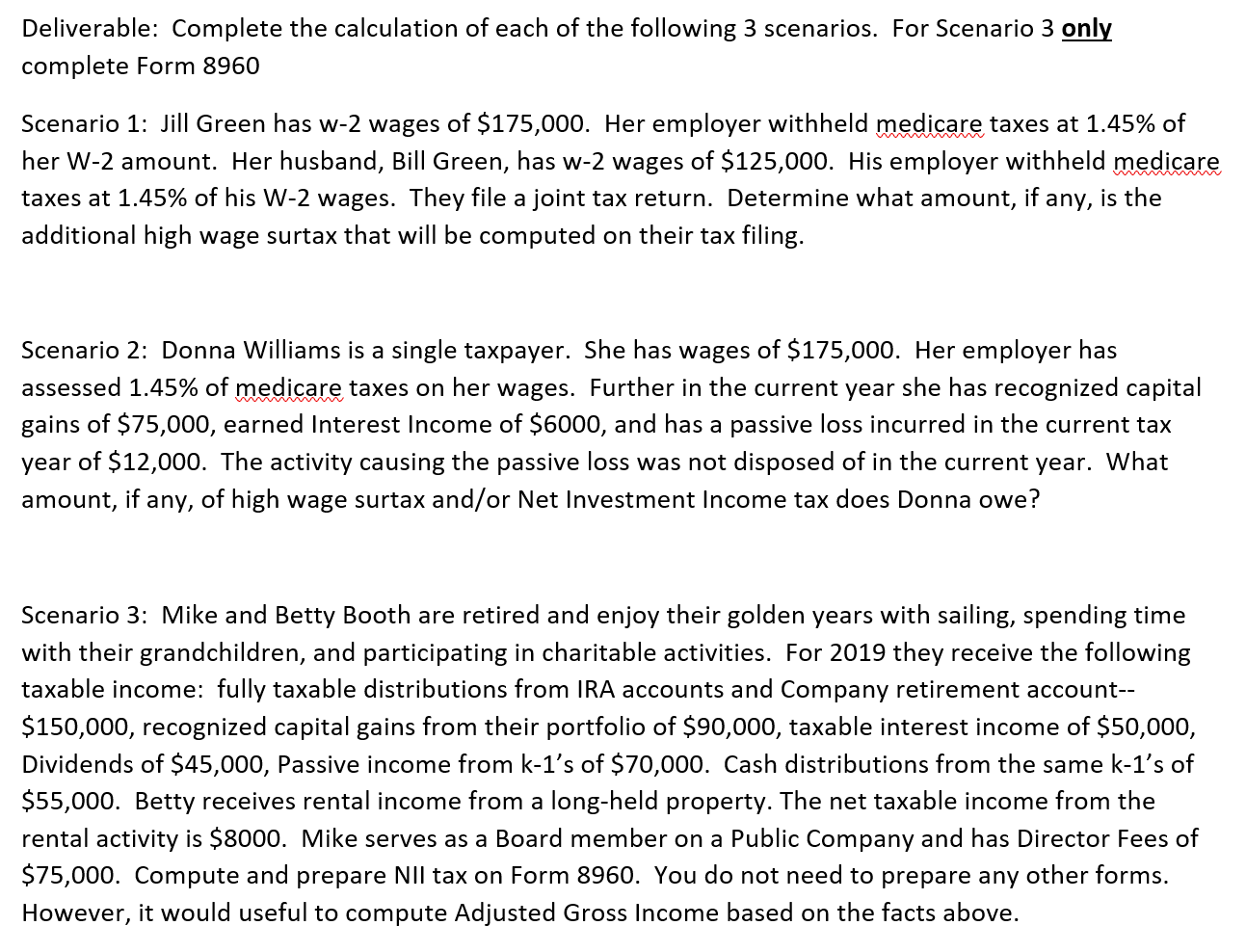

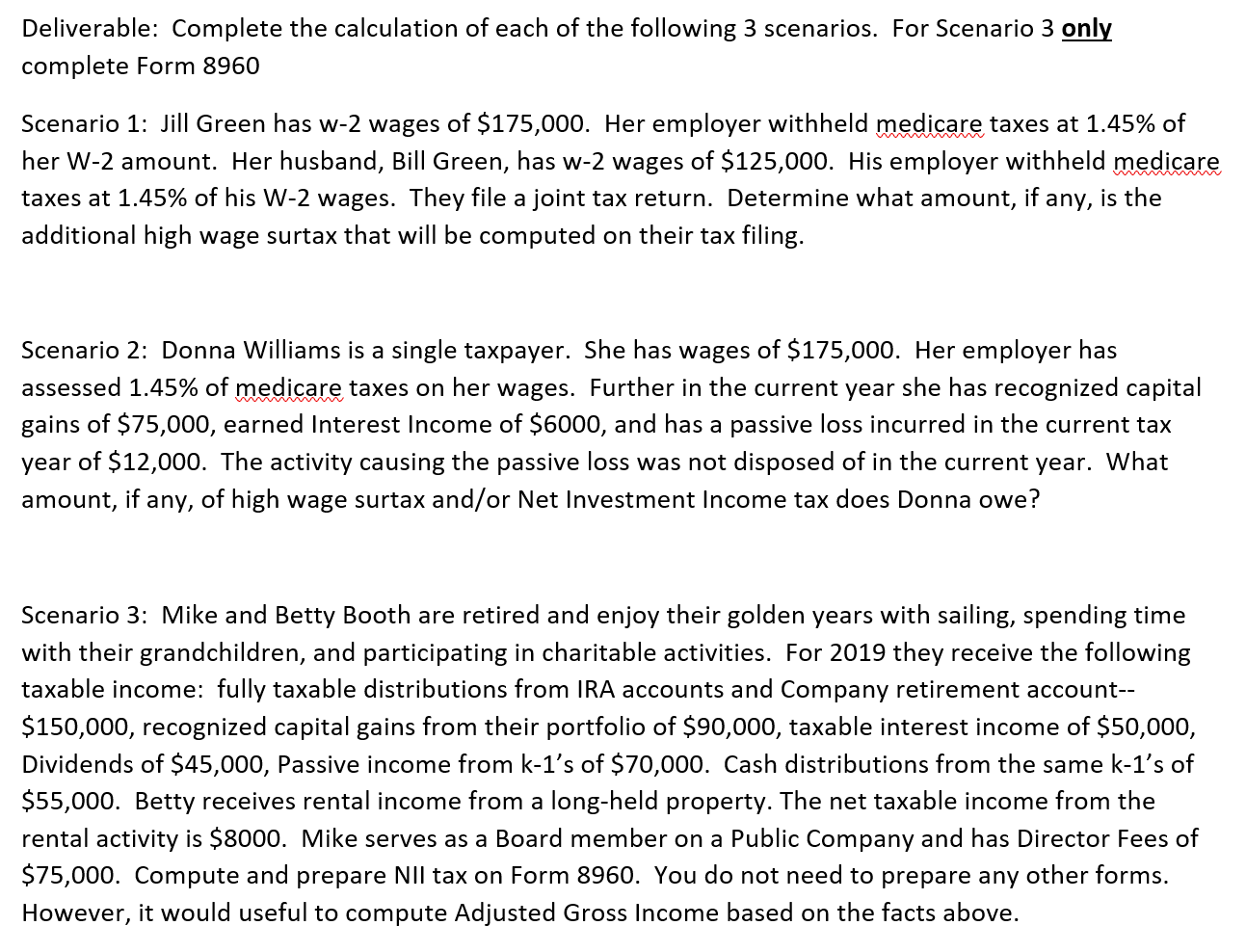

Deliverable: Complete the calculation of each of the following 3 scenarios. For Scenario 3 only complete Form 8960 Scenario 1: Jill Green has w-2 wages of $175,000. Her employer withheld medicare taxes at 1.45% of her W-2 amount. Her husband, Bill Green, has w-2 wages of $125,000. His employer withheld medicare taxes at 1.45% of his W-2 wages. They file a joint tax return. Determine what amount, if any, is the additional high wage surtax that will be computed on their tax filing. Scenario 2: Donna Williams is a single taxpayer. She has wages of $175,000. Her employer has assessed 1.45% of medicare taxes on her wages. Further in the current year she has recognized capital gains of $75,000, earned Interest Income of $6000, and has a passive loss incurred in the current tax year of $12,000. The activity causing the passive loss was not disposed of in the current year. What amount, if any, of high wage surtax and/or Net Investment Income tax does Donna owe? Scenario 3: Mike and Betty Booth are retired and enjoy their golden years with sailing, spending time with their grandchildren, and participating in charitable activities. For 2019 they receive the following taxable income: fully taxable distributions from IRA accounts and Company retirement account-- $150,000, recognized capital gains from their portfolio of $90,000, taxable interest income of $50,000, Dividends of $45,000, Passive income from k-l's of $70,000. Cash distributions from the same k-1's of $55,000. Betty receives rental income from a long-held property. The net taxable income from the rental activity is $8000. Mike serves as a Board member on a Public Company and has Director Fees of $75,000. Compute and prepare NII tax on Form 8960. You do not need to prepare any other forms. However, it would useful to compute Adjusted