Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Depreciation methods and useful lives: Buildings-150% declining balance; 25 years. Equipment-Straight line; 10 years. Automobiles and trucks-200% declining balance; 5 years, all acquired after 2020.

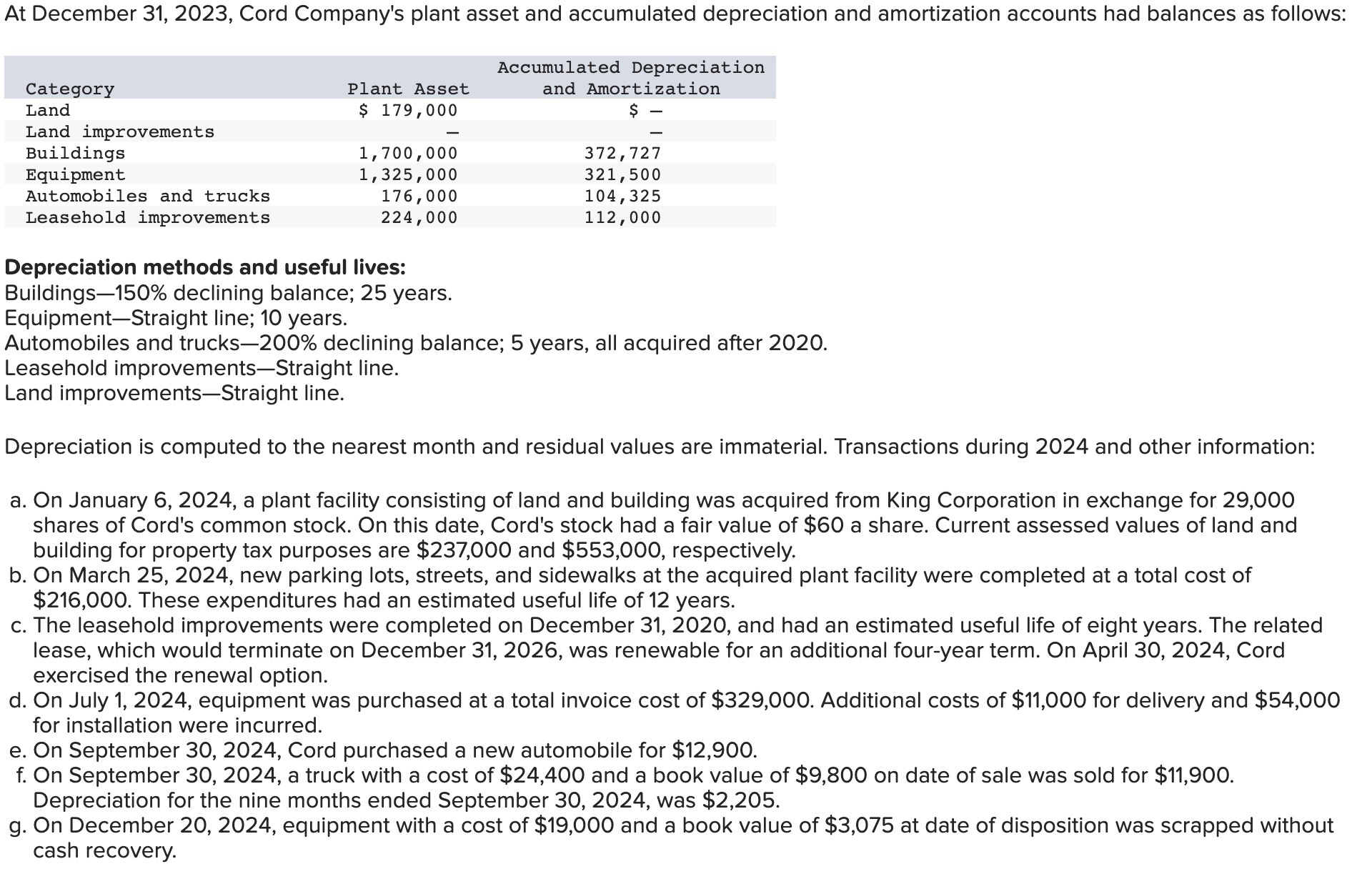

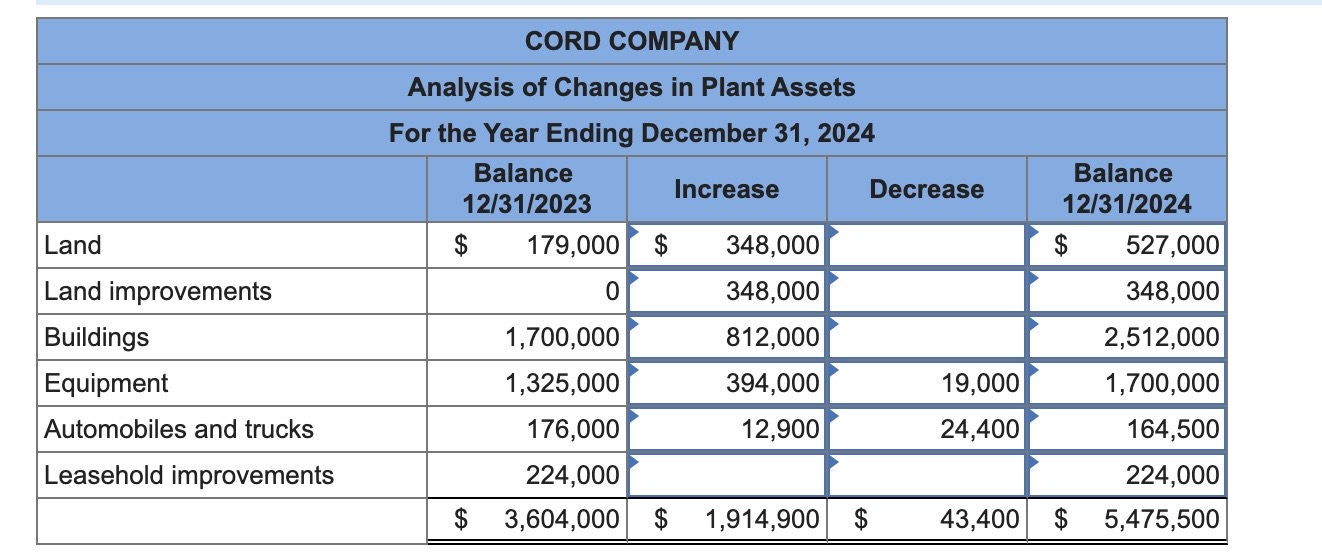

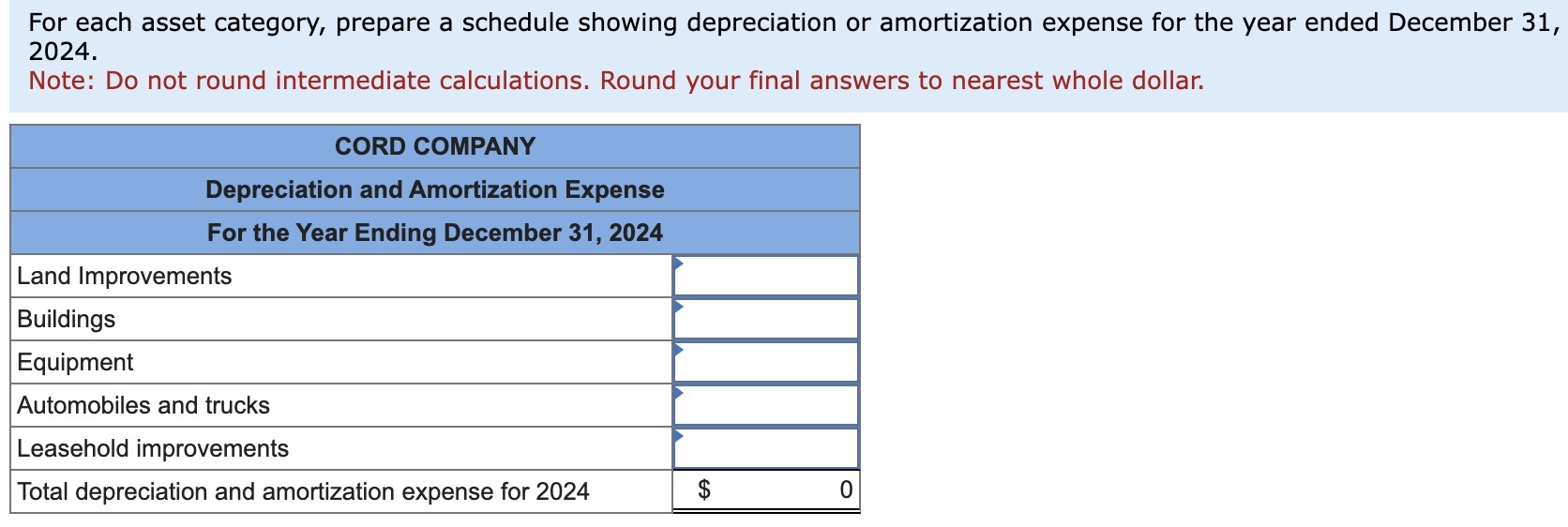

Depreciation methods and useful lives: Buildings-150\% declining balance; 25 years. Equipment-Straight line; 10 years. Automobiles and trucks-200\% declining balance; 5 years, all acquired after 2020. Leasehold improvements-Straight line. Land improvements-Straight line. Depreciation is computed to the nearest month and residual values are immaterial. Transactions during 2024 and other information: a. On January 6, 2024, a plant facility consisting of land and building was acquired from King Corporation in exchange for 29,000 shares of Cord's common stock. On this date, Cord's stock had a fair value of $60 a share. Current assessed values of land and building for property tax purposes are $237,000 and $553,000, respectively. b. On March 25, 2024, new parking lots, streets, and sidewalks at the acquired plant facility were completed at a total cost of $216,000. These expenditures had an estimated useful life of 12 years. c. The leasehold improvements were completed on December 31,2020 , and had an estimated useful life of eight years. The related lease, which would terminate on December 31, 