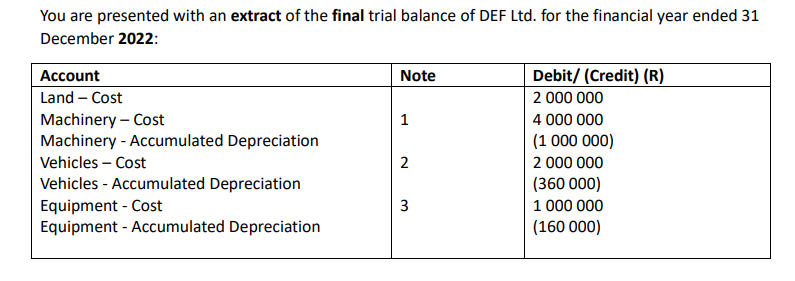

DEF Ltd. is a manufacturing company that produces custom-made furniture. The company's year-end is 31 December. You are presented with an extract of the final

DEF Ltd. is a manufacturing company that produces custom-made furniture. The company's year-end is 31 December. You are presented with an extract of the final trial balance of DEF Ltd. for the financial year ended 31 December 2022:  The following information still needs to be recorded for the current financial year ending 31 December 2023:

The following information still needs to be recorded for the current financial year ending 31 December 2023:

Notes:

1. Machinery The existing machinery is depreciated using the straight-line depreciation method over a period of 8 years, with no residual value. On 1 February 2023, the company purchased a new laser cutting machine for R2 500 000. In addition, installation costs of R50 000 were incurred. The manager in charge of overseeing the installation of the machine received a monthly salary of R40 000. The machine was ready for use on 1 March 2023. The useful life of the laser cutting machine is 5 years, with no residual value, and the straight-line depreciation method will be applied. This machine has a shorter life span than the rest of the machinery of the business. On 1 August 2023, the company imported a new CNC machine from Germany for 200,000, FOB shipping point. The exchange rate on that day was R16: 1. The shipment arrived at Cape Town harbour on 1 September 2023. The exchange rate on that day was R17: 1. On 1 September 2023, the company incurred additional costs of R25 000 for customs duties and shipping. The company started using the machine on 1 September 2023. The CNC machine has a useful life of 8 years and no residual value. The straight-line depreciation method is applicable.

2. Vehicles Existing vehicles are depreciated using the straight-line depreciation method over a period of 5 years, with a residual value of 10% on the total cost price. On 1 May 2023, the company purchased and started using a new delivery truck for R400 000. The truck has a useful life of 5 years and a residual value of R40 000. The straight-line depreciation method is applicable.

3. Equipment Existing equipment is depreciated using the diminishing balance method at a rate of 20% per year, with a residual value of R100 000. On 1 October 2023, the company purchased an improvement part on the existing equipment in the factory for R330 000, with a residual value of R30 000. The part was successfully installed and fully functional on the same day. The replacement part is depreciated using the diminishing balance method at a rate of 20% per year.

Additional information:

- Ignore VAT.

- The company has credit terms established with all of its suppliers and purchases all assets exclusively on credit.

REQUIRED:

2.1 Prepare the general ledger account for Machinery-Cost of DEF Ltd. for the financial year ended 31 December 2023. The account must be closed off. (8marks)

2.2 Prepare the general ledger account for Machinery - Accumulated Depreciation of MachineryAsset of DEF Ltd. for the financial year ended 31 December 2023. The account must be closed off. (14marks)

2.3 Prepare all the general journal entries to account for all vehicle-related transactions of DEF Ltd. for the financial year ended 31 December 2023. (10marks)

2.4 Prepare all the general journal entries to account for all equipment-related transactions of DEF Ltd. for the financial year ended 31 December 2023. (10marks)

2.5 Prepare the reconciliation note for Property, Plant, and Equipment, focusing specifically on the Machinery category only as at 31 December 2023. (8marks)

You are presented with an extract of the final trial balance of DEF Ltd. for the financial year ended 31 December 2022Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started