Question

Della Valle Inc. is a company that manufactured footwear out of a factory in Kalamazoo, Michigan. Della Valle has been in business since 2016 and

Della Valle Inc. is a company that manufactured footwear out of a factory in Kalamazoo, Michigan.

Della Valle has been in business since 2016 and sells three different types of sneakers to major retailers in the United States.

Della Valle reports its financial results on a divisional basis. Currently, the three brands of sneakers that Della Valle produces, and sells are the Smash Hit, the Air Max and the Hogan.

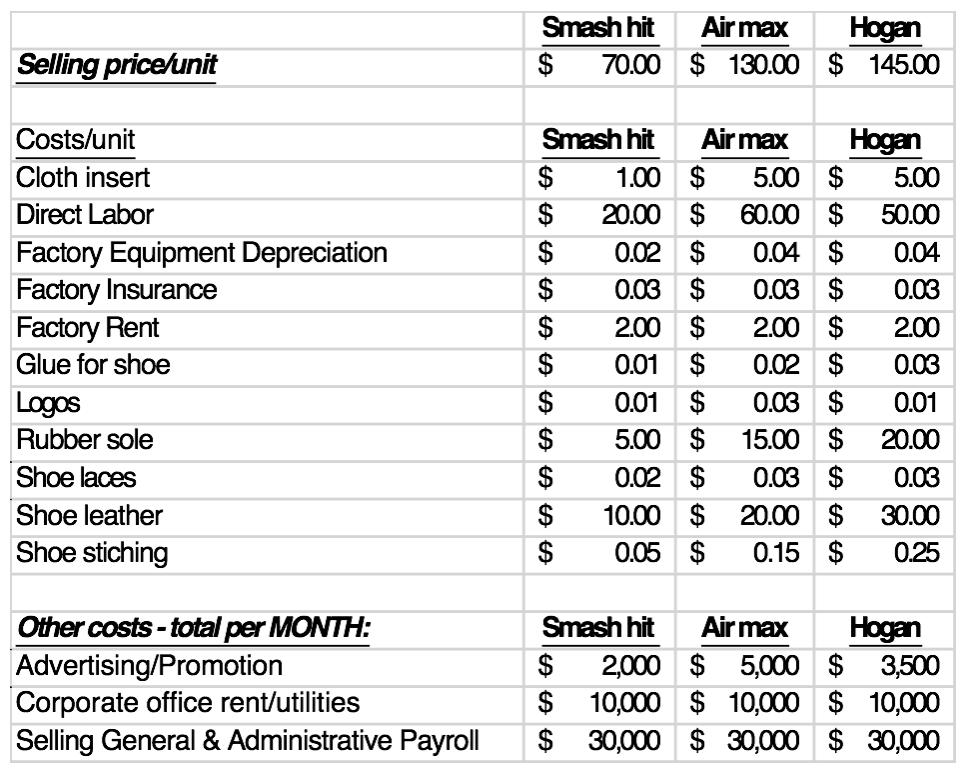

Della Valle’s financial team has been working on a cost budget modeling by division for 2019. Below is the most recent selling price and cost information for Della Valle as of the beginning of 2019.

In addition, you have been given the following information for year 2019:

