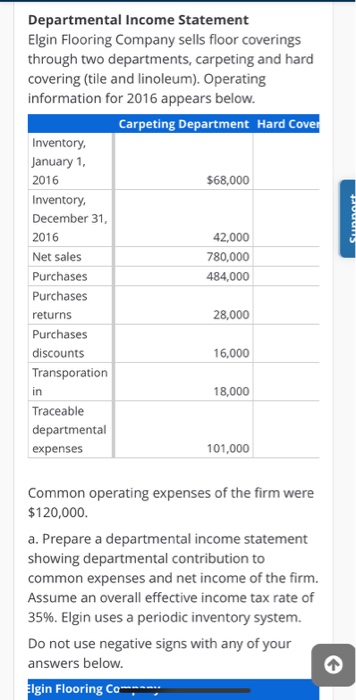

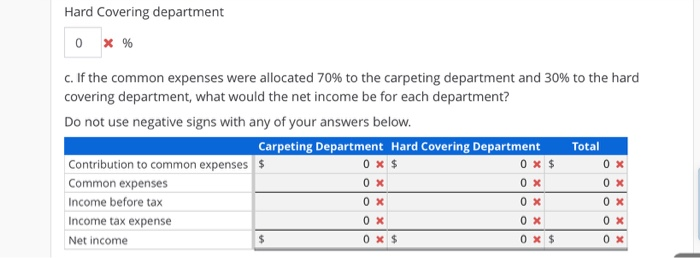

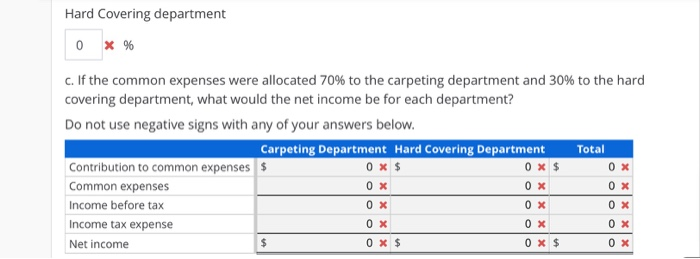

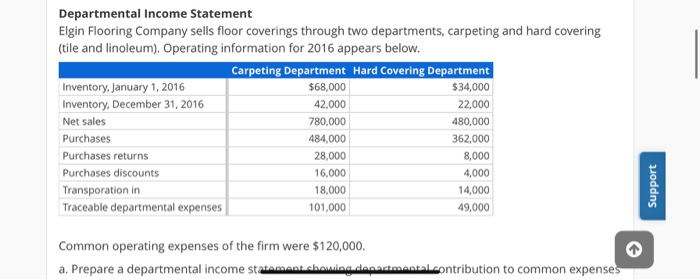

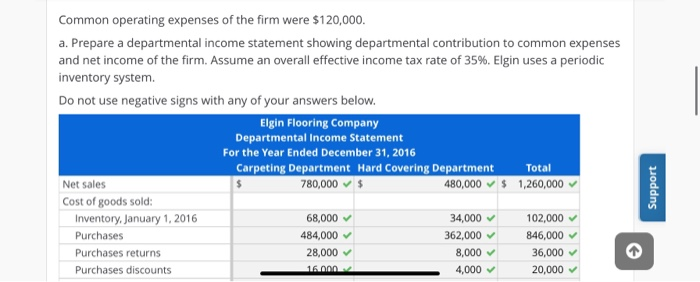

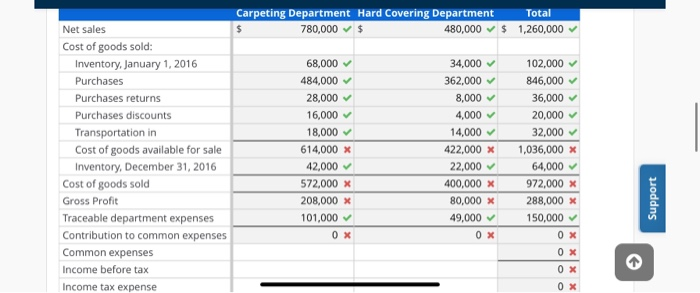

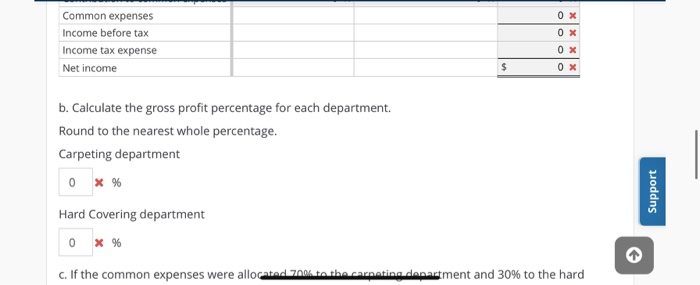

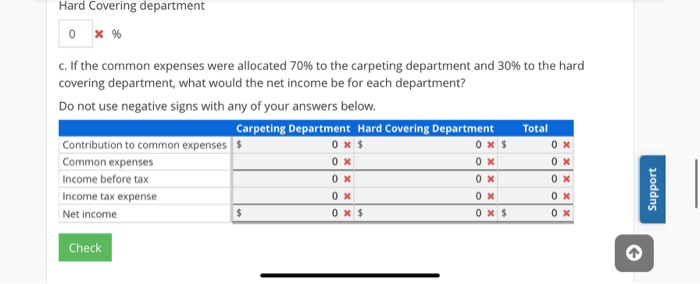

Departmental Income Statement Elgin Flooring Company sells floor coverings through two departments, carpeting and hard covering (tile and linoleum). Operating information for 2016 appears below. Carpeting Department Hard Cover Inventory. January 1, 2016 $68,000 Inventory December 31, 2016 42,000 Net sales 780,000 Purchases 484,000 Purchases returns 28,000 Purchases discounts 16,000 Transporation 18,000 Traceable departmental expenses 101,000 Common operating expenses of the firm were $120,000 a. Prepare a departmental income statement showing departmental contribution to common expenses and net income of the firm. Assume an overall effective income tax rate of 35%. Elgin uses a periodic inventory system. Do not use negative signs with any of your answers below. Elgin Flooring Com. Hard Covering department 0 X % c. If the common expenses were allocated 70% to the carpeting department and 30% to the hard covering department, what would the net income be for each department? Do not use negative signs with any of your answers below. Total $ Carpeting Department Hard Covering Department Contribution to common expenses $ 0 x $ 0 Common expenses OX 0 x Income before tax OX Ox Income tax expense OX OX Net income 0 X $ 0 x $ Departmental Income Statement Elgin Flooring Company sells floor coverings through two departments, carpeting and hard covering (tile and linoleum). Operating information for 2016 appears below. Carpeting Department Hard Covering Department Inventory, January 1, 2016 $68,000 $34,000 Inventory, December 31, 2016 42.000 22,000 Net sales 780,000 480,000 Purchases 484,000 362,000 Purchases returns 28,000 8,000 Purchases discounts 16,000 4,000 Transporation in 18,000 14,000 Traceable departmental expenses 101,000 49,000 Support Common operating expenses of the firm were $120,000. a. Prepare a departmental income statement