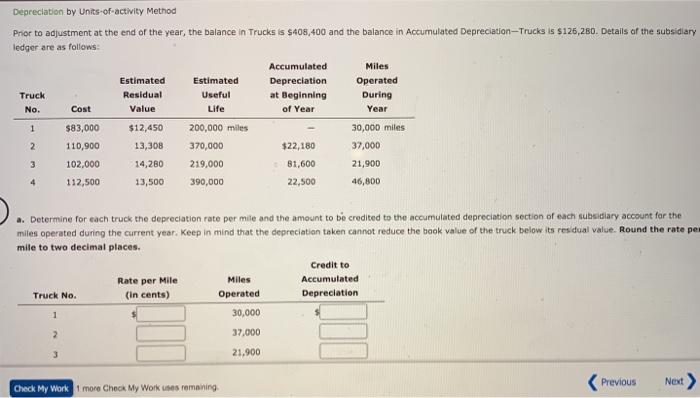

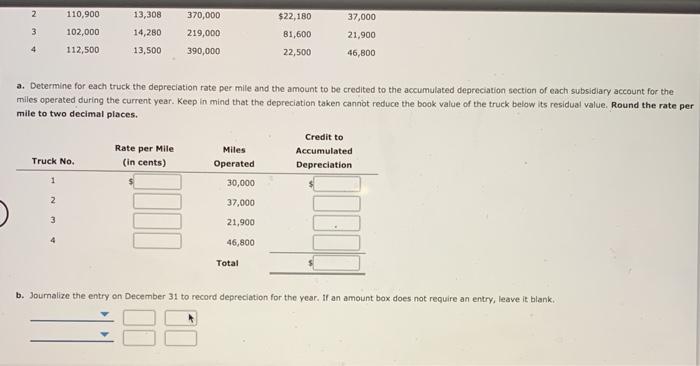

Depreciation by Units-of-activity Method Prior to adjustment at the end of the year, the balance in Trucks is $408,400 and the balance in Accumulated DepreciationTrucks is $126,260. Details of the subsidlary ledger are as follows: Accumulated Miles Estimated Estimated Depreciation Operated Truck Residual Useful at Beginning During No. Cost Value of Year Year 1 $83,000 $12,450 200,000 miles 30,000 miles 2 110,900 13,308 370,000 $22,180 37,000 3 102,000 14,280 219,000 81,600 21,900 112,500 13,500 390,000 22,500 46,800 Life 4 a. Determine for each truck the depreciation rate per mile and the amount to be credited to the accumulated depreciation section of each subsidiary account for the miles operated during the current year. Keep in mind that the depreciation taken cannot reduce the book value of the truck below its residual value. Round the rate pe mile to two decimal places. Credit to Rate per Mile Accumulated Truck No. (in cents) Operated Depreciation 30,000 Miles 1 37.000 2 3 21,900 Previous Next > Check My Work 1 more Check My Works remaining 2 110,900 $22,180 37,000 3 13,308 14,280 13,500 102,000 112,500 370,000 219,000 390,000 21,900 81,600 22,500 4 46,800 a. Determine for each truck the depreciation rate per mile and the amount to be credited to the accumulated depreciation section of each subsidiary account for the miles operated during the current year. Keep in mind that the depreciation taken cannot reduce the book value of the truck below its residual value. Round the rate per mile to two decimal places. Rate per Mile (in cents) Credit to Accumulated Depreciation Miles Operated 30,000 Truck No. 1 2 37,000 1 3 21,900 46,800 Total b. Joumalize the entry on December 31 to record depreciation for the year. If an amount box does not require an entry, leave it blank. Depreciation by Units-of-activity Method Prior to adjustment at the end of the year, the balance in Trucks is $408,400 and the balance in Accumulated DepreciationTrucks is $126,260. Details of the subsidlary ledger are as follows: Accumulated Miles Estimated Estimated Depreciation Operated Truck Residual Useful at Beginning During No. Cost Value of Year Year 1 $83,000 $12,450 200,000 miles 30,000 miles 2 110,900 13,308 370,000 $22,180 37,000 3 102,000 14,280 219,000 81,600 21,900 112,500 13,500 390,000 22,500 46,800 Life 4 a. Determine for each truck the depreciation rate per mile and the amount to be credited to the accumulated depreciation section of each subsidiary account for the miles operated during the current year. Keep in mind that the depreciation taken cannot reduce the book value of the truck below its residual value. Round the rate pe mile to two decimal places. Credit to Rate per Mile Accumulated Truck No. (in cents) Operated Depreciation 30,000 Miles 1 37.000 2 3 21,900 Previous Next > Check My Work 1 more Check My Works remaining 2 110,900 $22,180 37,000 3 13,308 14,280 13,500 102,000 112,500 370,000 219,000 390,000 21,900 81,600 22,500 4 46,800 a. Determine for each truck the depreciation rate per mile and the amount to be credited to the accumulated depreciation section of each subsidiary account for the miles operated during the current year. Keep in mind that the depreciation taken cannot reduce the book value of the truck below its residual value. Round the rate per mile to two decimal places. Rate per Mile (in cents) Credit to Accumulated Depreciation Miles Operated 30,000 Truck No. 1 2 37,000 1 3 21,900 46,800 Total b. Joumalize the entry on December 31 to record depreciation for the year. If an amount box does not require an entry, leave it blank