2026, was renewable for an additional four-year term. On April 30, 2024, Cord exercised the renewal option. d. On July 1, 2024, equipment was purchased at a total invoice cost of $329,000. Additional costs of $11,000 for delivery and $54,000 for installation were incurred. e. On September 30, 2024, Cord purchased a new automobile for $12,900. f. On September 30, 2024, a truck with a cost of $24,400 and a book value of $9,800 on date of sale was sold for $11,900. Depreciation for the nine months ended September 30, 2024, was \$2,205. g. On December 20,2024 , equipment with a cost of $19,000 and a book value of $3,075 at date of disposition was scrapped without cash recovery. For each asset category, prepare a schedule showing depreciation or amortization expense for the year ended December 31 2024. Note: Do not round intermediate calculations. Round your final answers to nearest whole dollar

Depreciation methods and useful lives: Buildings-150\% declining balance; 25 years. Equipment-Straight line; 10 years. Automobiles and trucks-200\% declining balance; 5 years, all acquired after 2020. Leasehold improvements-Straight line. Land improvements-Straight line. Depreciation is computed to the nearest month and residual values are immaterial. Transactions during 2024 and other information: a. On January 6, 2024, a plant facility consisting of land and building was acquired from King Corporation in exchange for 29,000 shares of Cord's common stock. On this date, Cord's stock had a fair value of $60 a share. Current assessed values of land and building for property tax purposes are $237,000 and $553,000, respectively. b. On March 25, 2024, new parking lots, streets, and sidewalks at the acquired plant facility were completed at a total cost of $216,000. These expenditures had an estimated useful life of 12 years. c. The leasehold improvements were completed on December 31,2020 , and had an estimated useful life of eight years. The related lease, which would terminate on December 31, 2026, was renewable for an additional four-year term. On April 30, 2024, Cord exercised the renewal option. d. On July 1, 2024, equipment was purchased at a total invoice cost of $329,000. Additional costs of $11,000 for delivery and $54,000 for installation were incurred. e. On September 30, 2024, Cord purchased a new automobile for $12,900. f. On September 30, 2024, a truck with a cost of $24,400 and a book value of $9,800 on date of sale was sold for $11,900. Depreciation for the nine months ended September 30, 2024, was \$2,205. g. On December 20,2024 , equipment with a cost of $19,000 and a book value of $3,075 at date of disposition was scrapped without cash recovery. For each asset category, prepare a schedule showing depreciation or amortization expense for the year ended December 31 2024. Note: Do not round intermediate calculations. Round your final answers to nearest whole dollar Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started