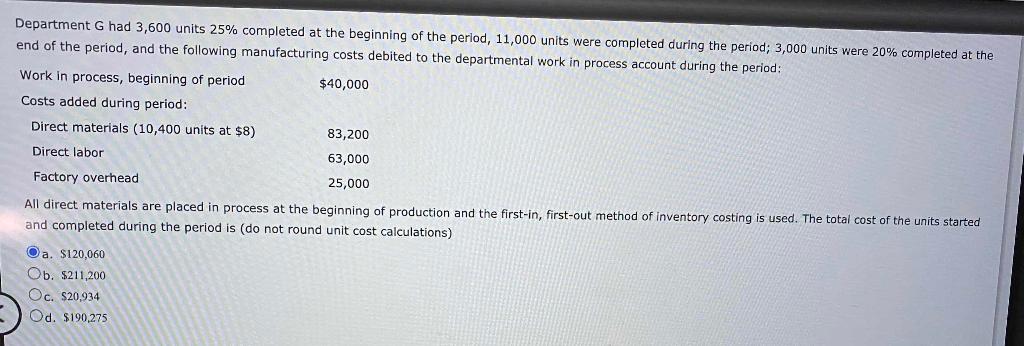

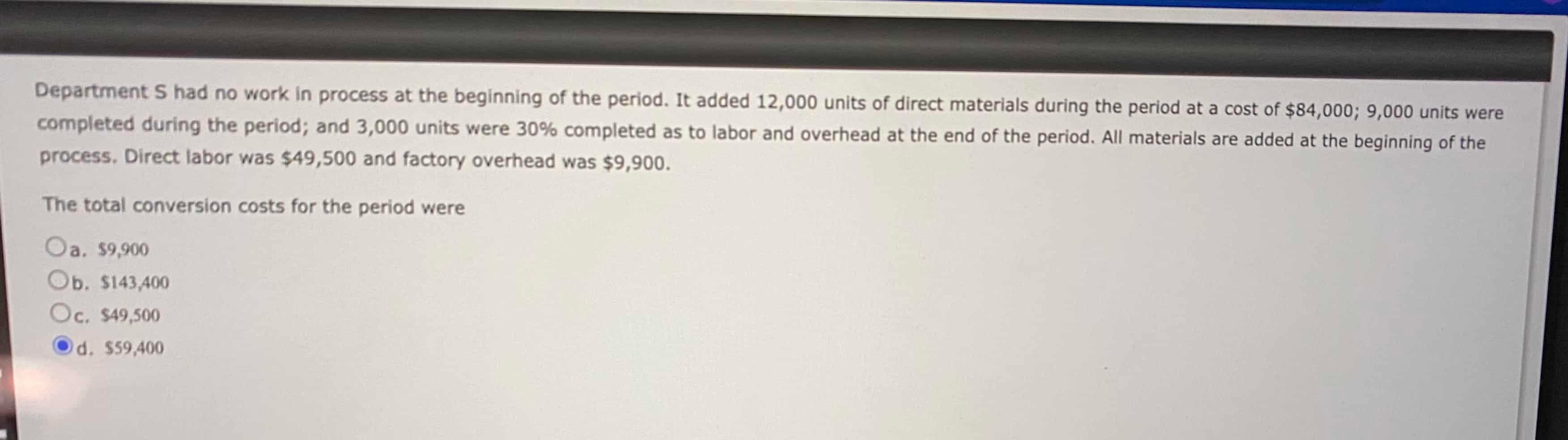

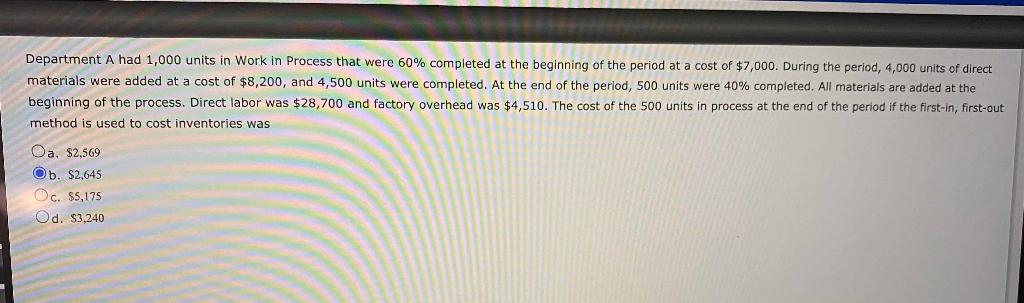

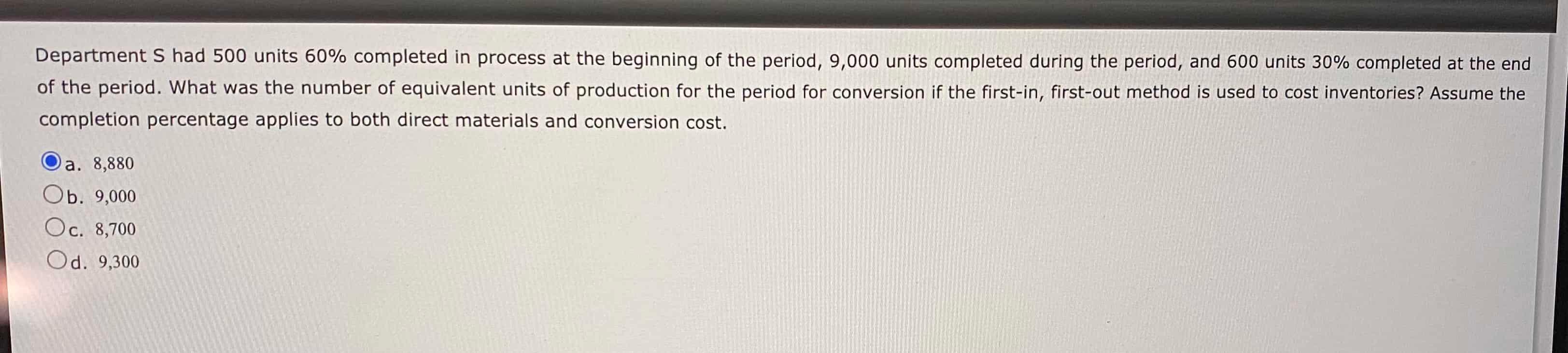

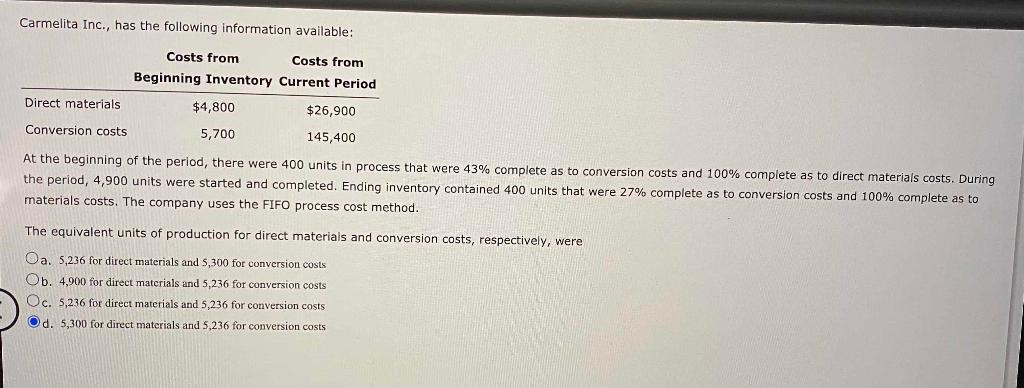

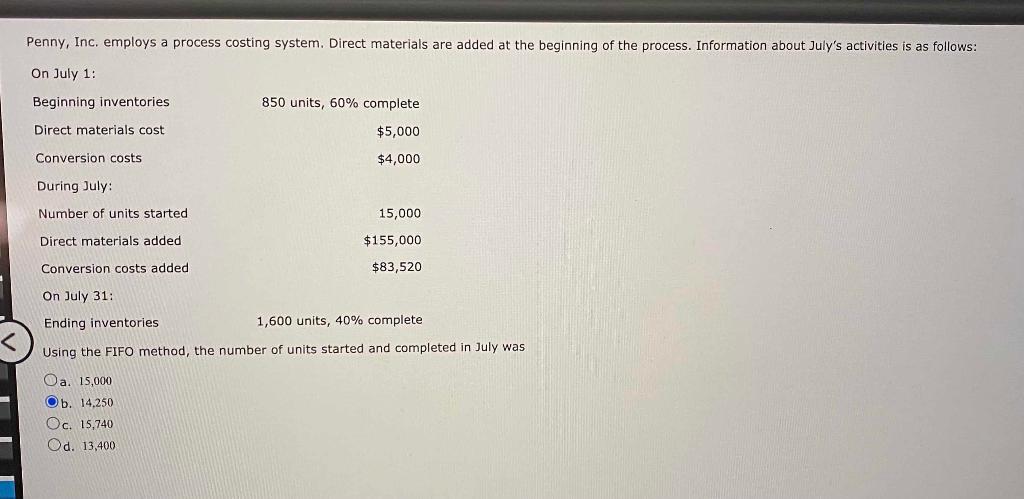

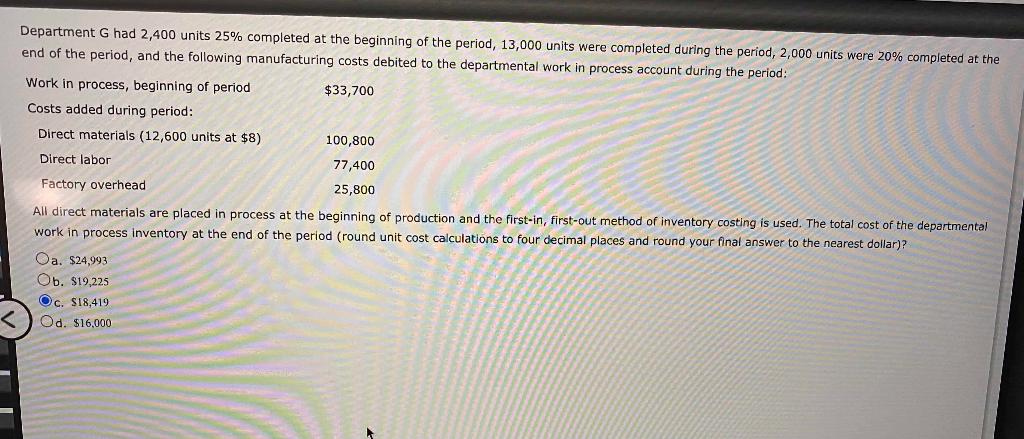

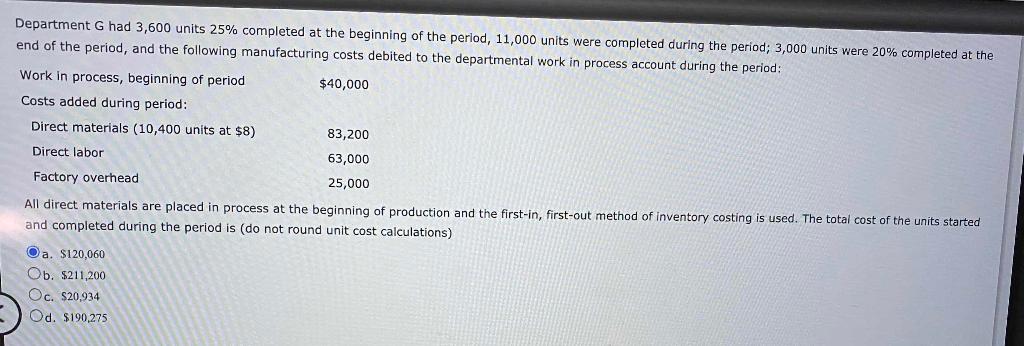

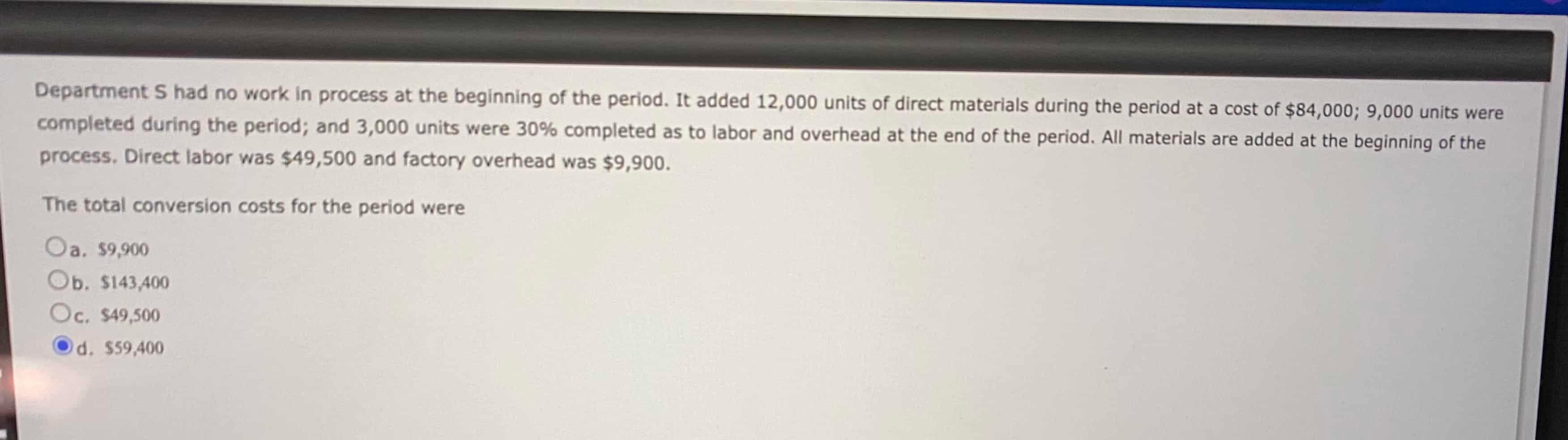

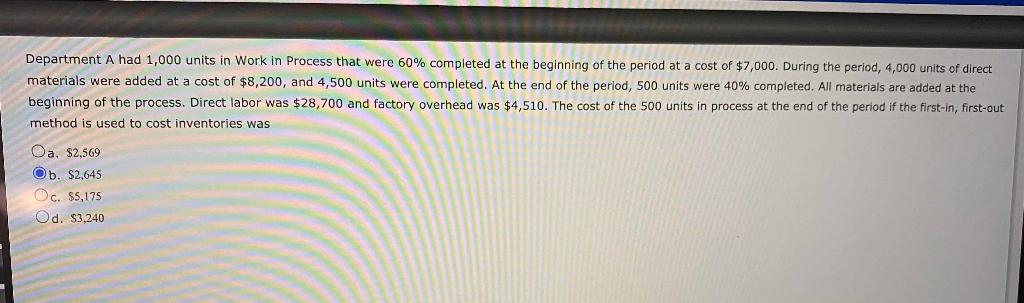

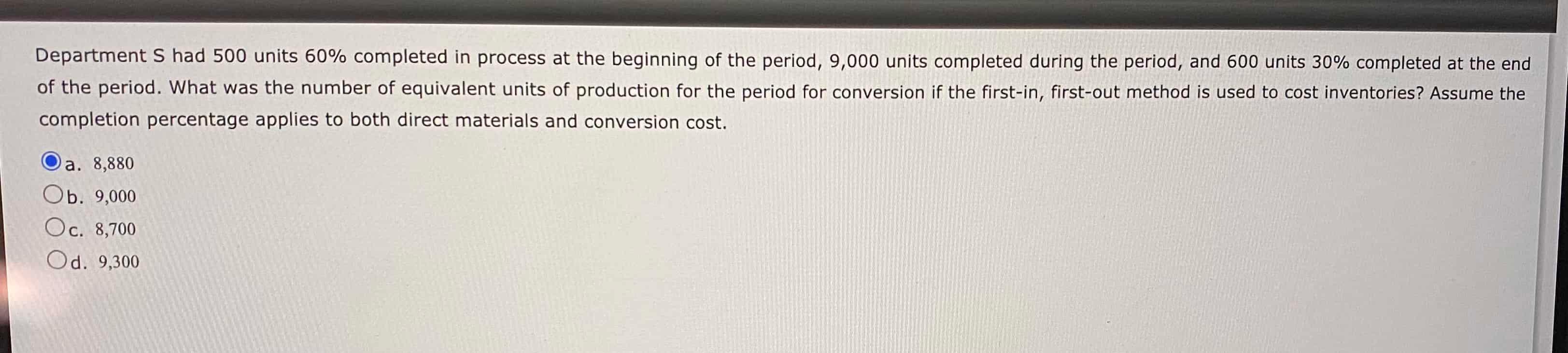

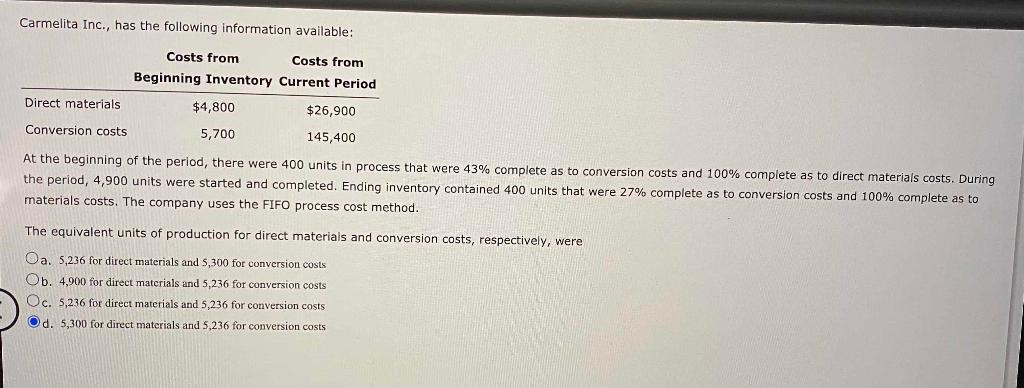

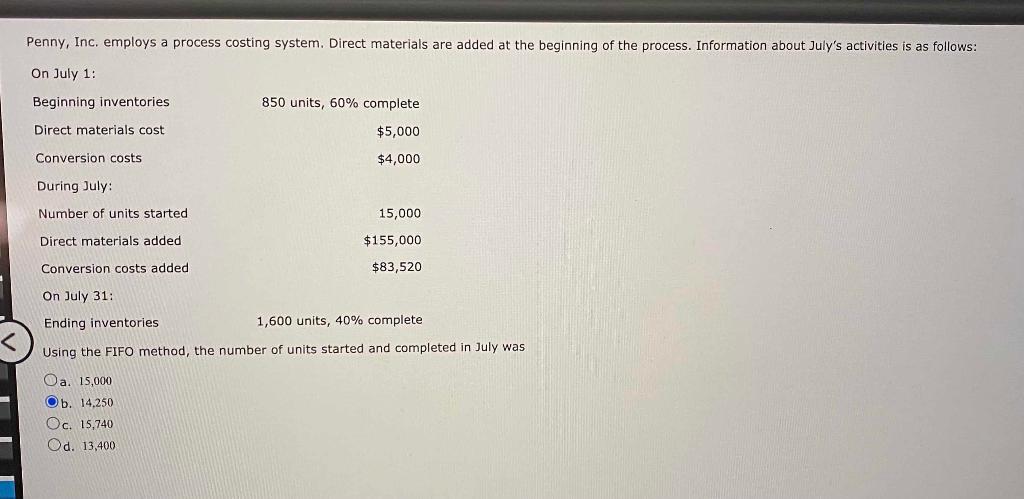

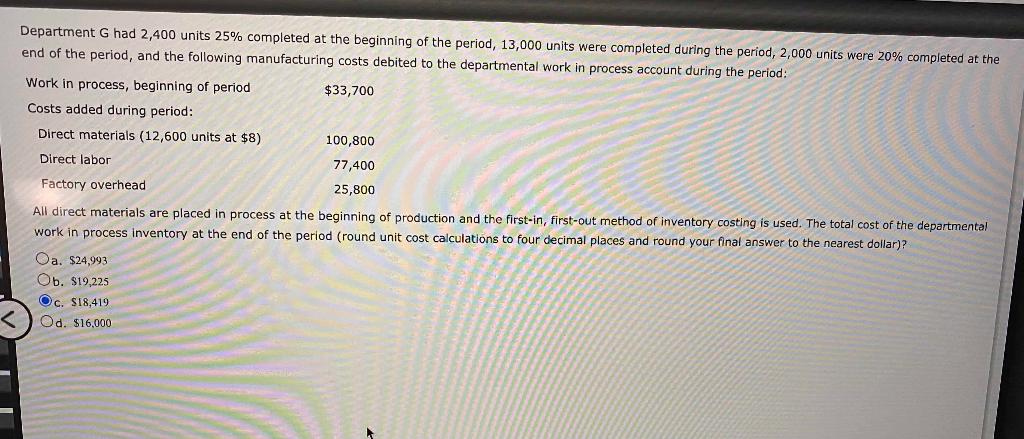

Department G had 3,600 units 25% completed at the beginning of the period, 11,000 units were completed during the period; 3,000 units were 20% completed at the end of the period, and the following manufacturing costs debited to the departmental work in process account