Question

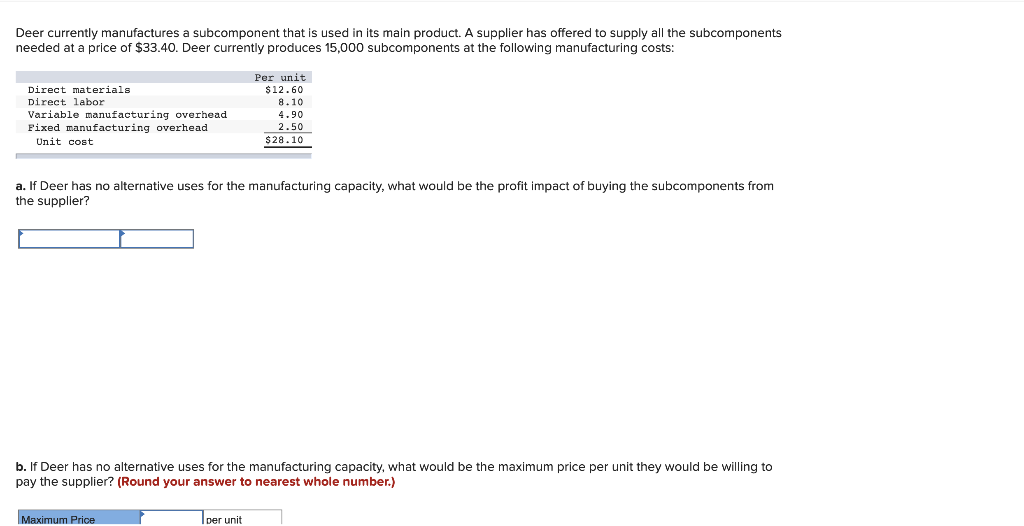

Deer currently manufactures a subcomponent that is used in its main product. A supplier has offered to supply all the subcomponents needed at a price

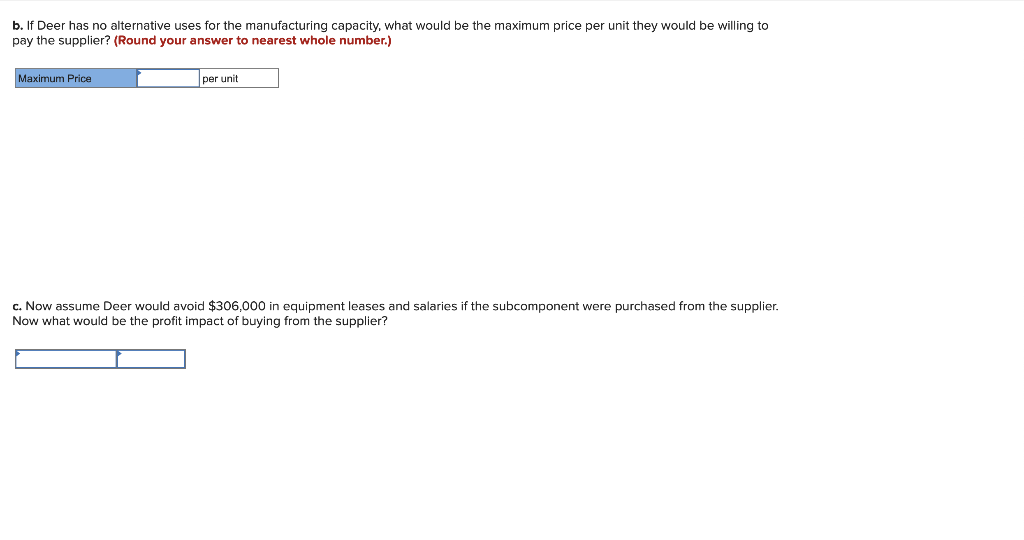

Deer currently manufactures a subcomponent that is used in its main product. A supplier has offered to supply all the subcomponents needed at a price of $33.40. Deer currently produces 15,000 subcomponents at the following manufacturing costs: Per unit Direct materials $ 12.60 Direct labor 8.10 Variable manufacturing overhead 4.90 Fixed manufacturing overhead 2.50 Unit cost $ 28.10 a. If Deer has no alternative uses for the manufacturing capacity, what would be the profit impact of buying the subcomponents from the supplier? b. If Deer has no alternative uses for the manufacturing capacity, what would be the maximum price per unit they would be willing to pay the supplier? (Round your answer to nearest whole number.) c. Now assume Deer would avoid $306,000 in equipment leases and salaries if the subcomponent were purchased from the supplier. Now what would be the profit impact of buying from the supplier?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started