- You do not have to factor in income taxes for Della Valle

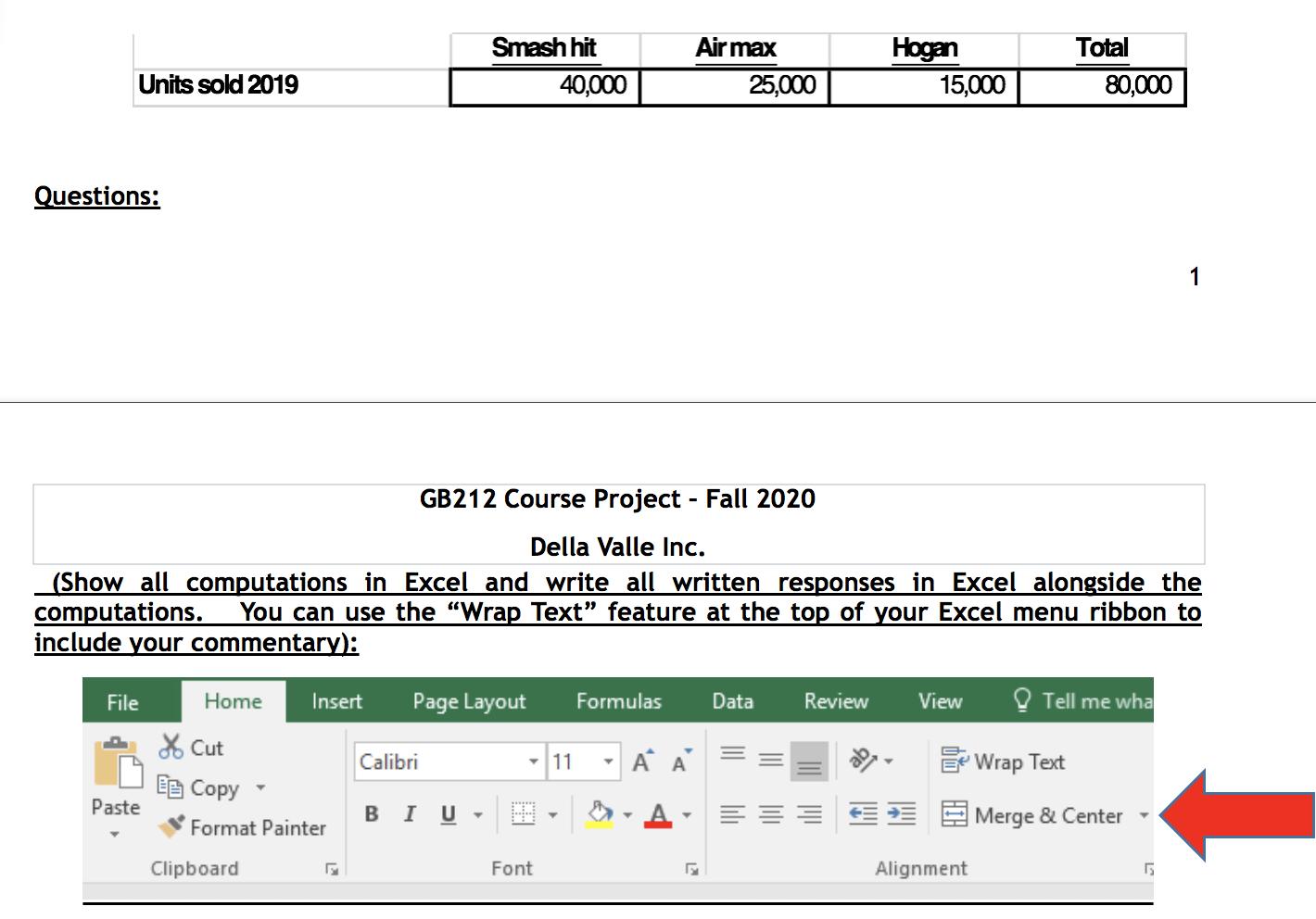

- Units actually sold in 2019 by product are as follows:

Questions:

(Show all computations in Excel and write all written responses in Excel alongside the computations. You can use the “Wrap Text” feature at the top of your Excel menu ribbon to include your commentary):

- For each product line in 2019:

- Calculate the contribution margin per unit.

- Calculate the contribution margin percentage.

2. Build a 2019 contribution income statement to operating income level for each of Della Valle’s products as well as the total company

Questions: .

- . For each product line in 2019:

- Calculate the break-even (in units).

- Calculate the break-even (in dollars).

- For each product line in 2019:

- Calculate the margin of safety (in dollars).

- Calculate the margin of safety in percentage for 2019.

