Answered step by step

Verified Expert Solution

Question

1 Approved Answer

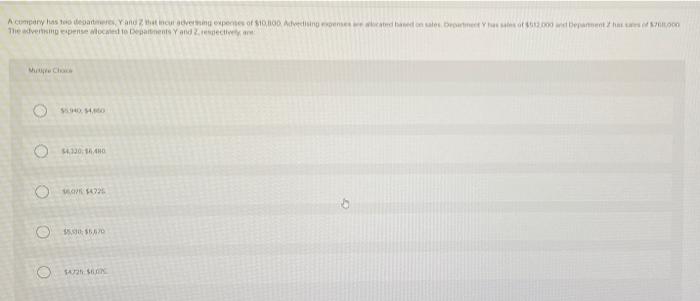

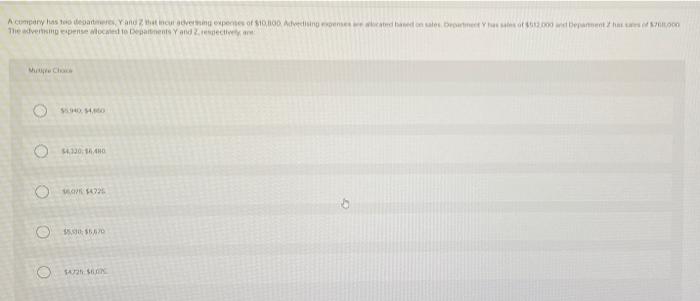

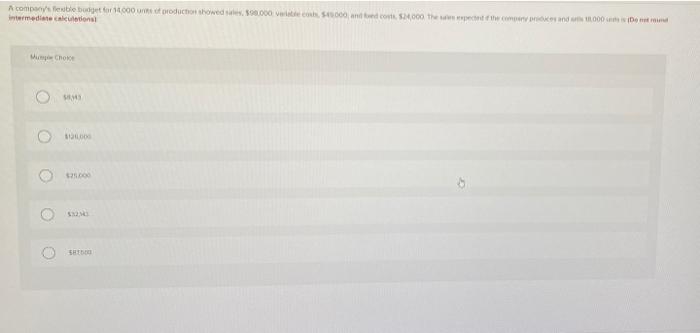

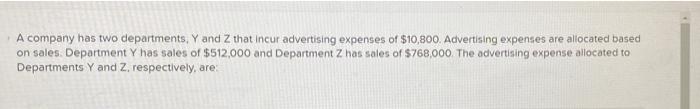

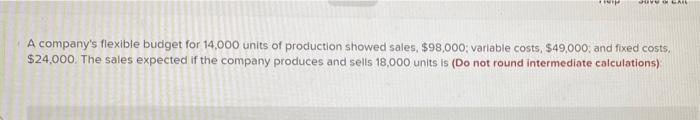

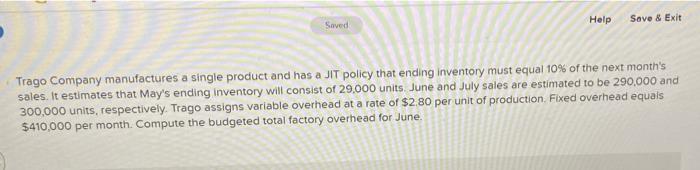

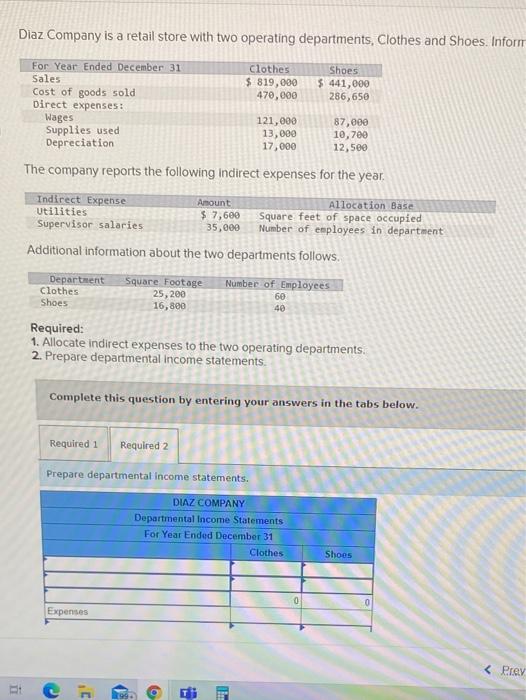

8-15 8-15 Acumper has to one another reports of 10000 de metal deth The advertise wiede Dates and recent 140 26 o OM A company's

