Answered step by step

Verified Expert Solution

Question

1 Approved Answer

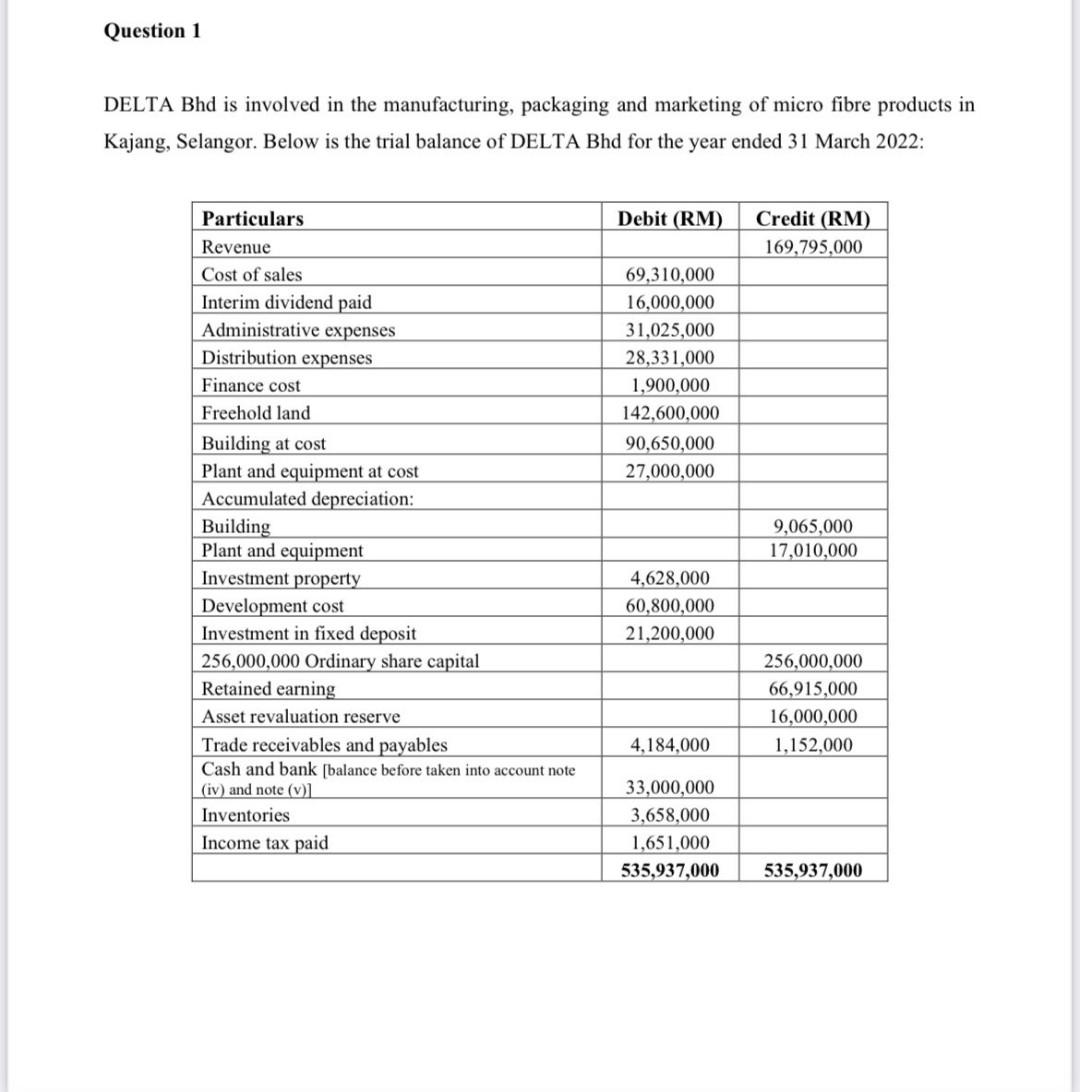

DELTA Bhd is involved in the manufacturing, packaging and marketing of micro fibre products in Kajang, Selangor. Below is the trial balance of DELTA Bhd