3. What is the degree of operating leverage for each of the products for 2019?

questions:

- Della Valle Inc. is doing financial planning for 2020:

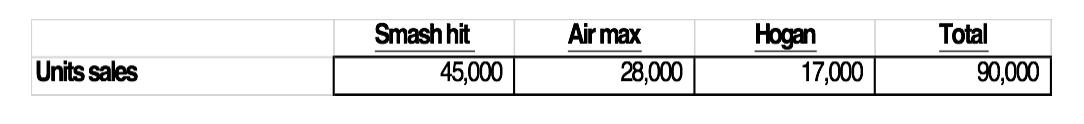

- Based on the results they have calculated for 2019, how many units must Della Valle sell of each product if they want to achieve a target operating income as shown in the chart below. Calculate this for each product individually.

2. Do you think they can achieve this target profit goal on any or all of the product lines? Why or why not?

questions:

- Based on your analysis above, should Della Valle eliminate any of its product lines in 2020?

- Answer from quantitative perspective using the calculations above.

- Answer from a qualitative perspective, what would be three things (internal or external to the company, positive or negative impacts) that could possibly be a reaction if any of the product lines were dropped.

- What could be done to resurrect any product line that you think should be eliminated? And if nothing can be done, why?

- Gianfranco an engineer from MIT, approached the production managers of Della Valle Inc. and had some ideas on how to further automate the manufacturing process. Per Gianfranco if Della Valle Inc. automated its facilities with her suggestions, Della Valle would decrease the total variable costs by 20% for each product but would increase the total fixed costs of each product by 12%.

- If Della Valle decides to do this, what is the new break-even in units for each product? Use the 2019 historical numbers you generated for in Parts #1-5 and compare to those results (i.e., don’t include the target profit into the equation).

- Do you recommend that Della Valle pursue this automation option with Gianfranco for any of the product lines? Where does it work and where does it seem less optimal?

- In 2020 Della Valle Inc. has been contacted by a major retailer regarding a special order of 15,000 of the Smash hit and 5,000 of the Hogan models at a selling price of $55 for Smash Hit and $125 for Hogan.

In deciding whether or not to accept these special orders you need to consider the following:

- You can only accept an order in full – you cannot take part orders of both.

- The forecast unit sales for 2020 is the following:

- Della Valle Footwear is operating at 80 percent of total capacity.

- The cost of the rubber sole is expected to increase by 20% per unit cost in 2020. The cost of Della Valle rent is expected to increase by $2 per unit cost in 2020. All the other costs are estimated to be at the same level of 2019.

Based on the above:

- Perform an incremental analysis of each order.

- Can Della Valle Footwear fulfill both orders as requested by the customer? Should Della Valle reject one of the orders?

Selling price/unit Costs/unit Cloth insert Direct Labor Factory Equipment Depreciation Factory Insurance Factory Rent Glue for shoe Logos Rubber sole Shoe laces Shoe leather Shoe stiching Other costs - total per MONTH: Advertising/Promotion Corporate office rent/utilities Selling General & Administrative Payroll Smash hit $ 70.00 Smash hit 1.00 $ 20.00 $ LA LA LA LA LA LA LA LA LA LA LA $ $ $ $ $ $ $ $ $ $ $ LA LA LA Air max $ 130.00 Smash hit $ Air max $ 0.02 $ 0.03 $ 2.00 $ 0.01 $ 0.01 $ 5.00 $ 0.02 $ Hogan $ 145.00 5.00 $ 60.00 $ 0.04 $ 0.03 $ 2.00 $ 0.02 $ 0.03 $ 15.00 $ 0.03 $ 10.00 $ 20.00 $ 0.05 $ 0.15 $ Air max 2,000 $ 5,000 10,000 $10,000 $ 10,000 $ 30,000 $30,000 $30,000 Hogan 5.00 50.00 0.04 0.03 2.00 0.03 0.01 20.00 0.03 30.00 0.25 Hogan $3,500

Step by Step Solution

3.55 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

Answer Smash Hit Air max Hogan Selling Price per Unit A 7000 13000 14500 Less Variable Costs pe...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started