8-15

8-15

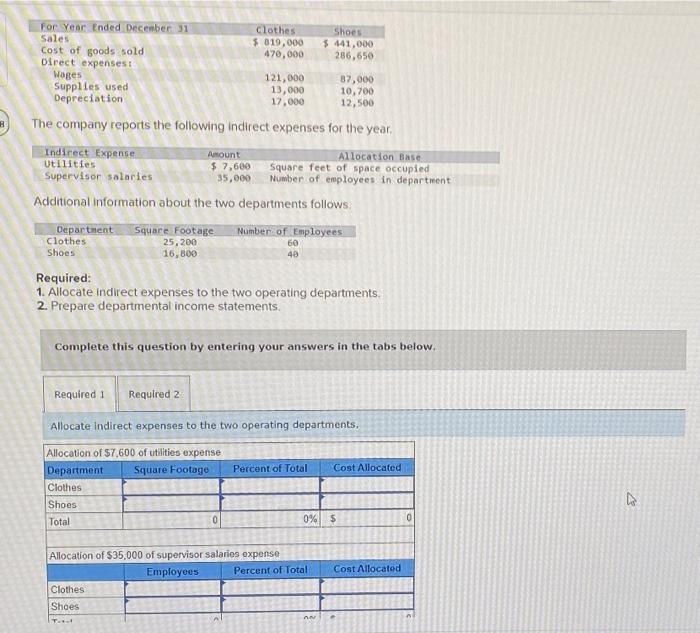

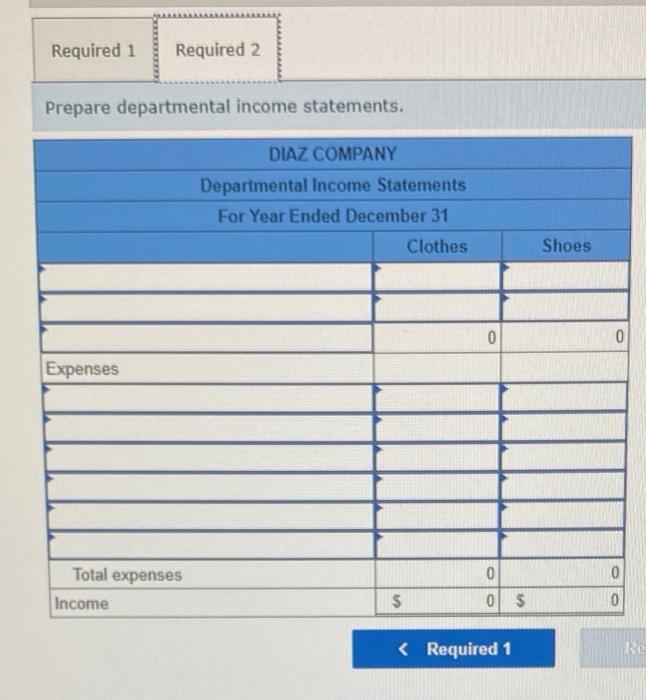

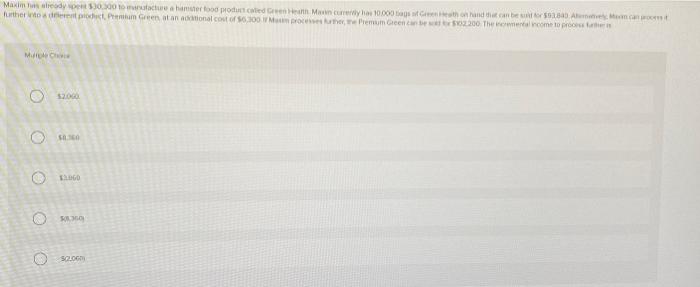

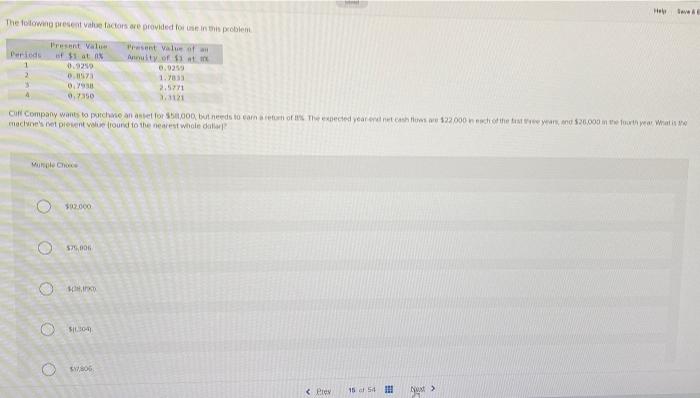

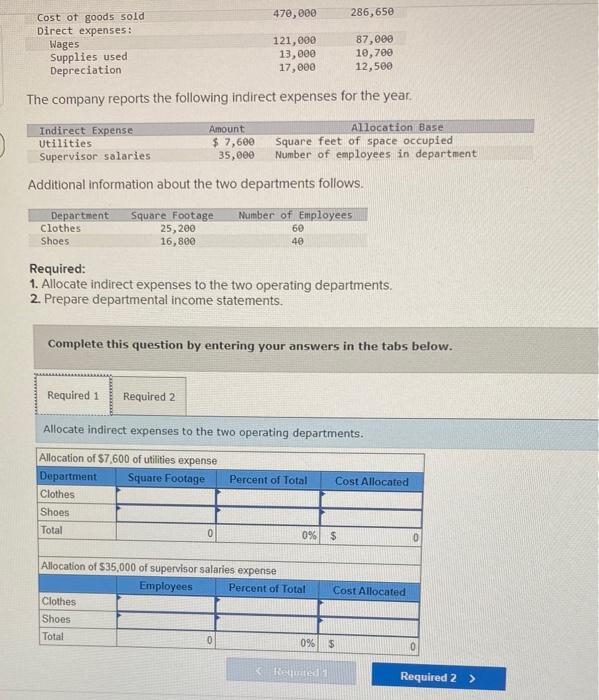

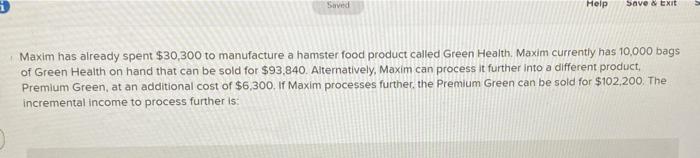

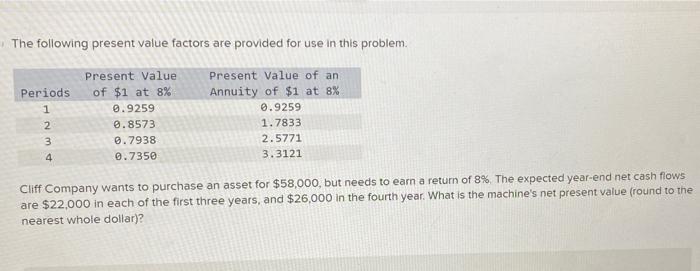

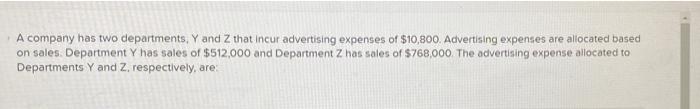

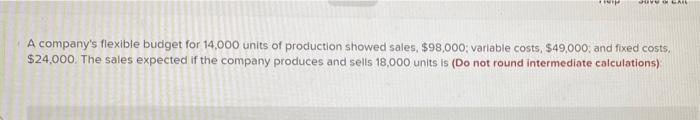

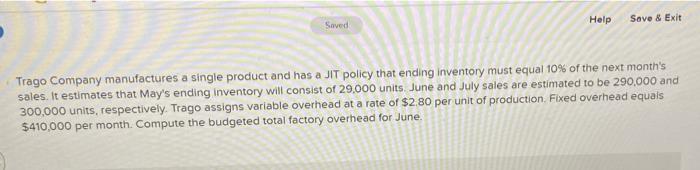

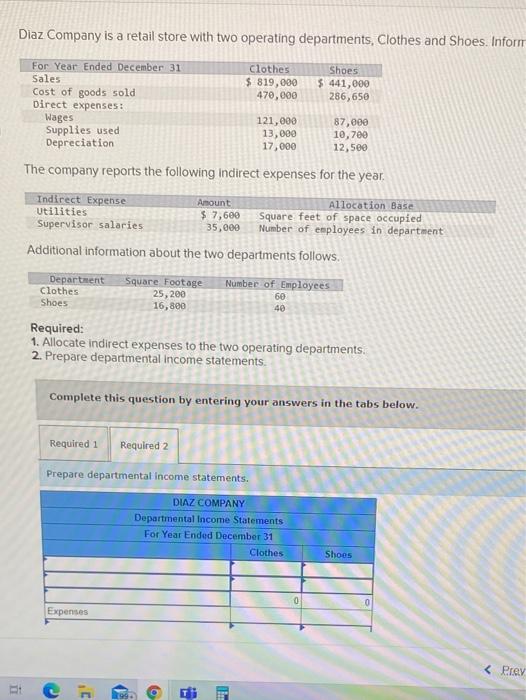

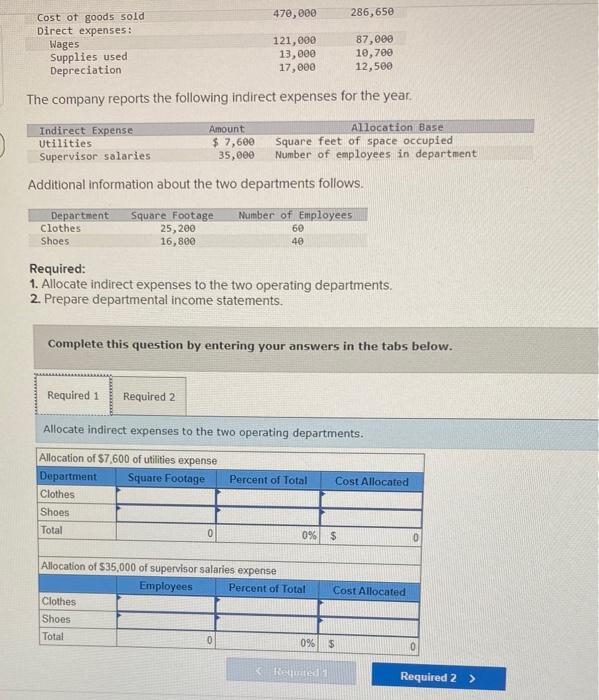

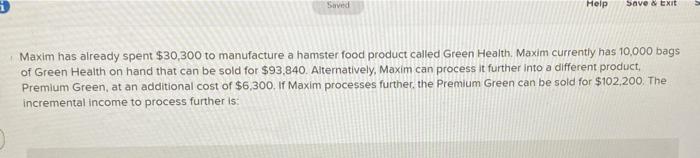

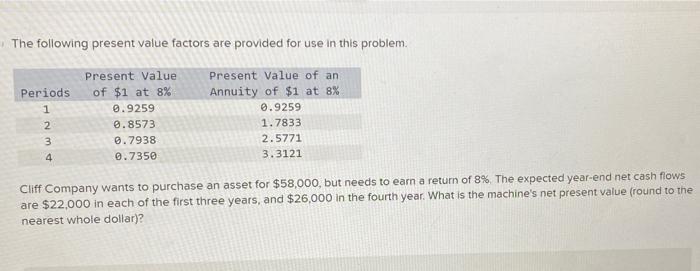

Acumper has to one another reports of 10000 de metal deth The advertise wiede Dates and recent 140 26 o OM A company's fible bit of production showed 590.000 vnt000 the checker and 4000 Det intermediate calculations Cho See Trago Company with a poche 2000 wested to the 200.000.000.000 factory head for me Cho 814.00 50250.000 4 O 5:20 4.00 For Year Ended December 31 Clothes Shoes Sales $ 819,000 $441,000 Cost of goods sold 470,000 286,650 Direct expenses Wages 121,000 37,000 Supplies used 13,000 10,700 Depreciation 17.000 12,500 The company reports the following indirect expenses for the year. Indirect Expense Amount Allocation Base Utilities $ 7.680 Square feet