showing demamental contribution to common expenses Common operating expenses of the firm were $120,000. a. Prepare a departmental income statement showing departmental contribution to common expenses and net income of the firm. Assume an overall effective income tax rate of 35%. Elgin uses a periodic inventory system Do not use negative signs with any of your answers below. Elgin Flooring Company Departmental Income Statement For the Year Ended December 31, 2016 Carpeting Department Hard Covering Department Total Net sales 780,000 $ 480,000 $ 1,260,000 Cost of goods sold: Inventory, January 1, 2016 68,000 34,000 102,000 Purchases 484,000 362,000 846,000 Purchases returns 28,000 8,000 36,000 Purchases discounts 16.000 4,000 20,000 Support Carpeting Department Hard Covering Department 780,000 $ 480,000 Total 1,260,000 $ Net sales Cost of goods sold: Inventory, January 1, 2016 Purchases Purchases returns Purchases discounts Transportation in Cost of goods available for sale Inventory, December 31, 2016 Cost of goods sold Gross Profit Traceable department expenses Contribution to common expenses Common expenses Income before tax Income tax expense 68,000 484,000 28,000 16,000 18,000 614,000 X 42,000 572,000 X 208,000 x 101,000 34,000 362,000 8,000 4,000 14,000 422,000 X 22,000 400,000 X 80,000 x 49,000 0X 102,000 846,000 36,000 20,000 32,000 1,036,000 x 64,000 972,000 X 288,000 x 150,000 OX Support OX Common expenses Income before tax Income tax expense Net income b. Calculate the gross profit percentage for each department. Round to the nearest whole percentage. Carpeting department 0 x % Support Hard Covering department 0 X % c. If the common expenses were allocated in to the carnating dana ment and 30% to the hard Hard Covering department 0 X % c. If the common expenses were allocated 70% to the carpeting department and 30% to the hard covering department, what would the net income be for each department? Do not use negative signs with any of your answers below. Carpeting Department Hard Covering Department Total Contribution to common expenses $ 0 X $ Common expenses 0 X Income before tax OX Income tax expense Net income 0X $ 0X $ 0 X 0 X Support Check