Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Depreciation Conundrum Searay 3 8 0 Inc. ( Searay ) is a competitor of Formula 4 0 0 SS Inc. The company has changed from

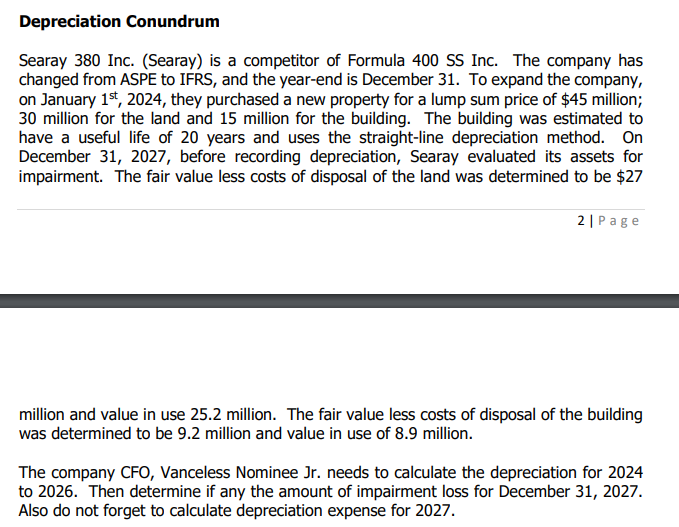

Depreciation Conundrum

Searay Inc. Searay is a competitor of Formula SS Inc. The company has

changed from ASPE to IFRS, and the yearend is December To expand the company,

on January they purchased a new property for a lump sum price of $ million;

million for the land and million for the building. The building was estimated to

have a useful life of years and uses the straightline depreciation method. On

December before recording depreciation, Searay evaluated its assets for

impairment. The fair value less costs of disposal of the land was determined to be $

million and value in use million. The fair value less costs of disposal of the building

was determined to be million and value in use of million.

The company CFO, Vanceless Nominee Jr needs to calculate the depreciation for

to Then determine if any the amount of impairment loss for December

Also do not forget to calculate depreciation expense for

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started