of space occupied Supervisor salaries 35,000 Number of employees in department Additional information about the two departments follows: B Department Clothes Shoes Square Footage 25,200 16,800 Number of employees 60 40 Required: 1. Allocate indirect expenses to the two operating departments, 2. Prepare departmental income statements. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Allocate indirect expenses to the two operating departments, Percent of Total Cost Allocated Allocation of 57,600 of utilities expense Department Square Footage Clothes Shoes Total 0% $ Cost Allocated Allocation of $35,000 of supervisor salaries expense Employees Percent of Total Clothes Shoes AN TE Required 1 Required 2 Prepare departmental income statements. DIAZ COMPANY Departmental Income Statements For Year Ended December 31 Clothes Shoes 0 0 Expenses 0 0 Total expenses Income $ 0 $ 0 A company has two departments. Y and Z that incur advertising expenses of $10,800. Advertising expenses are allocated based on sales Department Y has sales of $512,000 and Department Z has sales of $768.000 The advertising expense allocated to Departments Y and Z respectively, are VLAS A company's flexible budget for 14,000 units of production showed sales. $98,000; variable costs $49,000, and fixed costs, $24,000. The sales expected if the company produces and sells 18,000 units is (Do not round intermediate calculations) Help Save & Exit Saved Trago Company manufactures a single product and has a JIT policy that ending inventory must equal 10% of the next month's sales. It estimates that May's ending inventory will consist of 29,000 units. June and July sales are estimated to be 290,000 and 300,000 units, respectively. Trago assigns variable overhead at a rate of $2.80 per unit of production. Fixed overhead equals $410,000 per month Compute the budgeted total factory overhead for June. Diaz Company is a retail store with two operating departments, Clothes and Shoes. Inform Clothes $ 819,000 470,000 Shoes $ 441,000 286,650 For Year Ended December 31 Sales Cost of goods sold Direct expenses: Wages Supplies used Depreciation 121,000 13,000 17,000 87,000 10,700 12,500 The company reports the following indirect expenses for the year. Indirect Expense Amount Allocation Base Utilities $ 7,600 Square feet of space occupied Supervisor salaries 35,000 Number of employees in department Additional information about the two departments follows. Department Square Footage Number of Employees Clothes 25, 200 60 Shoes 16,800 40 Required: 1. Allocate indirect expenses to the two operating departments. 2. Prepare departmental income statements Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare departmental income statements. DIAZ COMPANY Departmental Income Statements For Year Ended December 31 Clothes Shoes 0 Expenses Said Help Save & Exit Maxim has already spent $30,300 to manufacture a hamster food product called Green Health, Maxim currently has 10,000 bags of Green Health on hand that can be sold for $93,840. Alternatively, Maxim can process it further into a different product, Premium Green, at an additional cost of $6,300 If Maxim processes further the Premium Green can be sold for $102,200. The incremental income to process further is: The following present value factors are provided for use in this problem. Periods 1 Present Value of $1 at 8% 0.9259 0.8573 0.7938 0.7350 Present Value of an Annuity of $1 at 8% 0.9259 1.7833 2.5771 3.3121 2 3 4 Cliff Company wants to purchase an asset for $58,000, but needs to earn a return of 8%. The expected year-end net cash flows are $22.000 in each of the first three years, and $26,000 in the fourth year. What is the machine's net present value (round to the nearest whole dollar)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started