during the period: Work in process, beginning of period $40,000 Costs added during period: Direct materials (10,400 units at $8) 83,200 Direct labor 63,000 Factory overhead 25,000 All direct materials are placed in process at the beginning of production and the first-in, first-out method of inventory costing is used. The total cost of the units started and completed during the period is (do not round unit cost calculations) O a. S120,060 Ob. $211,200 Oc. $20,934 Od. $190,275 Department S had no work in process at the beginning of the period. It added 12,000 units of direct materials during the period at a cost of $84,000; 9,000 units were completed during the period; and 3,000 units were 30% completed as to labor and overhead at the end of the period. All materials are added at the beginning of the process. Direct labor was $49,500 and factory overhead was $9,900. The total conversion costs for the period were Oa. $9,900 Ob. $143.400 Oc. $49,500 d. 559,400 Department A had 1,000 units in Work in Process that were 60% completed at the beginning of the period at a cost of $7,000. During the period, 4,000 units of direct materials were added at a cost of $8,200, and 4,500 units were completed. At the end of the period, 500 units were 40% completed. All materials are added at the beginning of the process. Direct labor was $28,700 and factory overhead was $4,510. The cost of the 500 units in process at the end of the period if the first-in, first-out method is used to cost inventories was Oa. $2,569 Ob. $2,645 Oc. $5,175 Od. $3,240 Department Shad 500 units 60% completed in process at the beginning of the period, 9,000 units completed during the period, and 600 units 30% completed at the end of