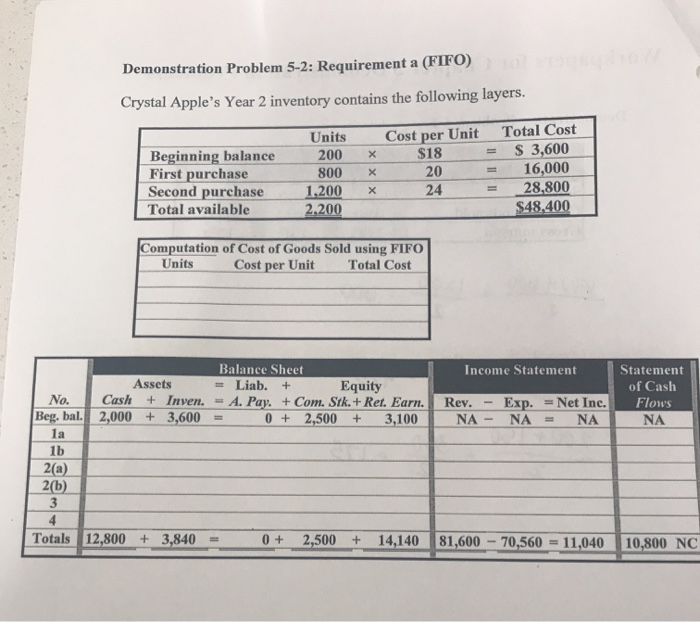

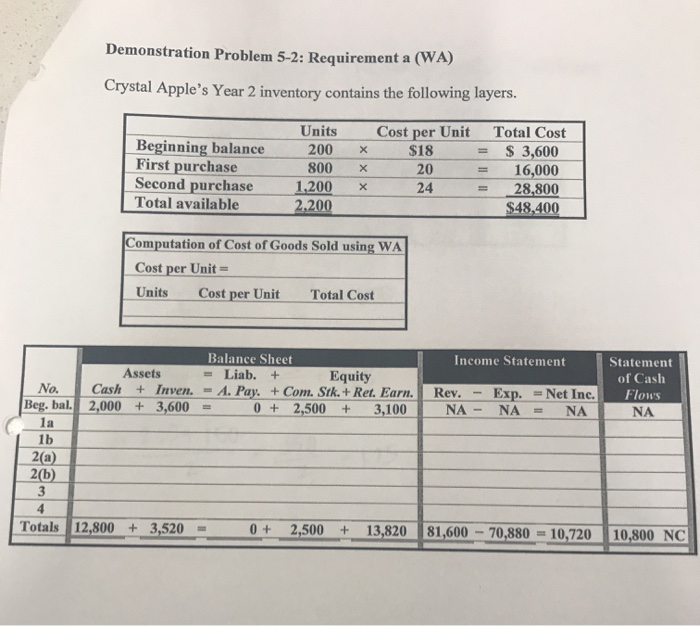

Demonstration Problem 5-2: Requirement a (FIFO) Crystal Apple's Year 2 inventory contains the following layers. Beginning balance First purchase Second purchase Total available Units 200 800 1.200 2.200 X X X Cost per Unit $18 20 24 = = = Total Cost S 3,600 16,000 28,800 $48.400 Computation of Cost of Goods Sold using FIFO Units Cost per Unit Total Cost Income Statement Balance Sheet Assets = Liab. + Equity Cash + Inven. = A. Pay. + Com. Stk. + Ref. Earn. 2,000 + 3,600 = 0 + 2,500 + 3,100 Statement of Cash Flows No. Beg. bal. Rev. - Exp. Net Inc. N A - NA - NA la 2a) 2(b) Totals 12,800 + 3,840 = 0 + 2,500 + 14,140 81,600 - 70,560 = 11,040 10,800 NC Demonstration Problem 5-2: Requirement a (WA) Crystal Apple's Year 2 inventory contains the following layers. Beginning balance First purchase Second purchase Total available Units 200 800 1.200 2,200 X X X Cost per Unit $18 20 24 = = = Total Cost $ 3,600 16,000 28.800 $48,400 Computation of Cost of Goods Sold using WA Cost per Unit Units Cost per Unit Total Cost Income Statement Balance Sheet Assets = Liab. + Equity Cash + Inven. - 1. Pay. + Com. Stk. + Ret. Earn. 2,000 + 3,600 = 0 + 2,500 + 3,100 Statement of Cash Flows NA No. Rev. - Exp. Net Ine. N A - NA - NA Beg. bal. la 1b 2(a) Totals 12,800 + 3,520 = 0 + 2,500 + 13,820 81,600 - 70,880 = 10,720 10,800 NC Demonstration Problems for Chapter 5 Demonstration Problem 5-1 - Inventory Cost Issue A furniture store inventory includes two beds that are identical with respect to appearance. quality, and brand name. However, the store purchased the beds at different times for dif- ferent prices. The first bed cost the store $400, and the second bed cost $450. Assume the store sells one of the beds for $600. Also assume the store manager cannot identify which bed was sold. Required Determine the gross margin on the sale of the bed. 1st bed = $400 2nd bed= $450 Demonstration Problem 5-2: Requirement a (FIFO) Crystal Apple's Year 2 inventory contains the following layers. Beginning balance First purchase Second purchase Total available Units 200 800 1.200 2.200 X X X Cost per Unit $18 20 24 = = = Total Cost S 3,600 16,000 28,800 $48.400 Computation of Cost of Goods Sold using FIFO Units Cost per Unit Total Cost Income Statement Balance Sheet Assets = Liab. + Equity Cash + Inven. = A. Pay. + Com. Stk. + Ref. Earn. 2,000 + 3,600 = 0 + 2,500 + 3,100 Statement of Cash Flows No. Beg. bal. Rev. - Exp. Net Inc. N A - NA - NA la 2a) 2(b) Totals 12,800 + 3,840 = 0 + 2,500 + 14,140 81,600 - 70,560 = 11,040 10,800 NC Demonstration Problem 5-2: Requirement a (WA) Crystal Apple's Year 2 inventory contains the following layers. Beginning balance First purchase Second purchase Total available Units 200 800 1.200 2,200 X X X Cost per Unit $18 20 24 = = = Total Cost $ 3,600 16,000 28.800 $48,400 Computation of Cost of Goods Sold using WA Cost per Unit Units Cost per Unit Total Cost Income Statement Balance Sheet Assets = Liab. + Equity Cash + Inven. - 1. Pay. + Com. Stk. + Ret. Earn. 2,000 + 3,600 = 0 + 2,500 + 3,100 Statement of Cash Flows NA No. Rev. - Exp. Net Ine. N A - NA - NA Beg. bal. la 1b 2(a) Totals 12,800 + 3,520 = 0 + 2,500 + 13,820 81,600 - 70,880 = 10,720 10,800 NC Demonstration Problems for Chapter 5 Demonstration Problem 5-1 - Inventory Cost Issue A furniture store inventory includes two beds that are identical with respect to appearance. quality, and brand name. However, the store purchased the beds at different times for dif- ferent prices. The first bed cost the store $400, and the second bed cost $450. Assume the store sells one of the beds for $600. Also assume the store manager cannot identify which bed was sold. Required Determine the gross margin on the sale of the bed. 1st bed = $400 2nd bed= $450