Answered step by step

Verified Expert Solution

Question

1 Approved Answer

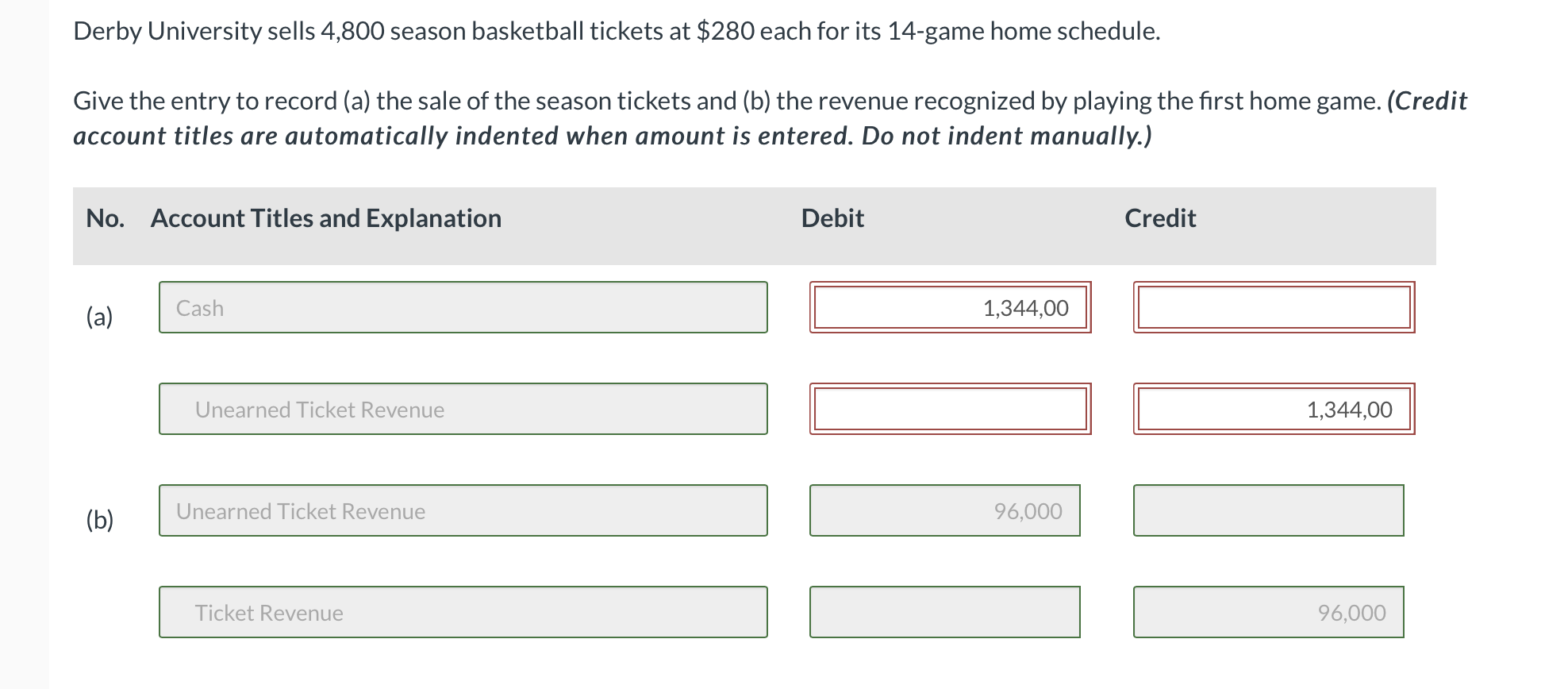

Derby University sells 4,800 season basketball tickets at $280 each for its 14-game home schedule. Give the entry to record (a) the sale of

