Answered step by step

Verified Expert Solution

Question

1 Approved Answer

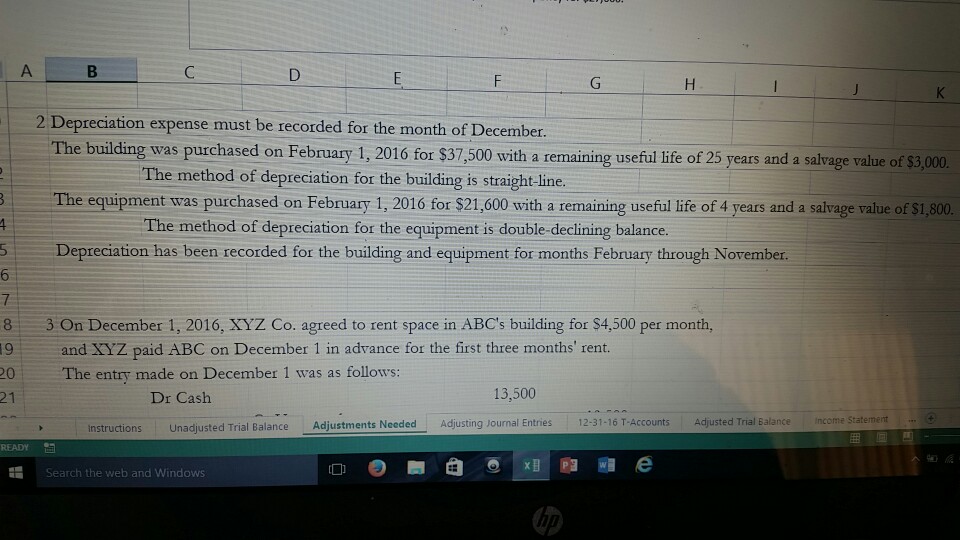

Depreciation expense must be recorded for the month of December. The building was purchased on February 1, 2016 for $37,500 with a remaining useful life

Depreciation expense must be recorded for the month of December. The building was purchased on February 1, 2016 for $37,500 with a remaining useful life of 25 years and a salvage value of $3,000. The method of depreciation for the building is straight line. The equipment was purchased on February 1, 2016 for $21,600 with a remaining useful life of 4 years and a salvage value of $1,800. The method of depreciation for the equipment is double decline balance. Depreciation has been recorded for the building and equipment for months February through November. On December 1, 2016, XYZ Co. agreed to rent space in ABC's building for $4,500 per month, and XYZ paid ABC on December 1 in advance for the first three month's rent. The entry made on December 1 was as follows

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started