Using the Texas Instruments Inc. 2015 annual report and financial statements , define economic value and explain how an adjusted book value approach to valuing

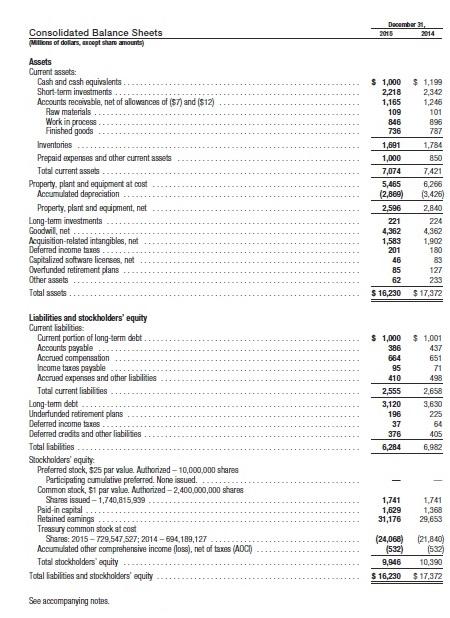

Using the Texas Instruments Inc. 2015 annual report and financial statements , define economic value and explain how an adjusted book value approach to valuing assets and liabilities moves book value nearer to economic value. You are required to provide a written response which highlights four specific elements in Texas Instruments’ balance sheet that might need to be adjusted to arrive at an economic value.

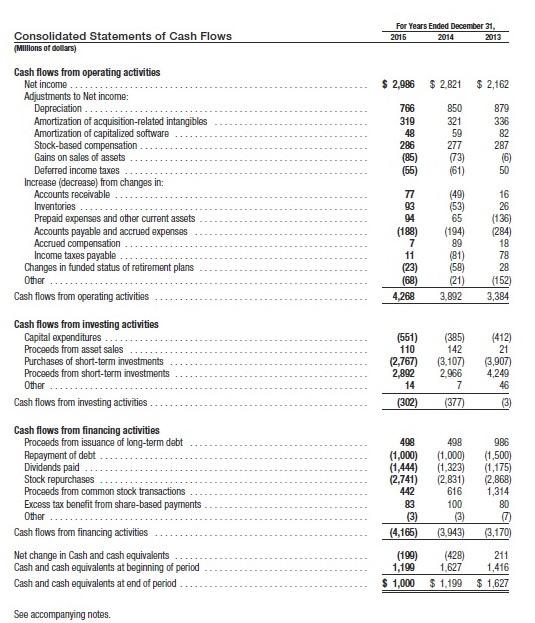

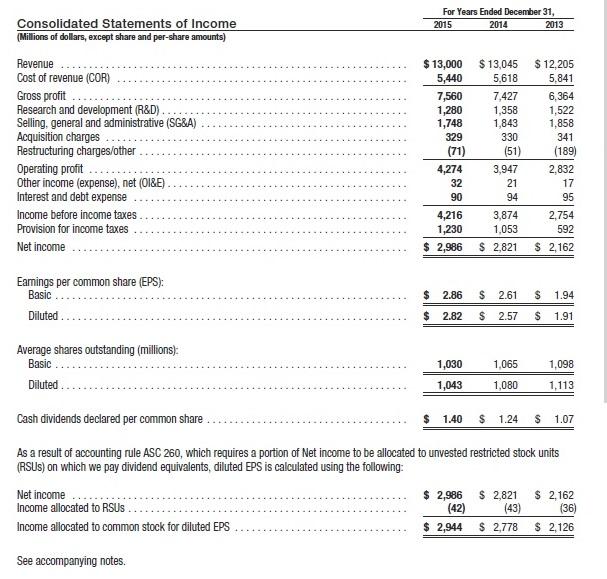

Calculate the following market multiple ratios for Texas Instruments Inc. at its 2015 financial year-end:

i. WACC

ii. ROI

Docember 31. Consolidated Balance Sheets 2015 2014 Mlions of dollars, Ecopt sharn amounts) Assets Current assets: Cash and cash equivalents. Short term investments Accounts receivable, net of allowances of ($7) and ($12) Raw materials $ 1,000 2,218 1,165 109 $ 1,199 2,342 1,246 Work in process Finished goods 101 896 787 846 736 Inventories 1,691 1.784 Prepaid axpenses and other current assets Total current assets. 1,000 850 7,074 7,421 Property, plant and equipment at cost Accumulated depreciation 5,465 6,266 (2,869) (3,426) Property, plant and equipment, net Long-tem investments Goodwill, net Acquisition-related intangibles, net Deferrad income taxes Capitalized software licerses, net Overfunded retirement plans Other assets 2,596 2,840 221 224 362 1,583 201 4,362 1,902 180 46 83 85 127 62 233 Total assets. 16,230 $ 17,372 Liabilities and stockholders' equity Current labilities: $ 1,000 Current portion of long-term debt Accounts payable Accrued compensation Income taxes payable Accruad expenses and other liabilities $ 1,001 386 437 664 651 95 71 410 498 Total current liabilites 2,555 2,658 Long-tom debt Underfunded retirement plans Deferred income taxes Deferred cradits and other liabilies 3,120 196 3,630 225 37 64 376 405 Total labities. Stockholders' equity: Preferred stock, $25 par value. Authorized - 10,000,000 shares Participating cumulative proferred. None issued. Common stock, $1 par value. Authorized -2,400,000,000 sharas Shares issued - 1,740,815,939 Paid-in capital Retained eamings Treasury common stock at cost Shares: 2015 - 729,547,527; 2014 -694,189,127 Accumulated other comprehensive income (loss), net of taxes (ADC) Tatal stockholders' equity 6,284 6,982 1,741 1,629 31,176 1,741 1,368 29,653 (24,068) (532) (21,840) (532) 9,946 10,390 Total labilities and stockholders' equity $ 16,230 $ 17,372 See accompanying notes.

Step by Step Solution

3.41 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

EVA Net Operating Profit After Tax WAACTotal Asset Current Liabilities EV...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started