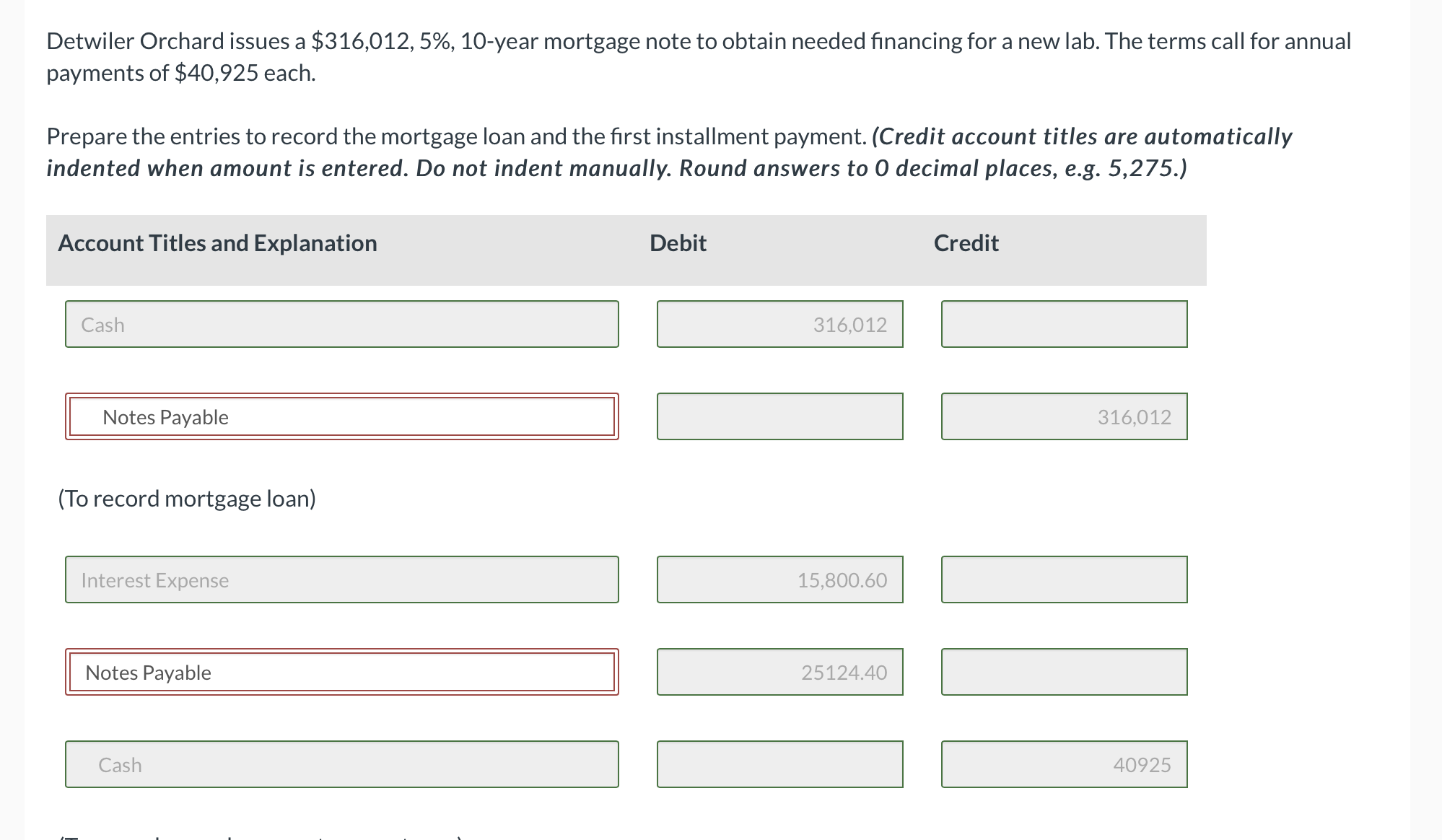

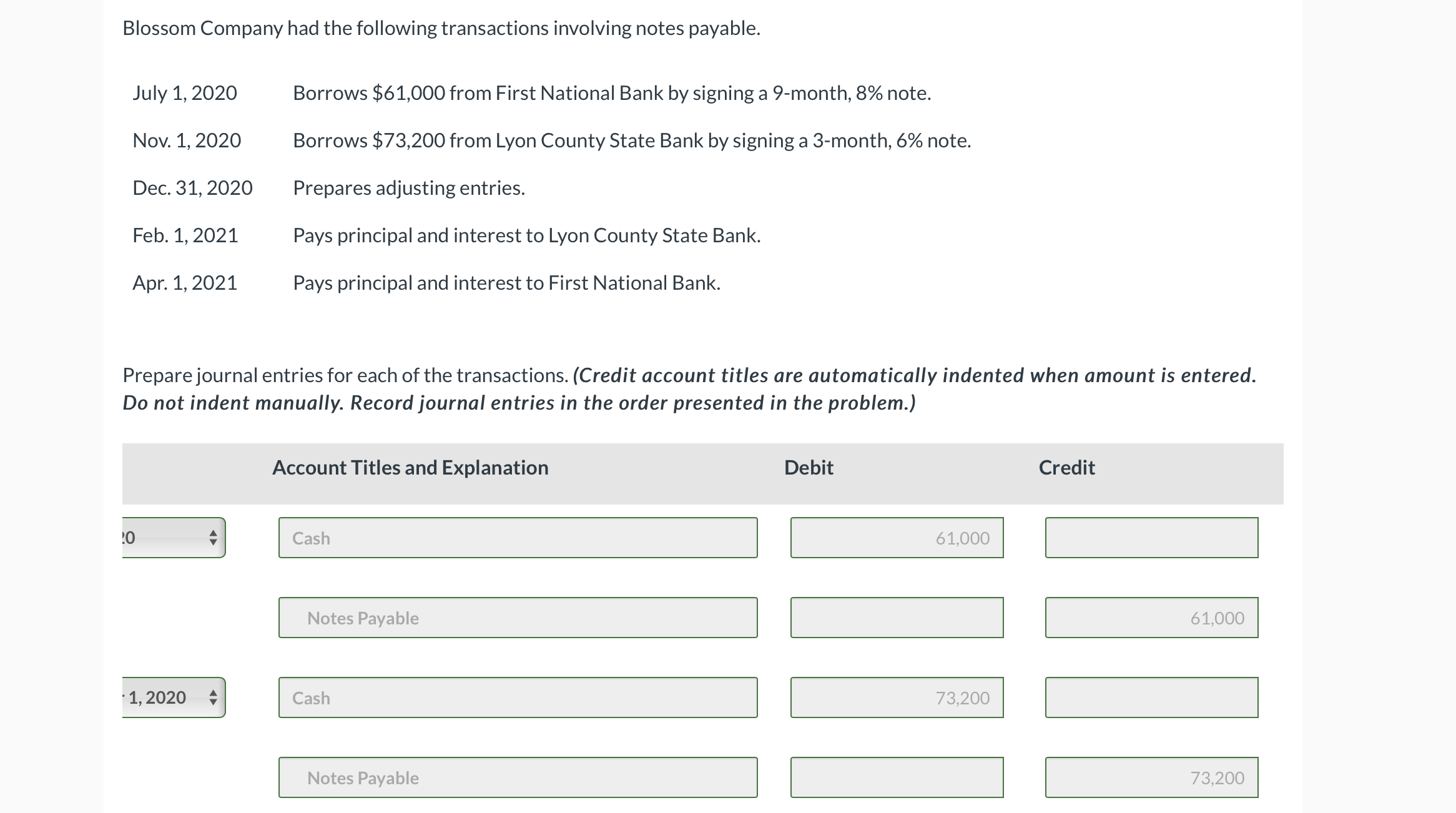

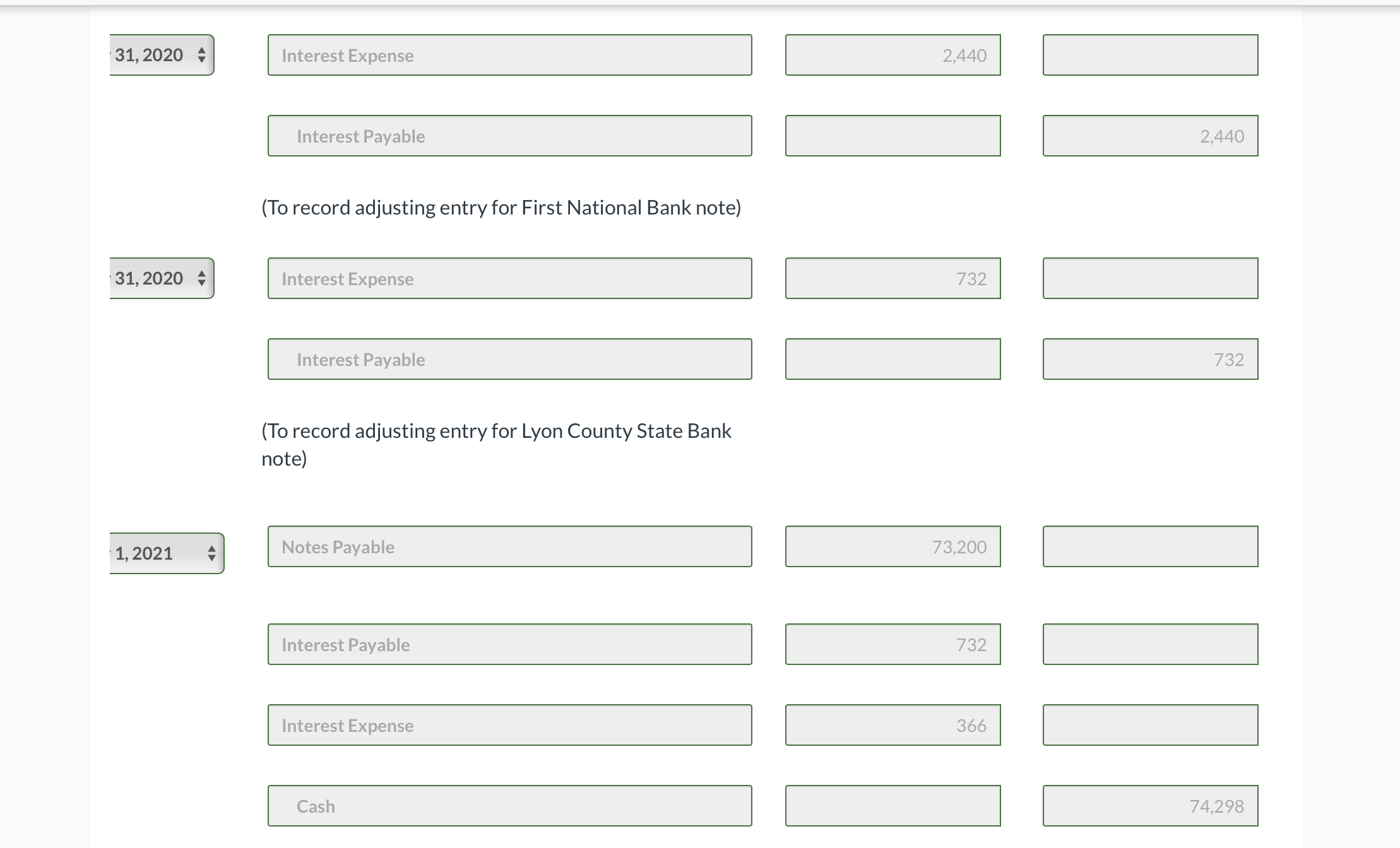

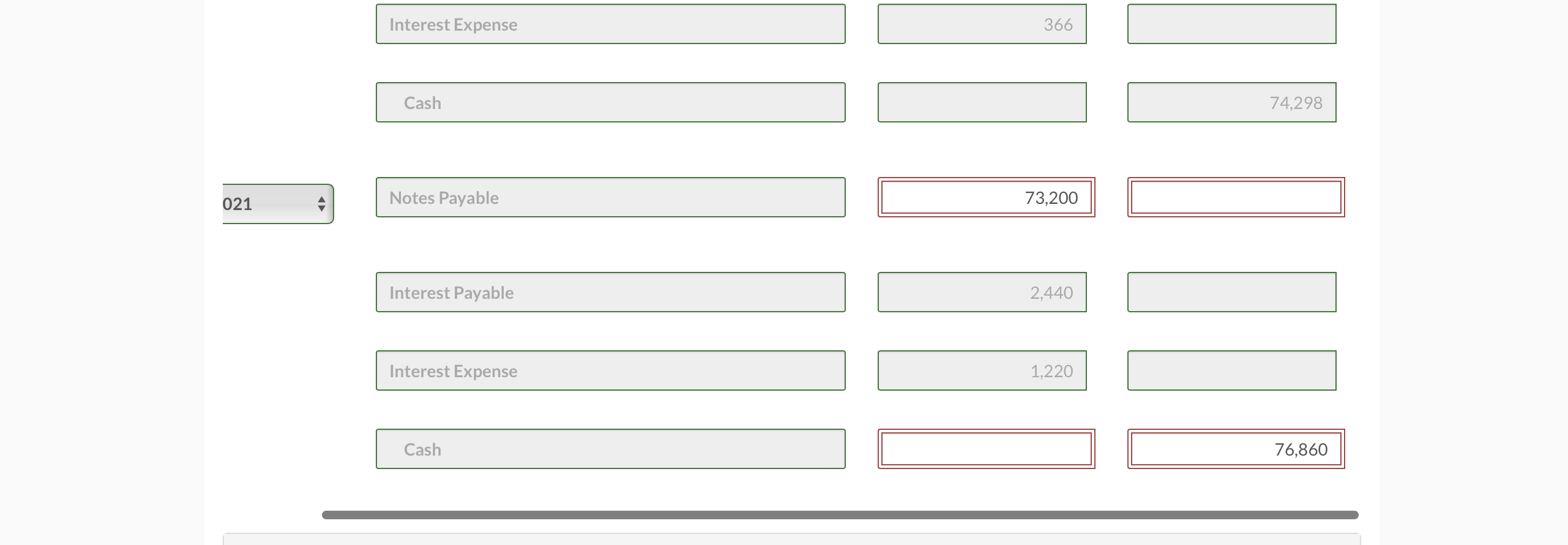

Derby University sells 4,800 season basketball tickets at $280 each for its 14-game home schedule. Give the entry to record (a) the sale of the season tickets and (b) the revenue recognized by playing the first home game. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) No. Account Titles and Explanation (a) (b) Cash Unearned Ticket Revenue Unearned Ticket Revenue Ticket Revenue Debit 1,344,00 96,000 Credit 1,344,00 96,000 