Question

dentification and Effects of Changes and Errors The following are independent events: Required: 1. Indicate what type of accounting change or error, if any, is

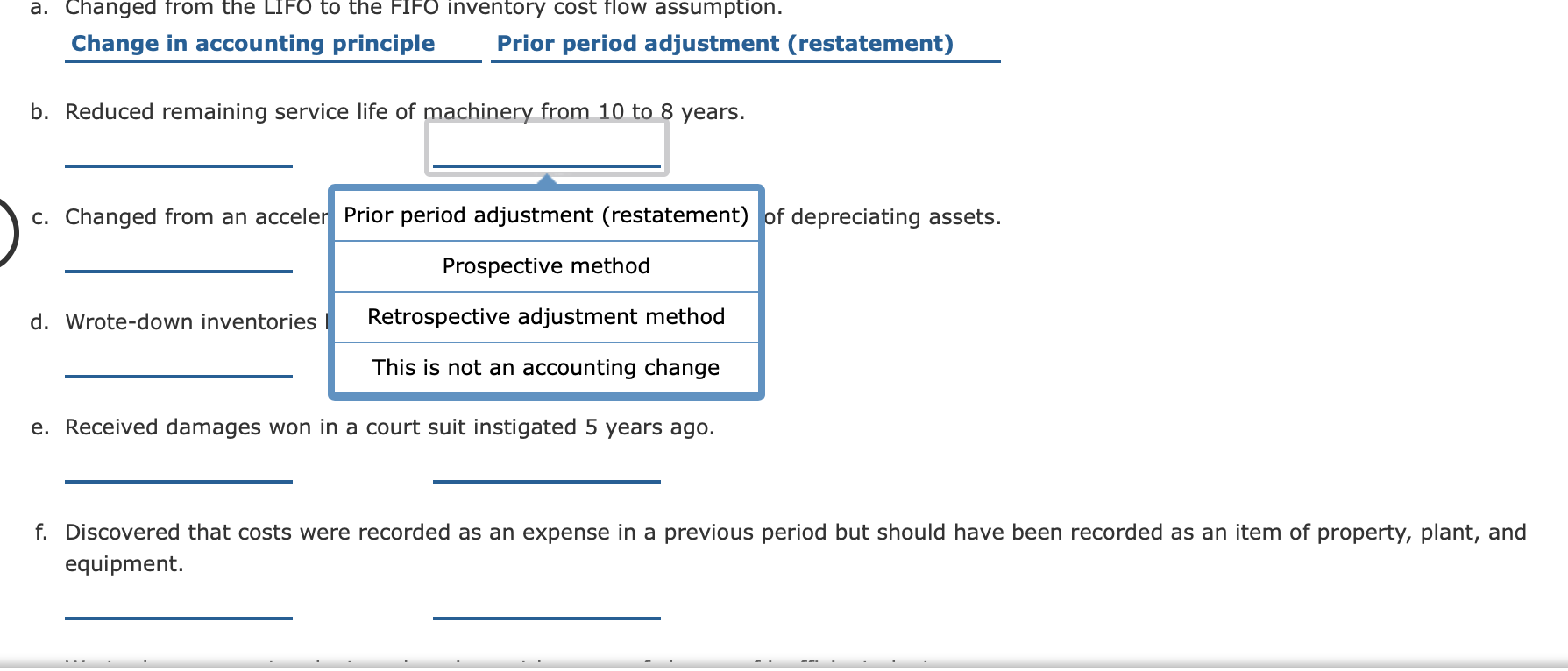

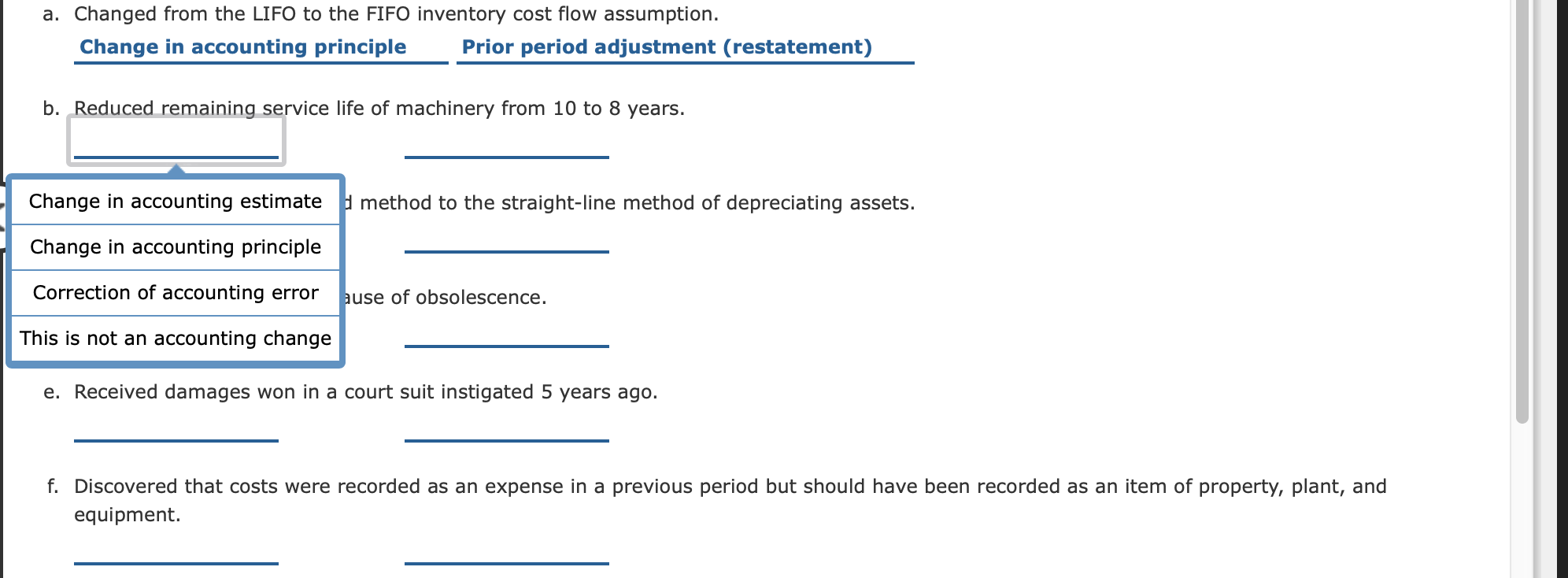

dentification and Effects of Changes and Errors The following are independent events: Required: 1. Indicate what type of accounting change or error, if any, is represented by each of the preceding items and the method of accounting (retrospective adjustment, prospective, or prior period adjustment) for the item in the financial statements of the current year. If any statement has no accounting change, select "This is not an accounting change". Changed from the LIFO to the FIFO inventory cost flow assumption. Reduced remaining service life of machinery from 10 to 8 years. Changed from an accelerated method to the straight-line method of depreciating assets. Wrote-down inventories because of obsolescence. Received damages won in a court suit instigated 5 years ago. Discovered that costs were recorded as an expense in a previous period but should have been recorded as an item of property, plant, and equipment. Wrote down property, plant, and equipment because of closure of inefficient plants. Changed from the successful-efforts method to the full-cost accounting method for oil exploration costs.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started