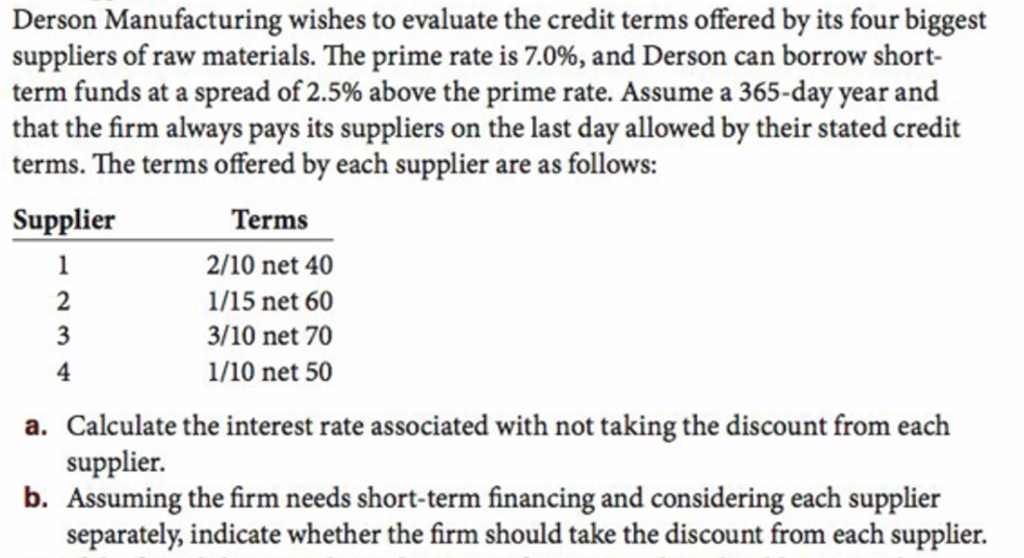

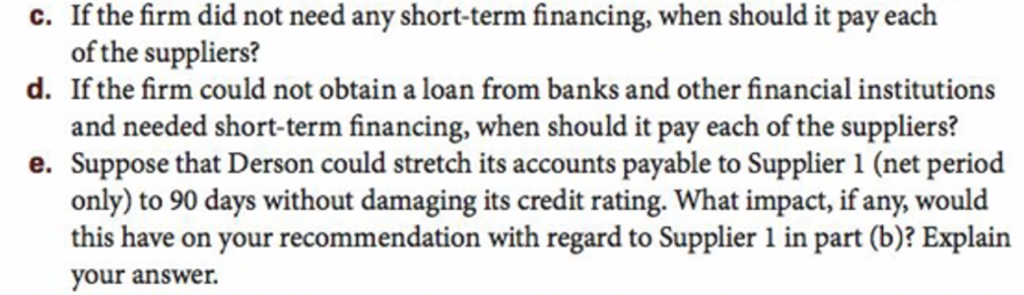

Derson Manufacturing wishes to evaluate the credit terms offered by its four biggest suppliers of raw materials. The prime rate is 7.0%, and Derson can borrow short- term funds at a spread of 2.5% above the prime rate. Assume a 365-day year and that the firm always pays its suppliers on the last day allowed by their stated credit terms. The terms offered by each supplier are as follows: Supplier Terms 2/10 net 40 1/15 net 60 3/10 net 70 1/10 net 50 4 a. Calculate the interest rate associated with not taking the discount from each supplier b. Assuming the firm needs short-term financing and considering each supplier separately, indicate whether the firm should take the discount from each supplier. c. If the firm did not need any short-term financing, when should it pay each d. If the firm could not obtain a loan from banks and other financial institutions e. Suppose that Derson could stretch its accounts payable to Supplier 1 (net period of the suppliers? and needed short-term financing, when should it pay each of the suppliers? only) to 90 days without damaging its credit rating. What impact, if any, would this have on your recommendation with regard to Supplier 1 in part (b)? Explain your answer Derson Manufacturing wishes to evaluate the credit terms offered by its four biggest suppliers of raw materials. The prime rate is 7.0%, and Derson can borrow short- term funds at a spread of 2.5% above the prime rate. Assume a 365-day year and that the firm always pays its suppliers on the last day allowed by their stated credit terms. The terms offered by each supplier are as follows: Supplier Terms 2/10 net 40 1/15 net 60 3/10 net 70 1/10 net 50 4 a. Calculate the interest rate associated with not taking the discount from each supplier b. Assuming the firm needs short-term financing and considering each supplier separately, indicate whether the firm should take the discount from each supplier. c. If the firm did not need any short-term financing, when should it pay each d. If the firm could not obtain a loan from banks and other financial institutions e. Suppose that Derson could stretch its accounts payable to Supplier 1 (net period of the suppliers? and needed short-term financing, when should it pay each of the suppliers? only) to 90 days without damaging its credit rating. What impact, if any, would this have on your recommendation with regard to Supplier 1 in part (b)? Explain your