Answered step by step

Verified Expert Solution

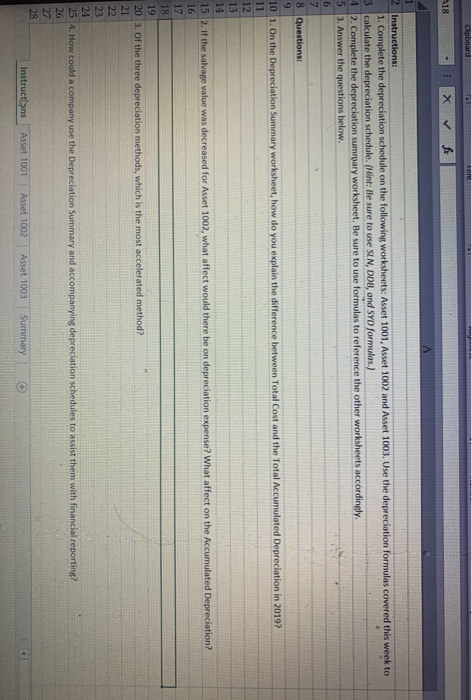

Question

1 Approved Answer

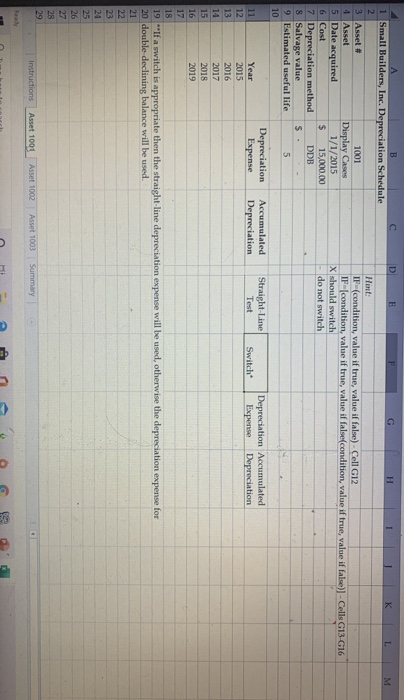

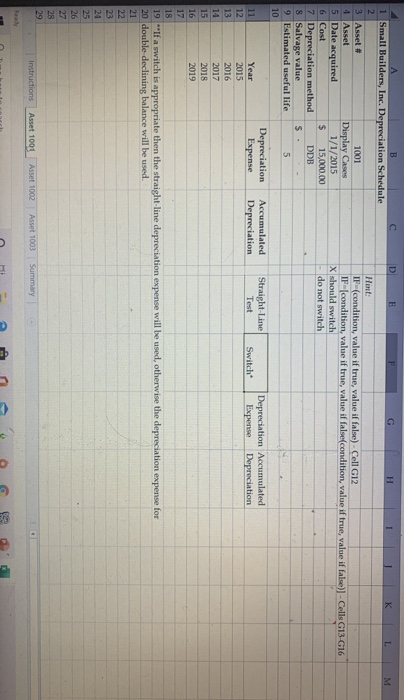

depreciation using excel this is for the DDB For the first one M B D E F H 1 Small Builders, Inc. Depreciation Schedule K

depreciation using excel

this is for the DDB For the first one

M B D E F H 1 Small Builders, Inc. Depreciation Schedule K 2 Hint: 3 Asset 1001 IF (condition, value if true, value if false)-Cell G12 4 Asset Display Cases IF-condition, value if true, value if false condition, value if true, value if false) - Cells G13 G16 5 Date acquired 1/1/2015 X should switch 6 Cast $ 15,000.00 do not switch 7 Depreciation method DDB 8 Salvage value S. 9 Estimated useful life 5 10 Depreciation Accumulated Straight-Line Depreciation Accumulated 11 Year Expense Depreciation Test Switch Expense Depreciation 12 2015 13 2016 14 2017 15 2018 16 2019 17 18 19 If a switch is appropriate then the straight-line depreciation expense will be used, otherwise the depreciation expense for 20 double declining balance will be used. 21 22 23 24 25 26 27 28 29 Instructions Asset 1000 Asset 1002 Asset 1003 Summary Clipboard Fon 18 A 2 Instructions: 1. Complete the depreciation schedule on the following worksheets: Asset 1001, Asset 1002 and Asset 1003. Use the depreciation formulas covered this week to 3 calculate the depreciation schedule. (Hint: Be sure to use SLN, DDB, and SYD formulas.) 4 2. Complete the depreciation sumrpary worksheet. Be sure to use formulas to reference the other worksheets accordingly. 5 3. Answer the questions below. 6 7 8 Questions: 9 10 1. On the Depreciation Summary worksheet, how do you explain the difference between Total Cost and the Total Accumulated Depreciation in 2019? 11 12 13 14 15 2. If the salvage value was decreased for Asset 1002, what affect would there be on depreciation expense? What affect on the Accumulated Depreciation? 16 17 18 19 20 3. Of the three depreciation methods, which is the most accelerated method? 21 22 23 24 25 4. How could a company use the Depreciation Summary and accompanying depreciation schedules to assist them with financial reporting? 26 27 28 Instructions Asset 1001 Asset 1002 Asset 1003 Summary M B D E F H 1 Small Builders, Inc. Depreciation Schedule K 2 Hint: 3 Asset 1001 IF (condition, value if true, value if false)-Cell G12 4 Asset Display Cases IF-condition, value if true, value if false condition, value if true, value if false) - Cells G13 G16 5 Date acquired 1/1/2015 X should switch 6 Cast $ 15,000.00 do not switch 7 Depreciation method DDB 8 Salvage value S. 9 Estimated useful life 5 10 Depreciation Accumulated Straight-Line Depreciation Accumulated 11 Year Expense Depreciation Test Switch Expense Depreciation 12 2015 13 2016 14 2017 15 2018 16 2019 17 18 19 If a switch is appropriate then the straight-line depreciation expense will be used, otherwise the depreciation expense for 20 double declining balance will be used. 21 22 23 24 25 26 27 28 29 Instructions Asset 1000 Asset 1002 Asset 1003 Summary Clipboard Fon 18 A 2 Instructions: 1. Complete the depreciation schedule on the following worksheets: Asset 1001, Asset 1002 and Asset 1003. Use the depreciation formulas covered this week to 3 calculate the depreciation schedule. (Hint: Be sure to use SLN, DDB, and SYD formulas.) 4 2. Complete the depreciation sumrpary worksheet. Be sure to use formulas to reference the other worksheets accordingly. 5 3. Answer the questions below. 6 7 8 Questions: 9 10 1. On the Depreciation Summary worksheet, how do you explain the difference between Total Cost and the Total Accumulated Depreciation in 2019? 11 12 13 14 15 2. If the salvage value was decreased for Asset 1002, what affect would there be on depreciation expense? What affect on the Accumulated Depreciation? 16 17 18 19 20 3. Of the three depreciation methods, which is the most accelerated method? 21 22 23 24 25 4. How could a company use the Depreciation Summary and accompanying depreciation schedules to assist them with financial reporting? 26 27 28 Instructions Asset 1001 Asset 1002 Asset 1003 Summary Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started