Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Demonstrate how FRAs, BAB futures and interest rate swaps establishes the company's cost of funds for the initial issue of the bills in a bills

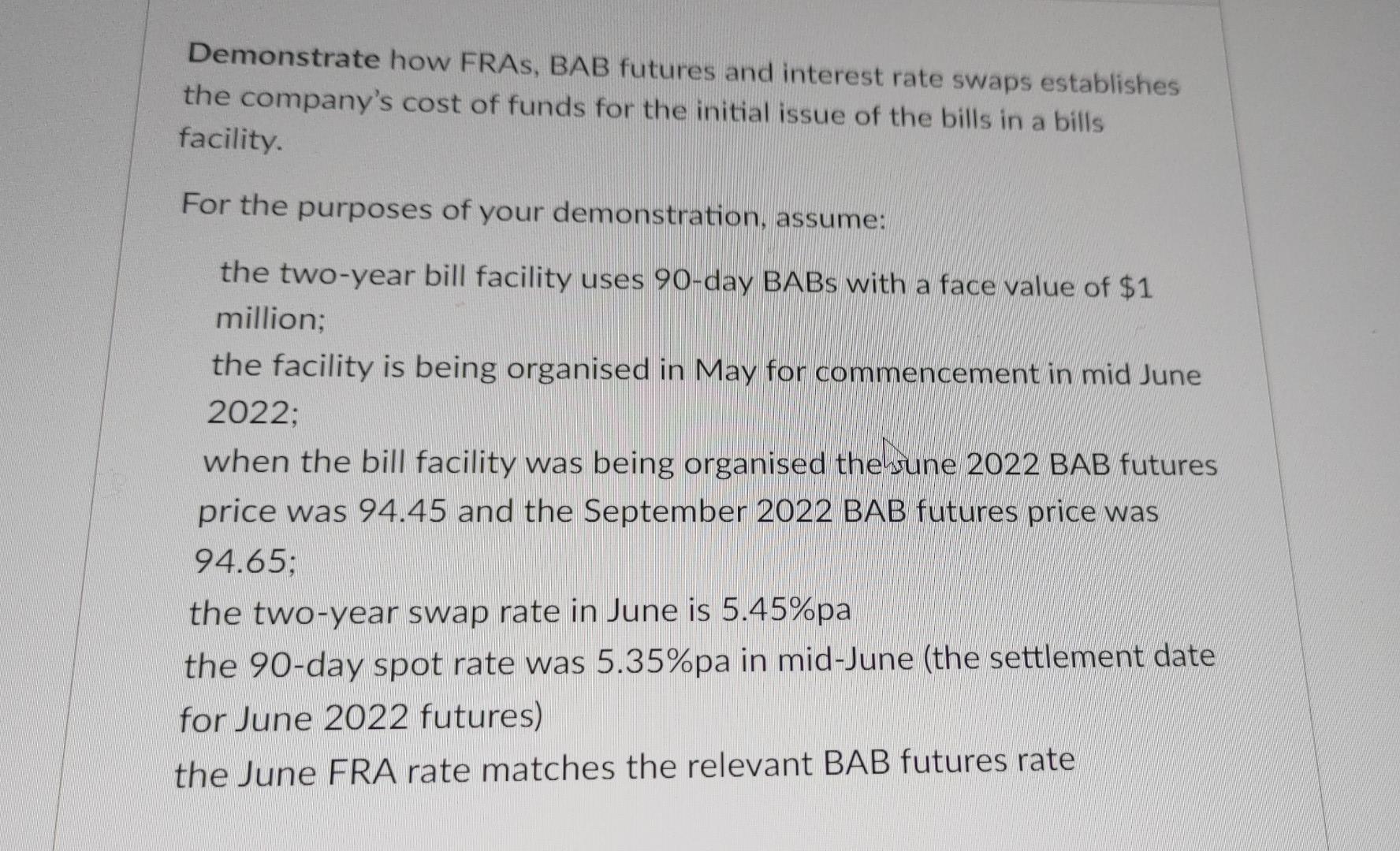

Demonstrate how FRAs, BAB futures and interest rate swaps establishes the company's cost of funds for the initial issue of the bills in a bills facility. For the purposes of your demonstration, assume: the two-year bill facility uses 90-day BABs with a face value of $1 million; the facility is being organised in May for commencement in mid June 2022: when the bill facility was being organised the sune 2022 BAB futures price was 94.45 and the September 2022 BAB futures price was 94.65; the two-year swap rate in June is 5.45%pa the 90-day spot rate was 5.35%pa in mid-June (the settlement date for June 2022 futures) the June FRA rate matches the relevant BAB futures rate Demonstrate how FRAs, BAB futures and interest rate swaps establishes the company's cost of funds for the initial issue of the bills in a bills facility. For the purposes of your demonstration, assume: the two-year bill facility uses 90-day BABs with a face value of $1 million; the facility is being organised in May for commencement in mid June 2022: when the bill facility was being organised the sune 2022 BAB futures price was 94.45 and the September 2022 BAB futures price was 94.65; the two-year swap rate in June is 5.45%pa the 90-day spot rate was 5.35%pa in mid-June (the settlement date for June 2022 futures) the June FRA rate matches the relevant BAB futures rate

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started