the period. What was the number of equivalent units of production for the period for conversion if the first-in, first-out method is used to cost inventories? Assume the completion percentage applies to both direct materials and conversion cost. O a. 8,880 Ob. 9,000 O c. 8,700 Od. 9,300 Carmelita Inc., has the following information available: Costs from Costs from Beginning Inventory Current Period Direct materials $4,800 $26,900 Conversion costs 5,700 145,400 At the beginning of the period, there were 400 units in process that were 43% complete as to conversion costs and 100% complete as to direct materials costs. During the period, 4,900 units were started and completed. Ending inventory contained 400 units that were 27% complete as to conversion costs and 100% complete as to materials costs. The company uses the FIFO process cost method. The equivalent units of production for direct materials and conversion costs, respectively, were Oa. 5,236 for direct materials and 5,300 for conversion costs Ob. 4,900 for direct materials and 5,236 for conversion costs Oc. 5,236 for direct materials and 5,236 for conversion costs O d. 5,300 for direct materials and 5,236 for conversion costs Penny, Inc. employs a process costing system. Direct materials are added at the beginning of the process. Information about July's activities is as follows: On July 1: Beginning inventories 850 units, 60% complete $5,000 Direct materials cost Conversion costs $4,000 During July: Number of units started 15,000 Direct materials added $155,000 Conversion costs added $83,520 On July 31: Ending inventories 1,600 units, 40% complete Using the FIFO method, the number of units started and completed in July was Oa. 15,000 Ob. 14.250 Oc. 15,740 Od. 13,400 Department G had 2,400 units 25% completed at the beginning of the period, 13,000 units were completed during the period, 2,000 units were 20% completed at the end of the period, and the following manufacturing costs debited to the departmental work in process account during the period: Work in process, beginning of period $33,700 Costs added during period: Direct materials (12,600 units at $8) 100,800 Direct labor 77,400 Factory overhead 25,800 All direct materials are placed in process at the beginning of production and the first-in, first-out method of inventory costing is used. The total cost of the departmental work in process inventory at the end of the period (round unit cost calculations to four decimal places and round your final answer to the nearest dollar)? Oa. $24.993 Ob. $19,225 Oc. $18,419 Od. $16.000