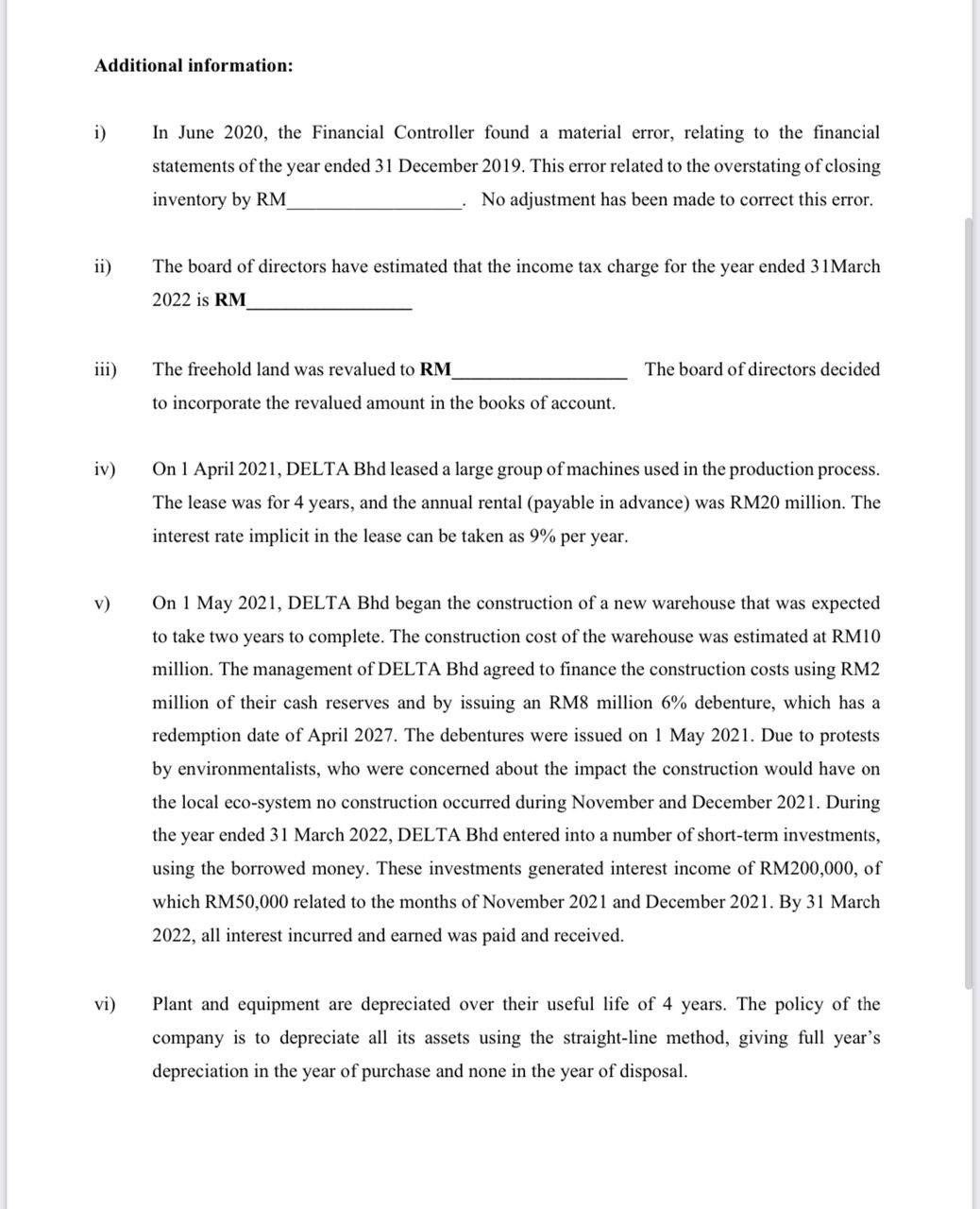

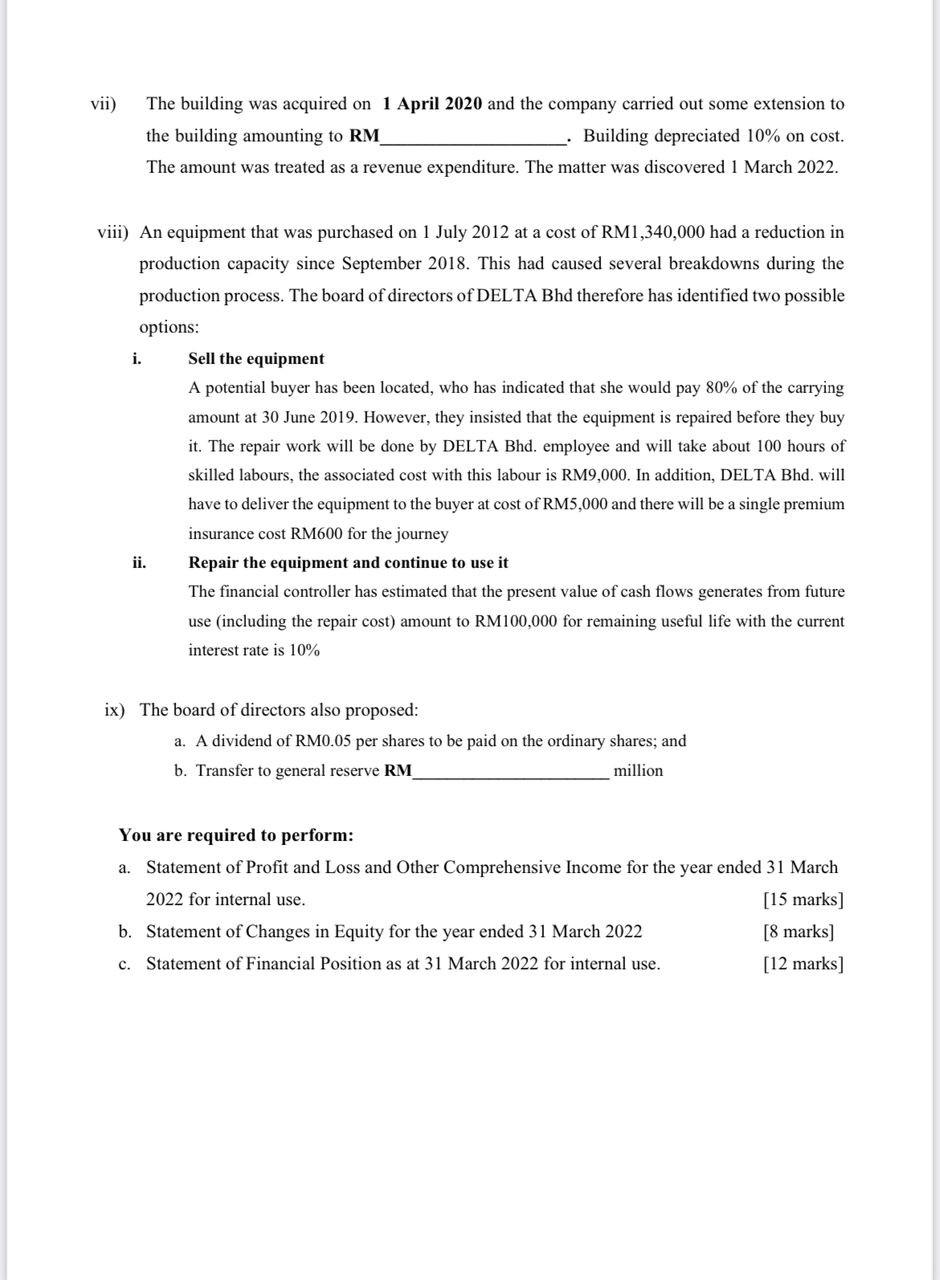

DELTA Bhd is involved in the manufacturing, packaging and marketing of micro fibre products in Kajang, Selangor. Below is the trial balance of DELTA Bhd for the year ended 31 March 2022: Additional information: i) In June 2020, the Financial Controller found a material error, relating to the financial statements of the year ended 31 December 2019. This error related to the overstating of closing inventory by RN. No adjustment has been made to correct this error. ii) The board of directors have estimated that the income tax charge for the year ended 31 March 2022 is RM iii) The freehold land was revalued to RM The board of directors decided to incorporate the revalued amount in the books of account. iv) On 1 April 2021, DELTA Bhd leased a large group of machines used in the production process. The lease was for 4 years, and the annual rental (payable in advance) was RM20 million. The interest rate implicit in the lease can be taken as 9% per year. v) On 1 May 2021, DELTA Bhd began the construction of a new warehouse that was expected to take two years to complete. The construction cost of the warehouse was estimated at RM10 million. The management of DELTA Bhd agreed to finance the construction costs using RM2 million of their cash reserves and by issuing an RM8 million 6\% debenture, which has a redemption date of April 2027. The debentures were issued on 1 May 2021. Due to protests by environmentalists, who were concerned about the impact the construction would have on the local eco-system no construction occurred during November and December 2021. During the year ended 31 March 2022, DELTA Bhd entered into a number of short-term investments, using the borrowed money. These investments generated interest income of RM200,000, of which RM50,000 related to the months of November 2021 and December 2021. By 31 March 2022 , all interest incurred and earned was paid and received. vi) Plant and equipment are depreciated over their useful life of 4 years. The policy of the company is to depreciate all its assets using the straight-line method, giving full year's depreciation in the year of purchase and none in the year of disposal. vii) The building was acquired on 1 April 2020 and the company carried out some extension to the building amounting to RN Building depreciated 10% on cost. The amount was treated as a revenue expenditure. The matter was discovered 1 March 2022. viii) An equipment that was purchased on 1 July 2012 at a cost of RM1,340,000 had a reduction in production capacity since September 2018. This had caused several breakdowns during the production