Answered step by step

Verified Expert Solution

Question

1 Approved Answer

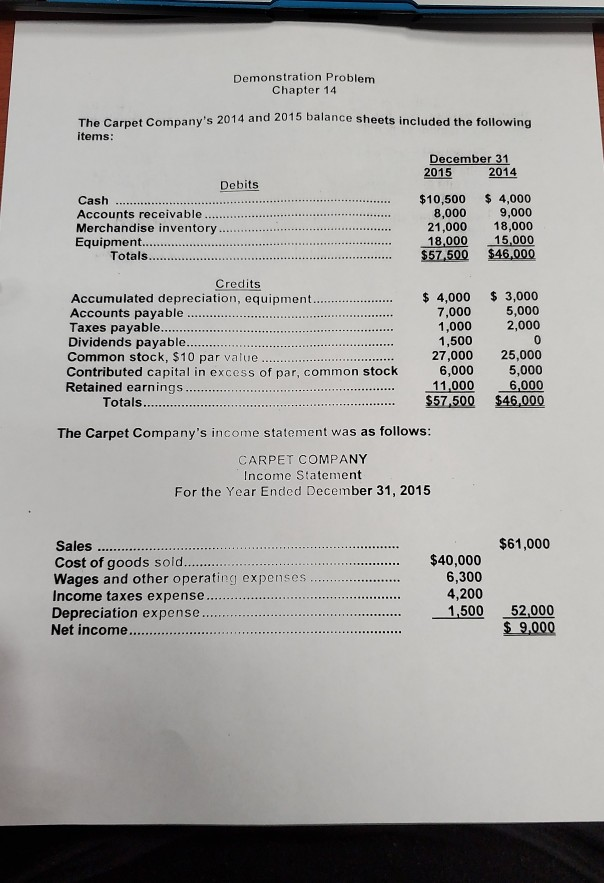

Demonstration Problem Chapter 14 The Carpet Company's 2014 and 2015 balance sheets included the following items: December 31 2015 2014 Debits Cash ...... Accounts receivable.

Demonstration Problem Chapter 14 The Carpet Company's 2014 and 2015 balance sheets included the following items: December 31 2015 2014 Debits Cash ...... Accounts receivable. Merchandise inventory......... Equipment... $10,500 8,000 21,000 18,000 $57,500 $ 4,000 9,000 18.000 15,000 $46,000 Totals............... $3,000 5,000 2,000 Credits Accumulated depreciation, equipment. Accounts payable ............ Taxes payable....... Dividends payable............. Common stock, $10 par value... Contributed capital in excess of par, common stock Retained earnings....... Totals.... $ 4,000 7,000 1,000 1,500 27,000 6,000 11,000 $57,500 25,000 5,000 6,000 $46,000 The Carpet Company's income statement was as follows: CARPET COMPANY Income Statement For the Year Ended December 31, 2015 Sales .... $61,000 Cost of goods sold..... Wages and other operating expenses ...... Income taxes expense............... Depreciation expense... Net income.. $40,000 6,300 4,200 1,500 52.000 $ 9,000 Demonstration Problem Chapter 14 The Carpet Company's 2014 and 2015 balance sheets included the following items: December 31 2015 2014 Debits Cash ...... Accounts receivable. Merchandise inventory......... Equipment... $10,500 8,000 21,000 18,000 $57,500 $ 4,000 9,000 18.000 15,000 $46,000 Totals............... $3,000 5,000 2,000 Credits Accumulated depreciation, equipment. Accounts payable ............ Taxes payable....... Dividends payable............. Common stock, $10 par value... Contributed capital in excess of par, common stock Retained earnings....... Totals.... $ 4,000 7,000 1,000 1,500 27,000 6,000 11,000 $57,500 25,000 5,000 6,000 $46,000 The Carpet Company's income statement was as follows: CARPET COMPANY Income Statement For the Year Ended December 31, 2015 Sales .... $61,000 Cost of goods sold..... Wages and other operating expenses ...... Income taxes expense............... Depreciation expense... Net income.. $40,000 6,300 4,200 1,500 52.000 $ 9,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started