Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Delsing Canning Company is considering an expansion of its facilities. Its current income statement is as follows: The company is currently financed with 50 percent

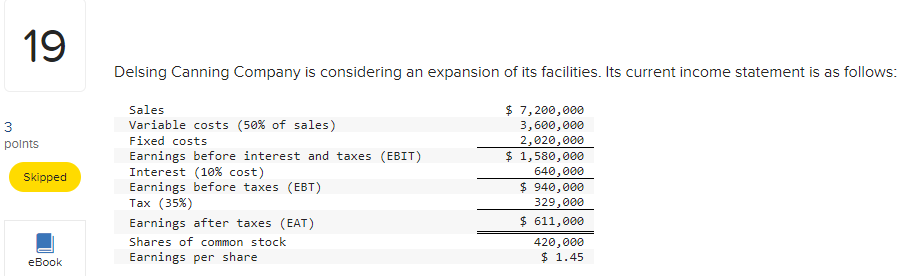

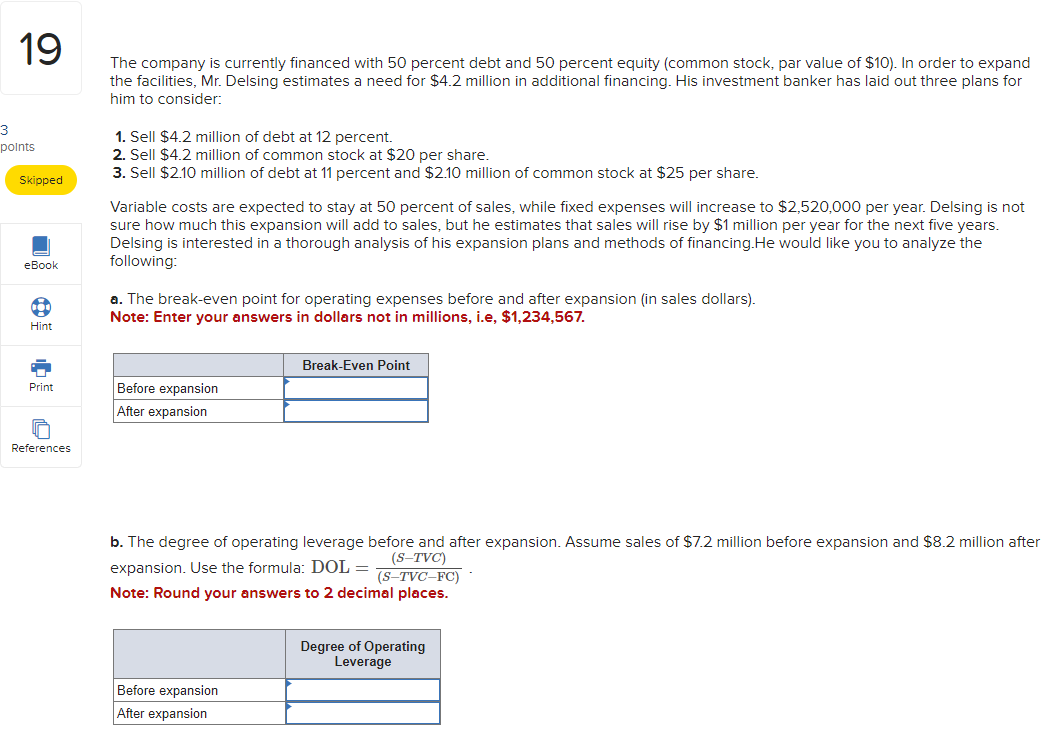

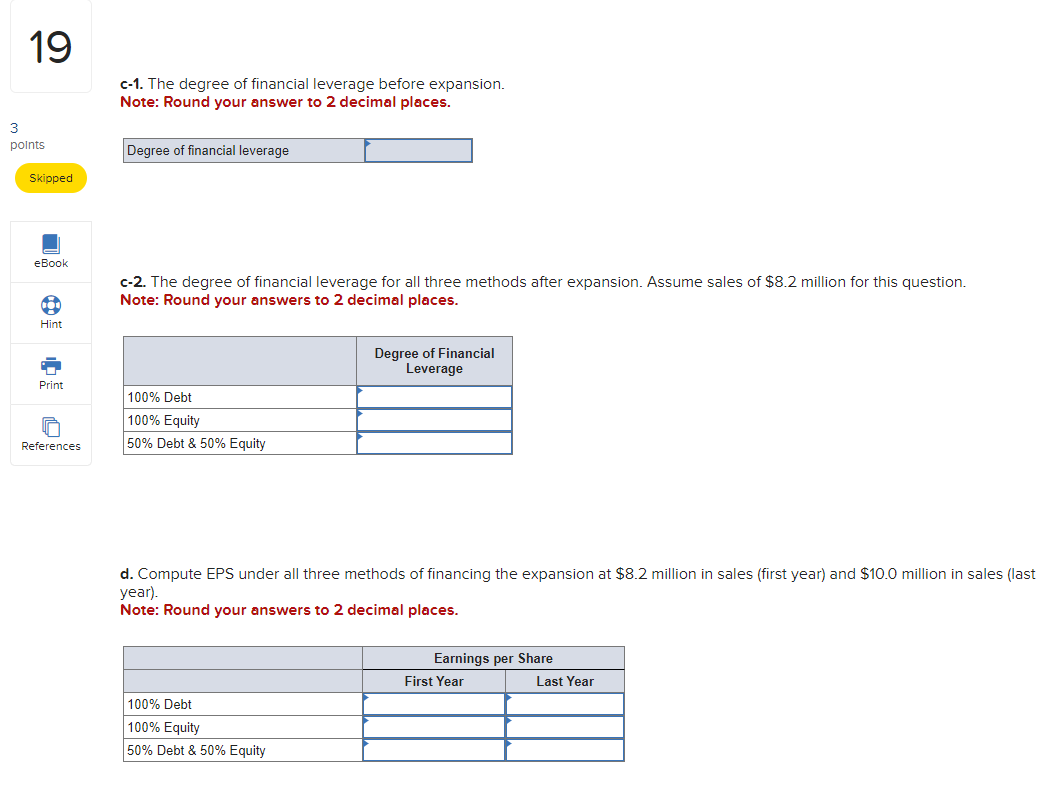

Delsing Canning Company is considering an expansion of its facilities. Its current income statement is as follows: The company is currently financed with 50 percent debt and 50 percent equity (common stock, par value of $10 ). In order to expand the facilities, Mr. Delsing estimates a need for $4.2 million in additional financing. His investment banker has laid out three plans for him to consider: 1. Sell $4.2 million of debt at 12 percent. 2. Sell $4.2 million of common stock at $20 per share. 3. Sell $2.10 million of debt at 11 percent and $2.10 million of common stock at $25 per share. Variable costs are expected to stay at 50 percent of sales, while fixed expenses will increase to $2,520,000 per year. Delsing is not sure how much this expansion will add to sales, but he estimates that sales will rise by $1 million per year for the next five years. Delsing is interested in a thorough analysis of his expansion plans and methods of financing.He would like you to analyze the following: a. The break-even point for operating expenses before and after expansion (in sales dollars). Note: Enter your answers in dollars not in millions, i.e, \$1,234,567. b. The degree of operating leverage before and after expansion. Assume sales of $7.2 million before expansion and $8.2 million after expansion. Use the formula: DOL=(STVCFC)(STVC). Note: Round your answers to 2 decimal places. c-1. The degree of financial leverage before expansion. Note: Round your answer to 2 decimal places. c-2. The degree of financial leverage for all three methods after expansion. Assume sales of $8.2 million for this question. Note: Round your answers to 2 decimal places. d. Compute EPS under all three methods of financing the expansion at $8.2 million in sales (first year) and $10.0 million in sales (last year). Note: Round your answers to 2 decimal places

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started