process. The board of directors of DELTA Bhd therefore has identified two possible options: i. Sell the equipment A potential buyer has been located, who has indicated that she would pay 80% of the carrying amount at 30 June 2019 . However, they insisted that the equipment is repaired before they buy it. The repair work will be done by DELTA Bhd. employee and will take about 100 hours of skilled labours, the associated cost with this labour is RM9,000. In addition, DELTA Bhd. will have to deliver the equipment to the buyer at cost of RM5,000 and there will be a single premium insurance cost RM600 for the journey ii. Repair the equipment and continue to use it The financial controller has estimated that the present value of cash flows generates from future use (including the repair cost) amount to RM100,000 for remaining useful life with the current interest rate is 10% ix) The board of directors also proposed: a. A dividend of RM0.05 per shares to be paid on the ordinary shares; and b. Transfer to general reserve RM million You are required to perform: a. Statement of Profit and Loss and Other Comprehensive Income for the year ended 31 March 2022 for internal use. [15 marks] b. Statement of Changes in Equity for the year ended 31 March 2022 [8 marks] c. Statement of Financial Position as at 31 March 2022 for internal use. [12 marks] DELTA Bhd is involved in the manufacturing, packaging and marketing of micro fibre products in Kajang, Selangor. Below is the trial balance of DELTA Bhd for the year ended 31 March 2022: Additional information: i) In June 2020, the Financial Controller found a material error, relating to the financial statements of the year ended 31 December 2019. This error related to the overstating of closing inventory by RN. No adjustment has been made to correct this error. ii) The board of directors have estimated that the income tax charge for the year ended 31 March 2022 is RM iii) The freehold land was revalued to RM The board of directors decided to incorporate the revalued amount in the books of account. iv) On 1 April 2021, DELTA Bhd leased a large group of machines used in the production process. The lease was for 4 years, and the annual rental (payable in advance) was RM20 million. The interest rate implicit in the lease can be taken as 9% per year. v) On 1 May 2021, DELTA Bhd began the construction of a new warehouse that was expected to take two years to complete. The construction cost of the warehouse was estimated at RM10 million. The management of DELTA Bhd agreed to finance the construction costs using RM2 million of their cash reserves and by issuing an RM8 million 6\% debenture, which has a redemption