Answered step by step

Verified Expert Solution

Question

1 Approved Answer

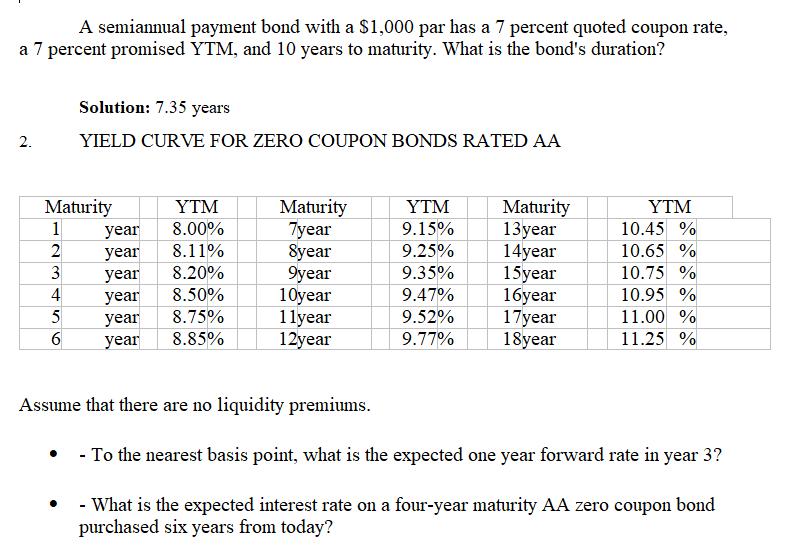

A semiannual payment bond with a $1,000 par has a 7 percent quoted coupon rate, a 7 percent promised YTM, and 10 years to

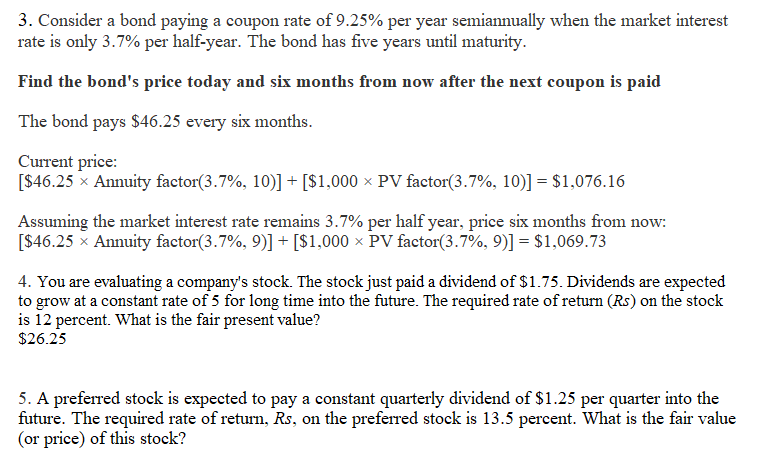

A semiannual payment bond with a $1,000 par has a 7 percent quoted coupon rate, a 7 percent promised YTM, and 10 years to maturity. What is the bond's duration? 2. 456 Solution: 7.35 years YIELD CURVE FOR ZERO COUPON BONDS RATED AA Maturity 1 2 3 6 YTM year 8.00% year 8.11% year 8.20% year 8.50% year 8.75% year 8.85% Maturity 7year Syear 9year 10year 11year 12year YTM Maturity 9.15% 13year 9.25% 14year 9.35% 15year 9.47% 16year 9.52% 17year 9.77% 18year YTM 10.45 % 10.65 % 10.75 % 10.95 % 11.00 % 11.25 % Assume that there are no liquidity premiums. - To the nearest basis point, what is the expected one year forward rate in year 3? - What is the expected interest rate on a four-year maturity AA zero coupon bond purchased six years from today? 3. Consider a bond paying a coupon rate of 9.25% per year semiannually when the market interest rate is only 3.7% per half-year. The bond has five years until maturity. Find the bond's price today and six months from now after the next coupon is paid The bond pays $46.25 every six months. Current price: [$46.25 Annuity factor(3.7%, 10)] + [$1,000 PV factor(3.7%, 10)] = $1,076.16 Assuming the market interest rate remains 3.7% per half year, price six months from nov [$46.25 Annuity factor(3.7%, 9)] + [$1,000 PV factor(3.7%, 9)] = $1,069.73 4. You are evaluating a company's stock. The stock just paid a dividend of $1.75. Dividends are expected to grow at a constant rate of 5 for long time into the future. The required rate of return (Rs) on the stock is 12 percent. What is the fair present value? $26.25 5. A preferred stock is expected to pay a constant quarterly dividend of $1.25 per quarter into the future. The required rate of return, Rs, on the preferred stock is 13.5 percent. What is the fair value (or price) of this stock?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1To calculate the expected one year forward rate in year 3 we need to use the formula 1 Y3 3 1 Y2 2 1 F21 where Y3 is the yield on a 3year AA zero cou...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started