Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 3 (12 marks) Turner Company purchased 70 percent of Split Company's shares approximately 20 years ago. On 1 January, 2019, Turner purchased a building

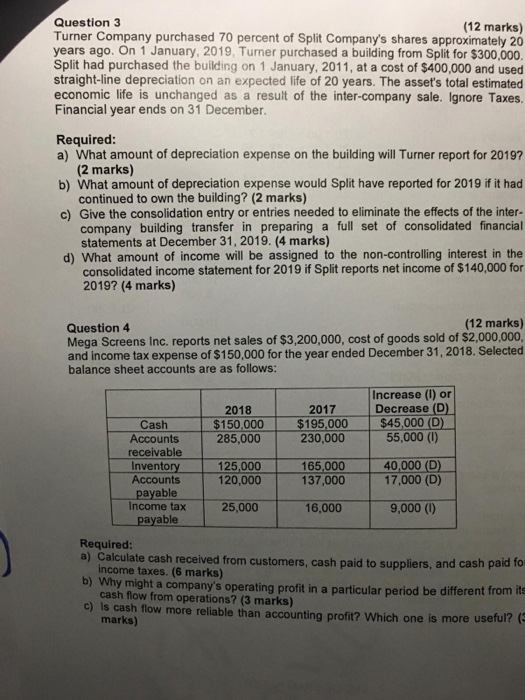

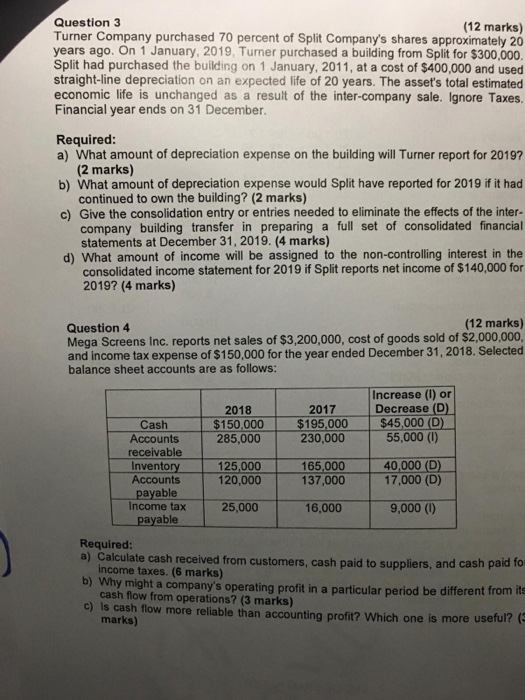

Question 3 (12 marks) Turner Company purchased 70 percent of Split Company's shares approximately 20 years ago. On 1 January, 2019, Turner purchased a building from Split for $300,000. Split had purchased the building on 1 January, 2011, at a cost of $400,000 and used straight-line depreciation on an expected life of 20 years. The asset's total estimated economic life is unchanged as a result of the inter-company sale. Ignore Taxes. Financial year ends on 31 December. Required: a) What amount of depreciation expense on the building will Turner report for 2019? (2 marks) b) What amount of depreciation expense would Split have reported for 2019 if it had continued to own the building? (2 marks) c) Give the consolidation entry or entries needed to eliminate the effects of the inter- company building transfer in preparing a full set of consolidated financial statements at December 31, 2019. (4 marks) d) What amount of income will be assigned to the non-controlling interest in the consolidated income statement for 2019 if Split reports net income of $140,000 for 2019? (4 marks) (12 marks) Question 4 Mega Screens Inc. reports net sales of $3,200,000, cost of goods sold of $2,000,000, and income tax expense of $150,000 for the year ended December 31, 2018. Selected balance sheet accounts are as follows: Increase (I) or Decrease (D) $45,000 (D) 55,000 (I) 2017 2018 $150,000 285,000 $195,000 230,000 Cash Accounts receivable Inventory Accounts 40,000 (D) 17,000 (D) 125,000 120,000 165,000 137,000 payable Income tax payable 9,000 (I) 25,000 16,000 Required: a) Calculate cash received from customers, cash paid to suppliers, and cash paid fo income taxes. (6 marks) b) Why might a company's operating profit in a particular period be different from its cash flow from operations? (3 marks) c) Is cash flow more reliable than accounting profit? Which one is marks) more useful? (3

Question 3 (12 marks) Turner Company purchased 70 percent of Split Company's shares approximately 20 years ago. On 1 January, 2019, Turner purchased a building from Split for $300,000. Split had purchased the building on 1 January, 2011, at a cost of $400,000 and used straight-line depreciation on an expected life of 20 years. The asset's total estimated economic life is unchanged as a result of the inter-company sale. Ignore Taxes. Financial year ends on 31 December. Required: a) What amount of depreciation expense on the building will Turner report for 2019? (2 marks) b) What amount of depreciation expense would Split have reported for 2019 if it had continued to own the building? (2 marks) c) Give the consolidation entry or entries needed to eliminate the effects of the inter- company building transfer in preparing a full set of consolidated financial statements at December 31, 2019. (4 marks) d) What amount of income will be assigned to the non-controlling interest in the consolidated income statement for 2019 if Split reports net income of $140,000 for 2019? (4 marks) (12 marks) Question 4 Mega Screens Inc. reports net sales of $3,200,000, cost of goods sold of $2,000,000, and income tax expense of $150,000 for the year ended December 31, 2018. Selected balance sheet accounts are as follows: Increase (I) or Decrease (D) $45,000 (D) 55,000 (I) 2017 2018 $150,000 285,000 $195,000 230,000 Cash Accounts receivable Inventory Accounts 40,000 (D) 17,000 (D) 125,000 120,000 165,000 137,000 payable Income tax payable 9,000 (I) 25,000 16,000 Required: a) Calculate cash received from customers, cash paid to suppliers, and cash paid fo income taxes. (6 marks) b) Why might a company's operating profit in a particular period be different from its cash flow from operations? (3 marks) c) Is cash flow more reliable than accounting profit? Which one is marks) more useful? (3

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started