date of April 2027. The debentures were issued on 1 May 2021. Due to protests by environmentalists, who were concerned about the impact the construction would have on the local eco-system no construction occurred during November and December 2021. During the year ended 31 March 2022, DELTA Bhd entered into a number of short-term investments, using the borrowed money. These investments generated interest income of RM200,000, of which RM50,000 related to the months of November 2021 and December 2021. By 31 March 2022 , all interest incurred and earned was paid and received. vi) Plant and equipment are depreciated over their useful life of 4 years. The policy of the company is to depreciate all its assets using the straight-line method, giving full year's depreciation in the year of purchase and none in the year of disposal. vii) The building was acquired on 1 April 2020 and the company carried out some extension to the building amounting to RN Building depreciated 10% on cost. The amount was treated as a revenue expenditure. The matter was discovered 1 March 2022. viii) An equipment that was purchased on 1 July 2012 at a cost of RM1,340,000 had a reduction in production capacity since September 2018. This had caused several breakdowns during the production process. The board of directors of DELTA Bhd therefore has identified two possible options: i. Sell the equipment A potential buyer has been located, who has indicated that she would pay 80% of the carrying amount at 30 June 2019 . However, they insisted that the equipment is repaired before they buy it. The repair work will be done by DELTA Bhd. employee and will take about 100 hours of skilled labours, the associated cost with this labour is RM9,000. In addition, DELTA Bhd. will have to deliver the equipment to the buyer at cost of RM5,000 and there will be a single premium insurance cost RM600 for the journey ii. Repair the equipment and continue to use it The financial controller has estimated that the present value of cash flows generates from future use (including the repair cost) amount to RM100,000 for remaining useful life with the current interest rate is 10% ix) The board of directors also proposed: a. A dividend of RM0.05 per shares to be paid on the ordinary shares; and b. Transfer to general reserve RM million You are required to perform: a. Statement of Profit and Loss and Other Comprehensive Income for the year ended 31 March 2022 for internal use. [15 marks] b. Statement of Changes in Equity for the year ended 31 March 2022 [8 marks] c. Statement of Financial Position as at 31 March 2022 for internal use. [12 marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started