Describe how and why each of the ratios has changed over the three-year period. For example, did the current ratio increase or decrease? Why? Describe how three of the ratios you calculated for your company compare to the general industry.

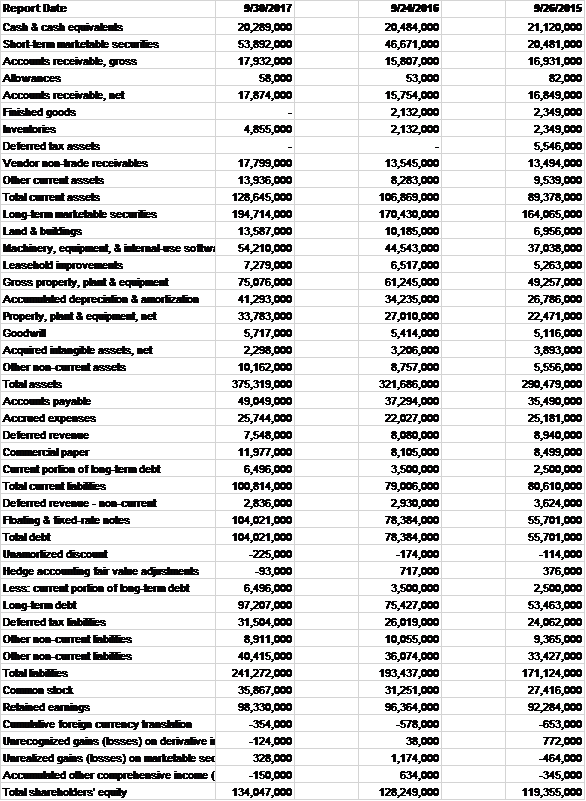

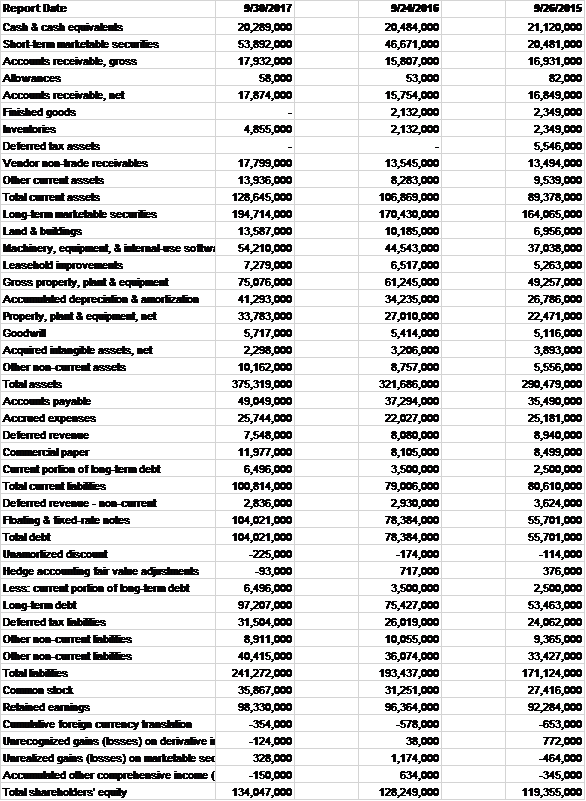

Below is apple Balance sheet for 2017, 2016,2015

On each data tab, use formulas to calculate the following financial indicators for each year of data:

o Currentratio

o Debt/equityratio

o Freecashflow

o Earnings per share o Price/earnings ratio o Returnonequity

o Netprofitmargin

Describe how and why each of the ratios has changed over the three-year period. For example, did the current ratio increase or decrease? Why? Describe how three of the ratios you calculated for your company compare to the general industry.

