Answered step by step

Verified Expert Solution

Question

1 Approved Answer

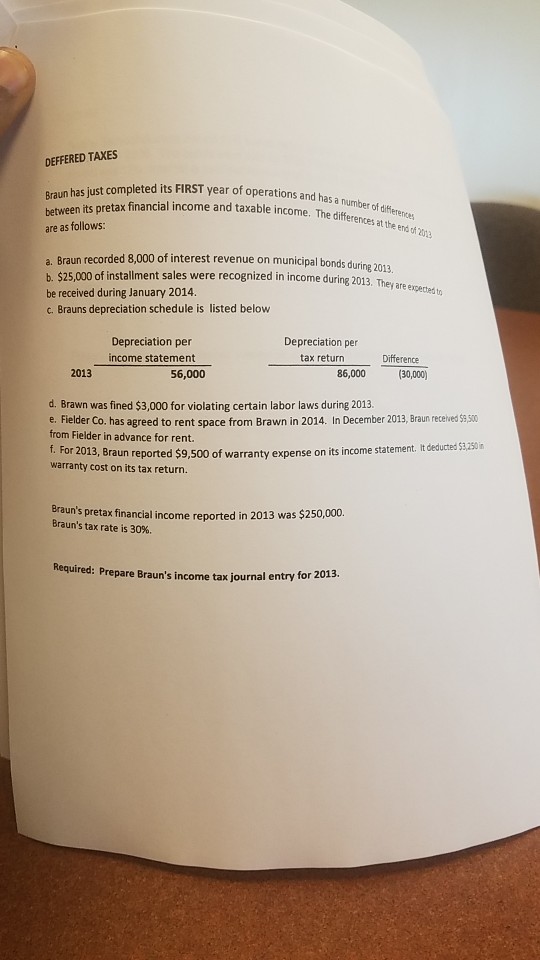

DEFFERED TAXES Braun has just completed its FIRST year of operations and between its pretax financial income and taxable income. The c are as follows

DEFFERED TAXES Braun has just completed its FIRST year of operations and between its pretax financial income and taxable income. The c are as follows has a number of differences differences at the end of 203 recorded 8,000 of interest revenue on municipal bonds during 2013, a. Braun b. $25,000 of installment sales were recognized in income during 2013. be received during January 2014. c. Brauns depreciation schedule is listed below Depreciation per income statement Depreciation per tax return Difference 2013 56,000 86,000 (30,000) d. Brawn was fined $3,000 for violating certain labor laws during 2013. e. Fielder Co. has agreed to rent space from Brawn in 2014. In December 2013, Braun recerved $9,500 from Fielder in advance for rent. it deducted $3,250 f. For 2013, Braun reported $9,500 of warranty expense on its income statement. warranty cost on its tax return. Braun's pretax financial Braun's tax rate is 30%. income reported in 2013 was $250,000. Required: Prepare Braun's income tax journal entry for 2013 DEFFERED TAXES Braun has just completed its FIRST year of operations and between its pretax financial income and taxable income. The c are as follows has a number of differences differences at the end of 203 recorded 8,000 of interest revenue on municipal bonds during 2013, a. Braun b. $25,000 of installment sales were recognized in income during 2013. be received during January 2014. c. Brauns depreciation schedule is listed below Depreciation per income statement Depreciation per tax return Difference 2013 56,000 86,000 (30,000) d. Brawn was fined $3,000 for violating certain labor laws during 2013. e. Fielder Co. has agreed to rent space from Brawn in 2014. In December 2013, Braun recerved $9,500 from Fielder in advance for rent. it deducted $3,250 f. For 2013, Braun reported $9,500 of warranty expense on its income statement. warranty cost on its tax return. Braun's pretax financial Braun's tax rate is 30%. income reported in 2013 was $250,000. Required: Prepare Braun's income tax journal entry for 2013

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started