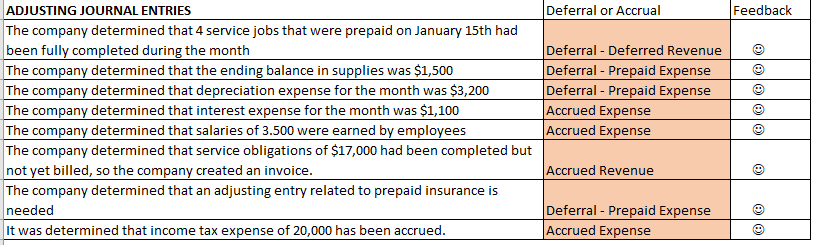

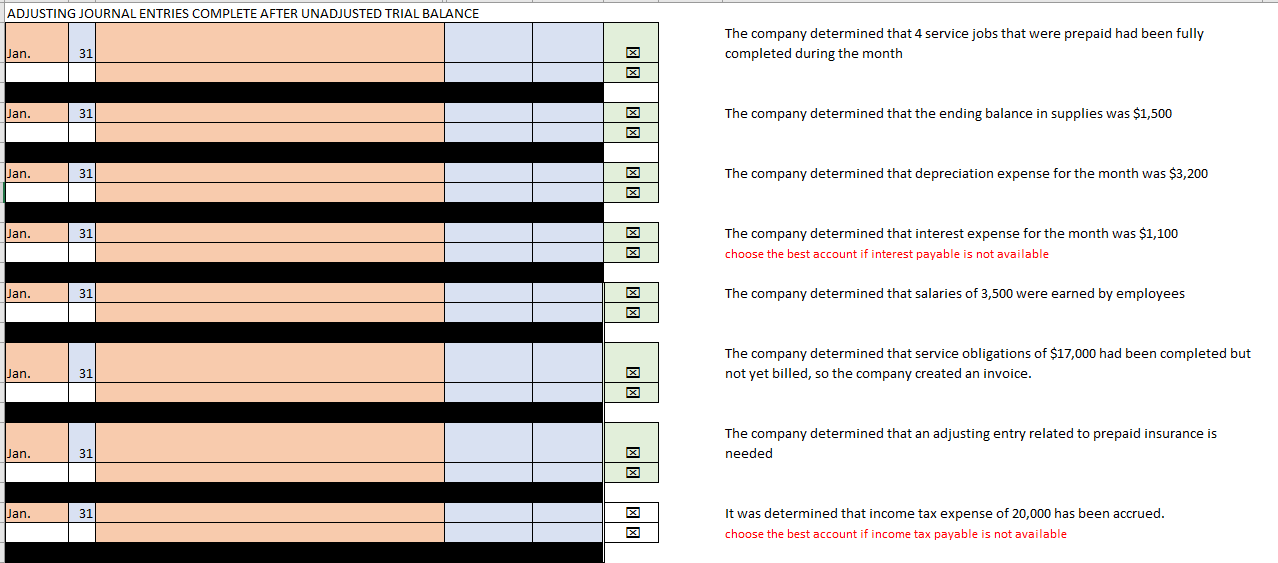

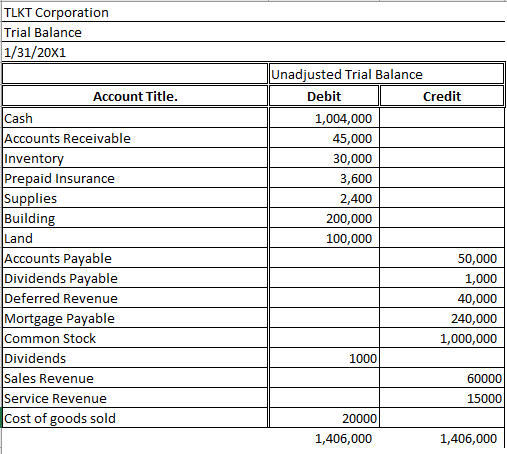

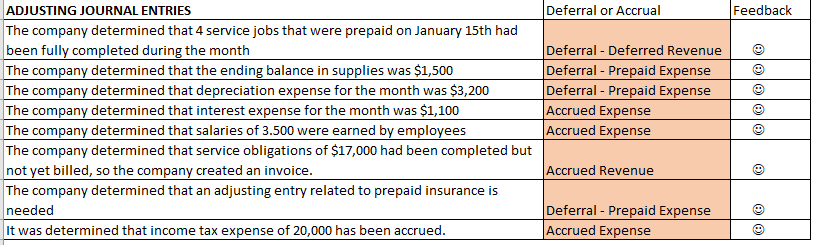

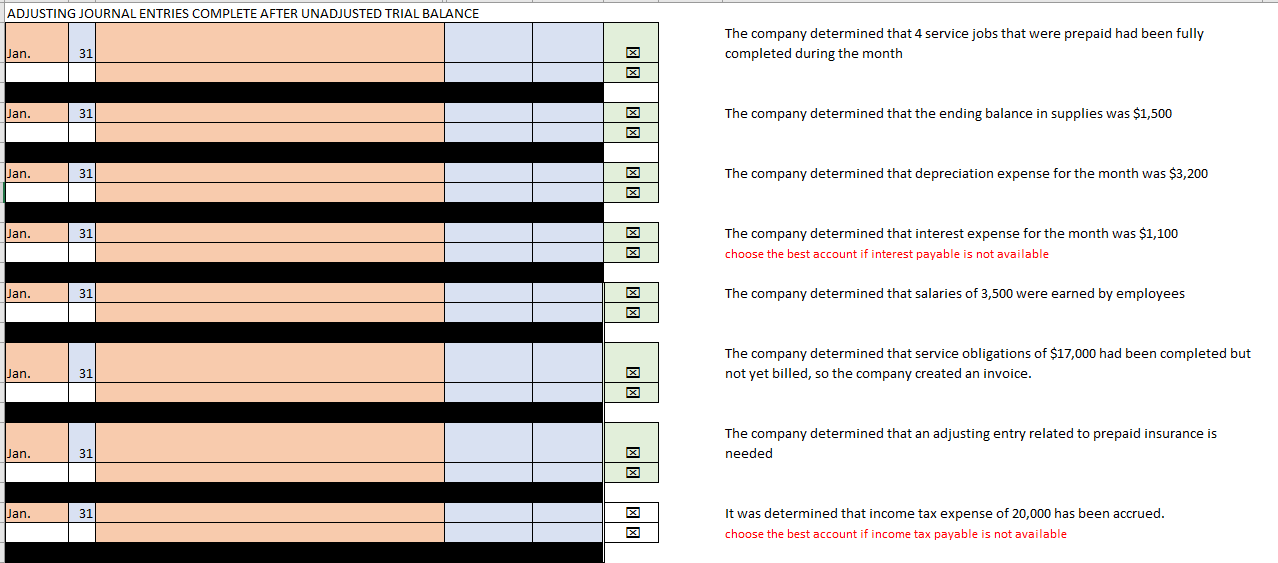

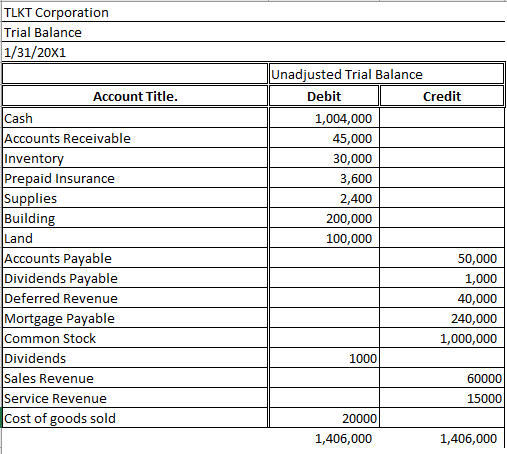

Deferral or Accrual Feedback @ ADJUSTING JOURNAL ENTRIES The company determined that 4 service jobs that were prepaid on January 15th had been fully completed during the month The company determined that the ending balance in supplies was $1,500 The company determined that depreciation expense for the month was $3,200 The company determined that interest expense for the month was $1,100 The company determined that salaries of 3.500 were earned by employees The company determined that service obligations of $17,000 had been completed but not yet billed, so the company created an invoice. The company determined that an adjusting entry related to prepaid insurance is needed It was determined that income tax expense of 20,000 has been accrued. Deferral - Deferred Revenue Deferral - Prepaid Expense Deferral - Prepaid Expense Accrued Expense Accrued Expense Accrued Revenue Deferral - Prepaid Expense Accrued Expense @ ADJUSTING JOURNAL ENTRIES COMPLETE AFTER UNADJUSTED TRIAL BALANCE The company determined that 4 service jobs that were prepaid had been fully completed during the month Pan. 31 X Jan. 31 The company determined that the ending balance in supplies was $1,500 Jan. 31 The company determined that depreciation expense for the month was $3,200 Jan. 31 The company determined that interest expense for the month was $1,100 choose the best account if interest payable is not available X Jan. 31 X The company determined that salaries of 3,500 were earned by employees The company determined that service obligations of $17,000 had been completed but not yet billed, so the company created an invoice. Jan. 31 The company determined that an adjusting entry related to prepaid insurance is needed Pan. 31 Pan. 31 It was determined that income tax expense of 20,000 has been accrued. choose the best account if income tax payable is not available TLKT Corporation Trial Balance 1/31/20X1 Account Title. Cash Accounts Receivable Inventory Prepaid Insurance Supplies Building Land Accounts Payable Dividends Payable Deferred Revenue Mortgage Payable Common Stock Dividends Sales Revenue Service Revenue Cost of goods sold Unadjusted Trial Balance Debit Credit 1,004,000 45,000 30,000 3,600 2,400 200,000 100,000 50,000 1,000 40,000 240,000 1,000,000 1000 60000 15000 20000 1,406,000 1,406,000