Gross Income based on the facts above. Deliverable: Complete the calculation of each of the following 3 scenarios. For Scenario 3 only complete Form 8960 Scenario 1: Jill Green has w-2 wages of $175,000. Her employer withheld medicare taxes at 1.45% of her W-2 amount. Her husband, Bill Green, has w-2 wages of $125,000. His employer withheld medicare taxes at 1.45% of his W-2 wages. They file a joint tax return. Determine what amount, if any, is the additional high wage surtax that will be computed on their tax filing. Scenario 2: Donna Williams is a single taxpayer. She has wages of $175,000. Her employer has assessed 1.45% of medicare taxes on her wages. Further in the current year she has recognized capital gains of $75,000, earned Interest Income of $6000, and has a passive loss incurred in the current tax year of $12,000. The activity causing the passive loss was not disposed of in the current year. What amount, if any, of high wage surtax and/or Net Investment Income tax does Donna owe? Scenario 3: Mike and Betty Booth are retired and enjoy their golden years with sailing, spending time with their grandchildren, and participating in charitable activities. For 2019 they receive the following taxable income: fully taxable distributions from IRA accounts and Company retirement account-- $150,000, recognized capital gains from their portfolio of $90,000, taxable interest income of $50,000, Dividends of $45,000, Passive income from k-l's of $70,000. Cash distributions from the same k-1's of $55,000. Betty receives rental income from a long-held property. The net taxable income from the rental activity is $8000. Mike serves as a Board member on a Public Company and has Director Fees of $75,000. Compute and prepare NII tax on Form 8960. You do not need to prepare any other forms. However, it would useful to compute Adjusted Gross Income based on the facts above