Answered step by step

Verified Expert Solution

Question

1 Approved Answer

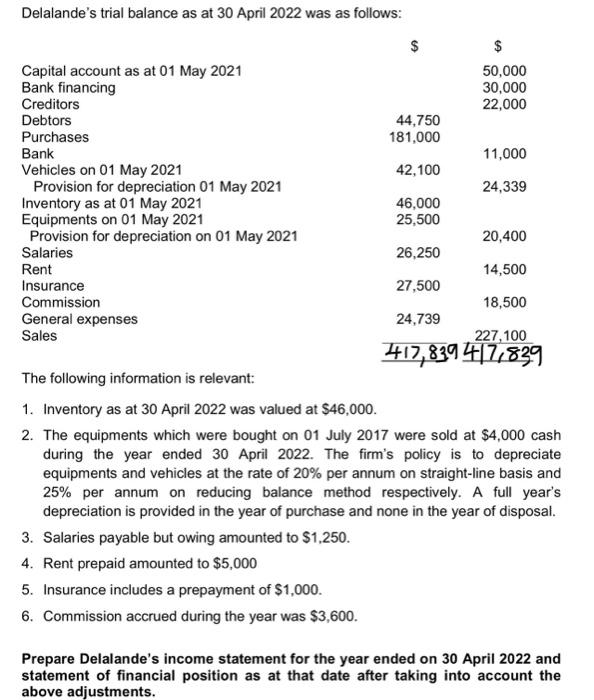

Delalande's trial balance as at 30 April 2022 was as follows: Capital account as at 01 May 2021 Bank financing Creditors Debtors Purchases Bank

Delalande's trial balance as at 30 April 2022 was as follows: Capital account as at 01 May 2021 Bank financing Creditors Debtors Purchases Bank Vehicles on 01 May 2021 Provision for depreciation 01 May 2021 Inventory as at 01 May 2021 Equipments on 01 May 2021 Provision for depreciation on 01 May 2021 Salaries Rent Insurance Commission General expenses Sales $ 4. Rent prepaid amounted to $5,000 5. Insurance includes a prepayment of $1,000. 6. Commission accrued during the year was $3,600. 44,750 181,000 42,100 46,000 25,500 26,250 27,500 24,739 $ 50,000 30,000 22,000 11,000 24,339 20,400 14,500 18,500 227,100 417,839417,839 The following information is relevant: 1. Inventory as at 30 April 2022 was valued at $46,000. 2. The equipments which were bought on 01 July 2017 were sold at $4,000 cash during the year ended 30 April 2022. The firm's policy is to depreciate equipments and vehicles at the rate of 20% per annum on straight-line basis and 25% per annum on reducing balance method respectively. A full year's depreciation is provided in the year of purchase and none in the year of disposal. 3. Salaries payable but owing amounted to $1,250. Prepare Delalande's income statement for the year ended on 30 April 2022 and statement of financial position as at that date after taking into account the above adjustments.

Step by Step Solution

★★★★★

3.45 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Delalandes Income Statement for the year ended 30 April 2022 Sales 227100 Less Cost of Goods Sold In...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started