.08 8.06 8.43 6.98 10.53 16.54 1.89 0.62 0.39 1.38 10.89 14.11 0.61 1.56 2.56 9.83 10.27 9.87 13.21 26.15 Current ratio 0.52 0.21 0.08 0.68 4.89 6.27 0.44 0.79 1.79 5.18 5.84 4.05 6.05 9.93 Quick ratio Cash ratio Total asset turnover Inventory turnover Receivables turnover Total debt ratio Debt-equity ratio Equity multiplier Times interest earned Cash coverage ratio Profit margin in % Return on assets in % Return on equity in % Income Statement 2012 Sales Cogs SG&A Depreciation EBIT Interest paid Taxable income Taxes Dh55,000,000 37,185,000 8,250,000 3,857,000 5,708,000 1,732,000 3,976,000 1,113,000 Dh2,863,000 Net Income Dividends Addition to retained earnings 2,290,000 573,000 Balance Sheet 2012 Assets Liabilities & Equity Current assets Current liabilities Cash AR Inventory Dh5,712,000 2,355,000 3,998,000 12,065,000 Dh2,310,000 1,350,000 3,660,000 Accounts payable Notes payable Current liabilities Current assets Long-term debt Total debt 21,655,000 25,315,000 Net fixed assets 38,565,000 Equity RE Total equity Total debt and equity 20,542,000 4,773,000 25,315,000 Dh50,630,000 Total assets Dh50,630,000 Balance Sheet 2011 Liabilities & Equity Assets Current assets Current liabilities Dh1,865,000 Cash AR Inventory Dh3,236,000 2,139,000 2,598,000 7,973,000 Accounts payable Notes payable 1,123,000 2,988,000 14,935,000 17,923,000 22,517,000 Current liabilities Current assets Long-term debt Total debt Net fixed assets 34,950,000 Equity RE 2,483,000 Total equity Total debt and equity 25,000,000 Dh42,923,000 Total assets Dh42,923,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started