Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Dellycious Foods produces 'Kueh Bakar Warisan'. Each product needs to undergo three production departments; Mixing, Baking and Packaging to complete the process. Mixing and

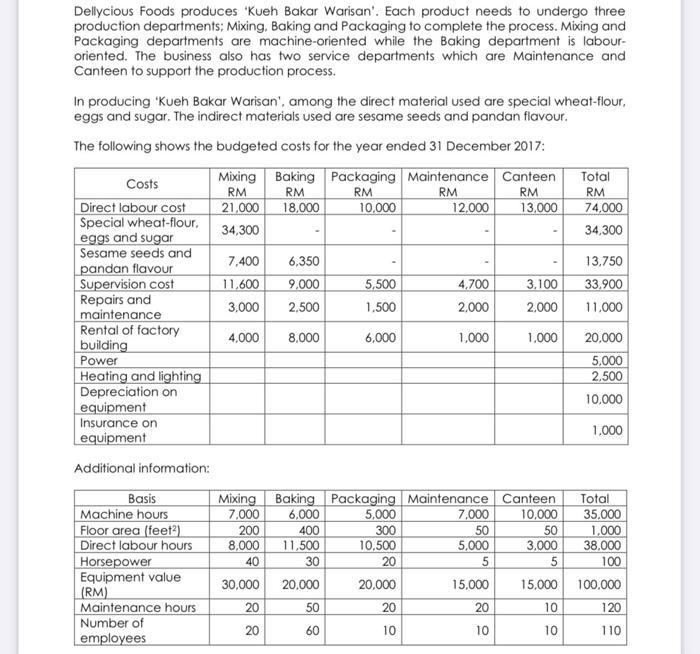

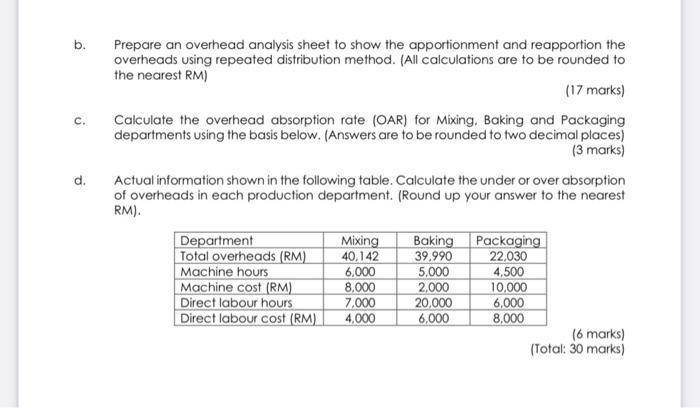

Dellycious Foods produces 'Kueh Bakar Warisan'. Each product needs to undergo three production departments; Mixing, Baking and Packaging to complete the process. Mixing and Packaging departments are machine-oriented while the Baking department is labour- oriented. The business also has two service departments which are Maintenance and Canteen to support the production process. In producing 'Kueh Bakar Warisan', among the direct material used are special wheat-flour, eggs and sugar. The indirect materials used are sesame seeds and pandan flavour. The following shows the budgeted costs for the year ended 31 December 2017: Mixing Baking Packaging Maintenance Canteen RM RM RM RM RM 21,000 18,000 13,000 34,300 Costs Direct labour cost Special wheat-flour, eggs and sugar Sesame seeds and pandan flavour Supervision cost Repairs and maintenance Rental of factory building Power Heating and lighting Depreciation on equipment Insurance on equipment Additional information: Basis Machine hours Floor area (feet2) Direct labour hours Horsepower Equipment value (RM) Maintenance hours Number of employees 7,400 6,350 11,600 9,000 3,000 2,500 4,000 8.000 10,000 5,500 1,500 6,000 Mixing Baking Packaging 7,000 6,000 200 400 8,000 11,500 40 30 30,000 20,000 20 50 20 60 5,000 300 10,500 20 20,000 20 10 12,000 4,700 2,000 1,000 3.100 2,000 20 10 1,000 Maintenance Canteen 7,000 10,000 50 5,000 5 15,000 50 3,000 5 15,000 10 10 Total RM 74,000 34,300 13,750 33,900 11,000 20,000 5,000 2.500 10,000 1,000 Total 35.000 1.000 38,000 100 100.000 120 110 b. C. d. Prepare an overhead analysis sheet to show the apportionment and reapportion the overheads using repeated distribution method. (All calculations are to be rounded to the nearest RM) (17 marks) Calculate the overhead absorption rate (OAR) for Mixing, Baking and Packaging departments using the basis below. (Answers are to be rounded to two decimal places) (3 marks) Actual information shown in the following table. Calculate the under or over absorption of overheads in each production department. (Round up your answer to the nearest RM). Department Total overheads (RM) Machine hours Machine cost (RM) Direct labour hours Direct labour cost (RM) Mixing 40,142 6.000 8,000 7,000 4,000 Baking 39,990 5.000 2,000 20,000 6,000 Packaging 22,030 4,500 10,000 6,000 8.000 (6 marks) (Total: 30 marks)

Step by Step Solution

★★★★★

3.31 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Answer a The budgeted costs for the year ended 31 December 2017 for producing Kueh Bakar Warisan are ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started