SENZ017 Report Date 21,120,000 Cash&casheqiralens 20,289,000 20,484,000 Shortlem marketable secuilies 20,481,000 53,892,000 46,671,000 Accos receivable, gross 17,932,000 15,807,000 16,931,000 Albwances 58,000 53,000 82,000 Accos receirable, et 17,874,000 15,754,000 16,849,000 Finished goods 2132,000 2,349,000 veniories 2,349,000 4,855,000 2132,000 5,546,000 Defered ta assets 17,799,000 13,545,000 8283,000 13,494,000 Yendor nonrade receivables Oher cumemt assets 13,936,000 9,539,000 Tobal cument assets 128,645,000 106,869,000 89,378,000 Long temrketable secuies 164,065,000 194,714,000 170,430,000 Land & buiinqs 13,587,000 54,210,000 10,185,000 6,956,000 37, 38,000 achincy, e Leasehold iprovemens &ilemalze sow 44,543,000 7279,000 6,517,000 5263,000 Gross property, pant& 75,076,000 61,245,000 49,257,000 orlizalipa i-ked depreci 26,786,000 Accu 41,293,000 34,235,000 33,783,000 Property, plt , net 27,010,000 22,471,000 Goodwil 5,717,000 5,414,000 5,116,000 2298,000 10,162,000 Acqied iangible assets, met Oerno-c etassels 3,206,000 3,893,000 8,757,000 5,556,000 Tobal assets 375,319,000 321,686,000 000'606z Acco payable 49,049,000 37,294,000 35,490,000 Acaued expenses 25,744,000 22,027,000 25,181,000 Defemed revemme 7,548,000 8,080,000 8,940,000 r 11,977,000 8,105,000 8,499,000 6,496,000 100,814,000 t portoe of bag-len debt 3,500,000 2,500,000 Tobal cumet abilies 80,610,000 ooa'9006 Defemed revemme-BO-CTet 2836,000 2,930,000 3,624,000 104,021,000 78,384,000 Fbaling & fed-ae moles 55,701,000 Total debt 104,021,000 55,701,000 T8,384,000 Uramorized discount -225,000 -174,000 -114,000 Hedge acconling fair vaine adin -93,000 717,000 376,000 Less cnet porlioe of bag-iem debt 6,496,000 3,500,000 2,500,000 Long-term debt 97,207,000 75,427,000 53,463,000 Defered ta abil 31,504,000 26,019,000 24,062,000 10,055,000 36,074,000 er - 9,365,000 8911,000 r - 40,415,000 33,427,000 Tobal linbillics 241,272,000 193,437,000 171,124,000 Como socdt Retained eanings 31,251,000 35,867,000 27,416,000 96,364,000 98,330,000 92284,000 C ive foreig cency tramsial 354,000 -578,000 653,000 Uarecognized gains (bsses) on deriralive i -124,000 38,000 T72,000 Urealized gais (bsses) on aketable se Acculaled ober comprebeasire income 328,000 1,174,000 464,000 -150,000 634,000 345,000 Tobalghareholders' equily 128,249,000 119,355,000 134,047,000 SENZ017 Report Date 21,120,000 Cash&casheqiralens 20,289,000 20,484,000 Shortlem marketable secuilies 20,481,000 53,892,000 46,671,000 Accos receivable, gross 17,932,000 15,807,000 16,931,000 Albwances 58,000 53,000 82,000 Accos receirable, et 17,874,000 15,754,000 16,849,000 Finished goods 2132,000 2,349,000 veniories 2,349,000 4,855,000 2132,000 5,546,000 Defered ta assets 17,799,000 13,545,000 8283,000 13,494,000 Yendor nonrade receivables Oher cumemt assets 13,936,000 9,539,000 Tobal cument assets 128,645,000 106,869,000 89,378,000 Long temrketable secuies 164,065,000 194,714,000 170,430,000 Land & buiinqs 13,587,000 54,210,000 10,185,000 6,956,000 37, 38,000 achincy, e Leasehold iprovemens &ilemalze sow 44,543,000 7279,000 6,517,000 5263,000 Gross property, pant& 75,076,000 61,245,000 49,257,000 orlizalipa i-ked depreci 26,786,000 Accu 41,293,000 34,235,000 33,783,000 Property, plt , net 27,010,000 22,471,000 Goodwil 5,717,000 5,414,000 5,116,000 2298,000 10,162,000 Acqied iangible assets, met Oerno-c etassels 3,206,000 3,893,000 8,757,000 5,556,000 Tobal assets 375,319,000 321,686,000 000'606z Acco payable 49,049,000 37,294,000 35,490,000 Acaued expenses 25,744,000 22,027,000 25,181,000 Defemed revemme 7,548,000 8,080,000 8,940,000 r 11,977,000 8,105,000 8,499,000 6,496,000 100,814,000 t portoe of bag-len debt 3,500,000 2,500,000 Tobal cumet abilies 80,610,000 ooa'9006 Defemed revemme-BO-CTet 2836,000 2,930,000 3,624,000 104,021,000 78,384,000 Fbaling & fed-ae moles 55,701,000 Total debt 104,021,000 55,701,000 T8,384,000 Uramorized discount -225,000 -174,000 -114,000 Hedge acconling fair vaine adin -93,000 717,000 376,000 Less cnet porlioe of bag-iem debt 6,496,000 3,500,000 2,500,000 Long-term debt 97,207,000 75,427,000 53,463,000 Defered ta abil 31,504,000 26,019,000 24,062,000 10,055,000 36,074,000 er - 9,365,000 8911,000 r - 40,415,000 33,427,000 Tobal linbillics 241,272,000 193,437,000 171,124,000 Como socdt Retained eanings 31,251,000 35,867,000 27,416,000 96,364,000 98,330,000 92284,000 C ive foreig cency tramsial 354,000 -578,000 653,000 Uarecognized gains (bsses) on deriralive i -124,000 38,000 T72,000 Urealized gais (bsses) on aketable se Acculaled ober comprebeasire income 328,000 1,174,000 464,000 -150,000 634,000 345,000 Tobalghareholders' equily 128,249,000 119,355,000 134,047,000