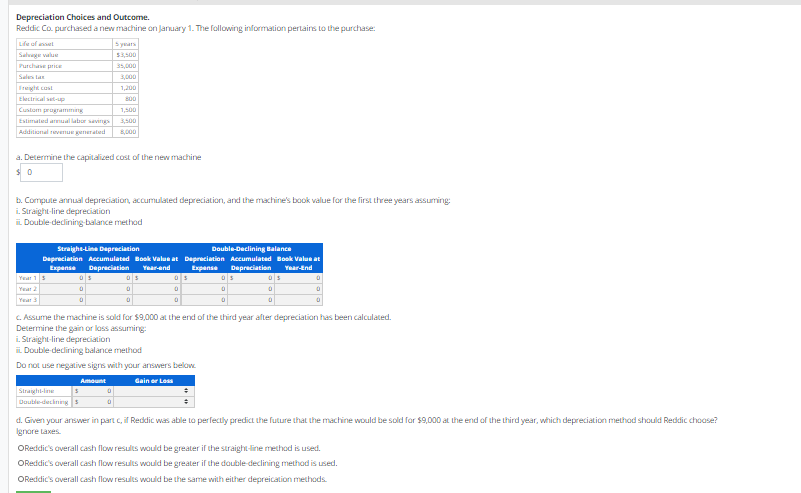

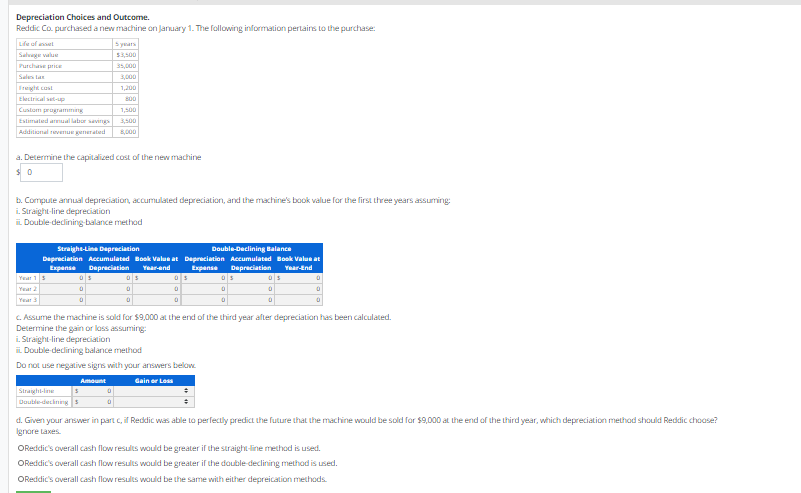

Depreciation Choices and outcome. Reddic Co. purchased a new machine on January 1. The following information perlains to the purchase: years Salayev 33600 Purchase 35,000 3,000 1,200 terap 800 1,500 Estimatedralborsa 3,500 Additional revenue generated 8,000 a. Determine the capitalized cost of the new machine $0 b. Compute annual cepreciation, accumulated depreciation, and the machine's book value for the first three years assurting i. Straight line depreciation ii. Double dedining balance method Straight-Line Depreciation Double-Declining Balance Depreciation Accumulated Book Value at Depreciation Accumulated Book Value at Expanse Depreciation Year-end Expanse Depreciation Year-End Year 15 OS 0 0 C. Assume the machine is sold for $9,000 at the end of the third year after depreciation has been calculated. Determine the gain or loss assuming i. Straight-line depreciation ii. Double-dedining balance method Do not use negative signs with your answers below Amount Gainer Less Straight-line Double-declinings 0 d. Giver your answer in parte, il Reddic was able to perfectly predict the future that the machine would be sold for $9,000 at the end of the third year, which depreciation method should Reddic chause? Ignore Laxes. OReddic's averall cash flow results would be greater if the straight-line method is used. Reddic's overall cash flow results would be greater if the double declining method is used. Reddic's overall cash flow results would be the same with either deprecation methods Depreciation Choices and outcome. Reddic Co. purchased a new machine on January 1. The following information perlains to the purchase: years Salayev 33600 Purchase 35,000 3,000 1,200 terap 800 1,500 Estimatedralborsa 3,500 Additional revenue generated 8,000 a. Determine the capitalized cost of the new machine $0 b. Compute annual cepreciation, accumulated depreciation, and the machine's book value for the first three years assurting i. Straight line depreciation ii. Double dedining balance method Straight-Line Depreciation Double-Declining Balance Depreciation Accumulated Book Value at Depreciation Accumulated Book Value at Expanse Depreciation Year-end Expanse Depreciation Year-End Year 15 OS 0 0 C. Assume the machine is sold for $9,000 at the end of the third year after depreciation has been calculated. Determine the gain or loss assuming i. Straight-line depreciation ii. Double-dedining balance method Do not use negative signs with your answers below Amount Gainer Less Straight-line Double-declinings 0 d. Giver your answer in parte, il Reddic was able to perfectly predict the future that the machine would be sold for $9,000 at the end of the third year, which depreciation method should Reddic chause? Ignore Laxes. OReddic's averall cash flow results would be greater if the straight-line method is used. Reddic's overall cash flow results would be greater if the double declining method is used. Reddic's overall cash flow results would be the same with either deprecation methods