Detwiler Orchard issues a $316,012, 5%, 10-year mortgage note to obtain needed financing for a new lab. The terms call for annual payments of $40,925 each. Prepare the entries to record the mortgage loan and the first installment payment. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Round answers to 0 decimal places, e.g. 5,275.) Account Titles and Explanation Cash Notes Payable (To record mortgage loan) Interest Expense Notes Payable Cash Debit 316,012 15,800.60 25124.40 Credit 316,012 11 40925 Blossom Company had the following transactions involving notes payable. July 1, 2020 Nov. 1, 2020 Dec. 31, 2020 Feb. 1, 2021 Apr. 1, 2021 Prepare journal entries for each of the transactions. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) 20 1, 2020 Borrows $61,000 from First National Bank by signing a 9-month, 8% note. Borrows $73,200 from Lyon County State Bank by signing a 3-month, 6% note. Prepares adjusting entries. Pays principal and interest to Lyon County State Bank. Pays principal and interest to First National Bank. - Account Titles and Explanation Cash Notes Payable Cash Notes Payable Debit 61,000 110 73,200 Credit 110 61,000 73,200 31, 2020 31, 2020 1, 2021 Interest Expense Interest Payable (To record adjusting entry for First National Bank note) Interest Expense Interest Payable (To record adjusting entry for Lyon County State Bank note) Notes Payable Interest Payable Interest Expense Cash 2,440 732 73,200 732 366 2,440 732 ||| 74,298 021 Interest Expense Cash Notes Payable Interest Payable Interest Expense Cash 366 73,200 2,440 1,220 74,298 |||| 76,860

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Journal entries of Derby University Date Upon Sale of Tickets Debit Cash Ac 1344000 4800 tickets 280 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started