Answered step by step

Verified Expert Solution

Question

1 Approved Answer

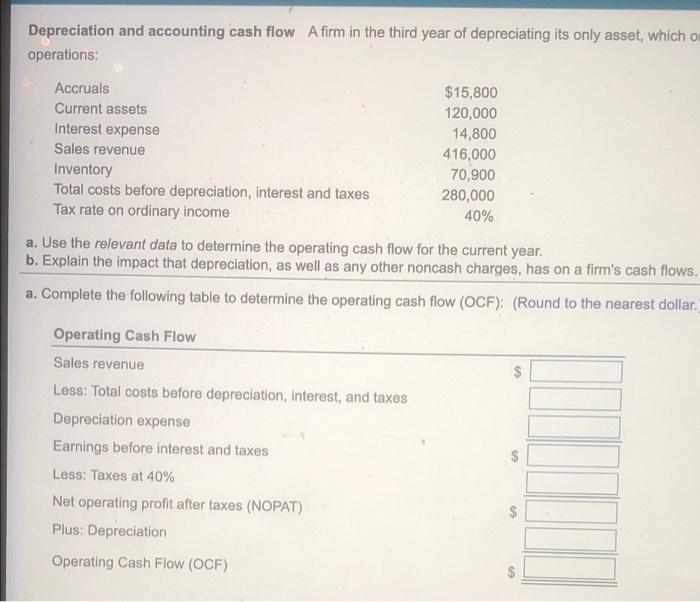

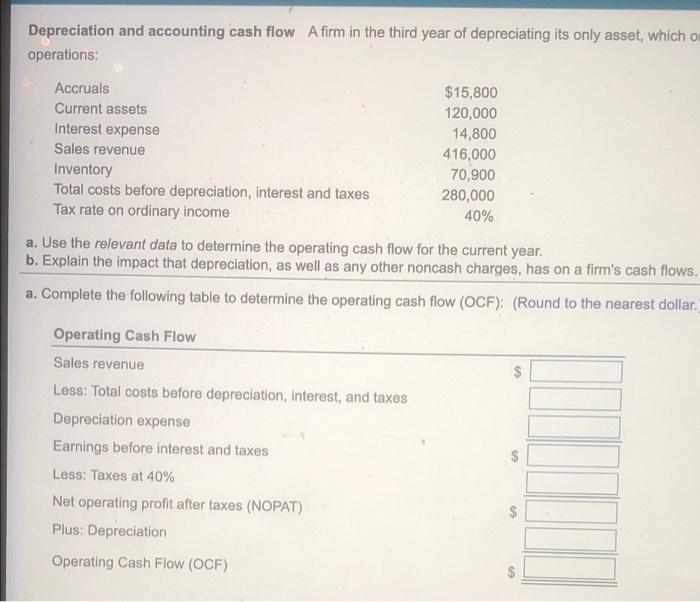

depreciation in accounting cash flow. A firm in the third year of depreciating it's only asset, which originally cost $174,000 and has a 5-year MACRS

depreciation in accounting cash flow. A firm in the third year of depreciating it's only asset, which originally cost $174,000 and has a 5-year MACRS recovery period. Has gathered the following data relative to current years operations

Depreciation and accounting cash flow A firm in the third year of depreciating its only asset, which on operations: Accruals $15,800 Current assets 120,000 Interest expense 14,800 Sales revenue 416,000 Inventory 70,900 Total costs before depreciation, interest and taxes 280,000 Tax rate on ordinary income 40% a. Use the relevant data to determine the operating cash flow for the current year. b. Explain the impact that depreciation, as well as any other noncash charges, has on a firm's cash flows. a. Complete the following table to determine the operating cash flow (OCF): (Round to the nearest dollar $ Operating Cash Flow Sales revenue Less: Total costs before depreciation, interest, and taxes Depreciation expense Earnings before interest and taxes Less: Taxes at 40% Net operating profit after taxes (NOPAT) Plus: Depreciation Operating Cash Flow (OCF) $ $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started