Question

Delta Air Lines adopted the provisions of ASC Topic 842 using the optional alternative transition method in which a company makes a cumulative adjustment to

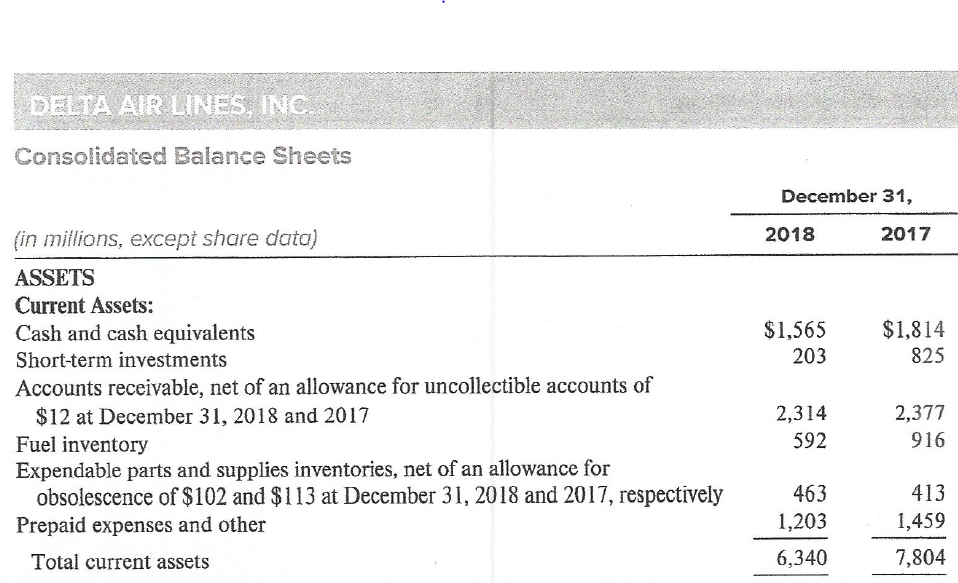

Delta Air Lines adopted the provisions of ASC Topic 842 using the optional alternative transition method in which a company makes a cumulative adjustment to the opening balance of retained earnings in the period of adoption instead of to the first comparative year reported. Presented below is information from the Delta Air Lines, Inc., Form 10-K for the year ended December 31, 2018.

1. Compute the debt asset ratio for 2018. How much did it increase because of the change in accounting for operating leases?

2. Explain any weaknesses associated with this optional transition method.

3. Explain why the Operating lease right-of-use-assets differs from the total Operating leases liability.

4. Explain how the new lease accounting changes the amount of operating lease expense recognized in the income statement.

5. Explain how the new lease accounting changes how the operating leases are portrayed on the statement of cash flows.

DELTA AIR LINES, INC. Consolidated Balance Sheets December 31, 2018 2017 $1,565 203 $1,814 825 (in millions, except share data) ASSETS Current Assets: Cash and cash equivalents Short-term investments Accounts receivable, net of an allowance for uncollectible accounts of $12 at December 31, 2018 and 2017 Fuel inventory Expendable parts and supplies inventories, net of an allowance for obsolescence of $102 and $113 at December 31, 2018 and 2017, respectively Prepaid expenses and other Total current assets 2,314 592 2,377 916 463 1,203 6,340 413 1,459 7,804

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started