Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Describe in detail how to apply Importance Sampling to the pricing of a deep out-of-the money European put option with Monte Carlo simulation assuming the

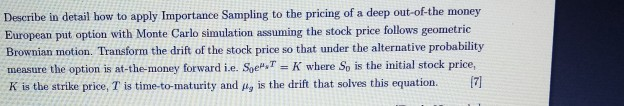

Describe in detail how to apply Importance Sampling to the pricing of a deep out-of-the money European put option with Monte Carlo simulation assuming the stock price follows geometric Brownian motion. Transform the drift of the stock price so that under the alternative probability measure the option is at-the-money forward i.e. SgeT = K where Sp is the initial stock price, (7] K is the strike price, T is time-to-maturity and , is the drift that solves this equation. Describe in detail how to apply Importance Sampling to the pricing of a deep out-of-the money European put option with Monte Carlo simulation assuming the stock price follows geometric Brownian motion. Transform the drift of the stock price so that under the alternative probability measure the option is at-the-money forward i.e. SgeT = K where Sp is the initial stock price, (7] K is the strike price, T is time-to-maturity and , is the drift that solves this equation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started