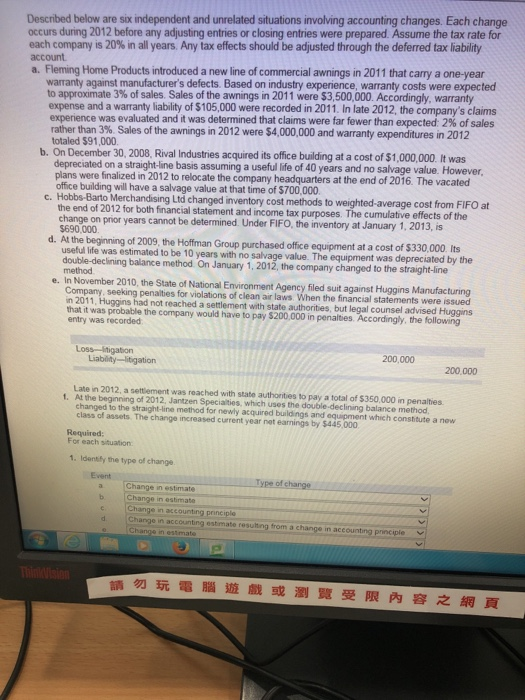

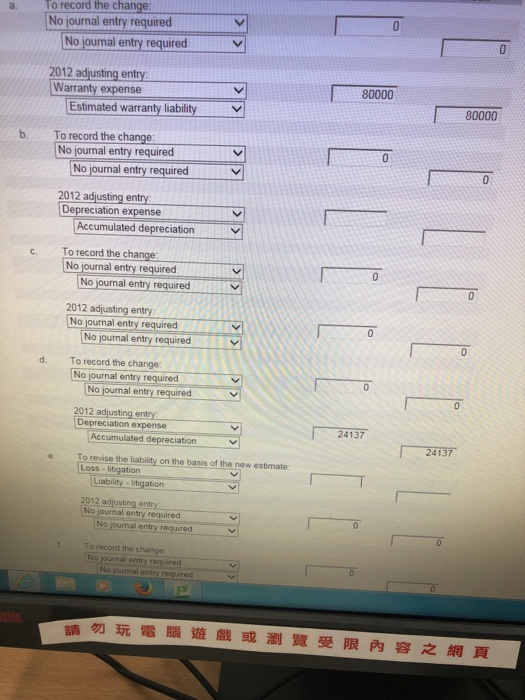

Described below are six independent and unrelated situations involving accounting changes. Each change occurs during 2012 before any adjusting entries or closing entries were prepared. Assume the tax rate for each company is 20% in all years. Any tax effects should be adjusted through the deferred tax liability account six independent and unrelated situatons invoveng a. Fleming Home Products introduced a new line of commercial awnings in 2011 that carry a one-year warranty against manufacturer's defects. Based on industry experience, warranty costs were expected to approximate 3% of sales Sales of the awnings in 2011 were $3.500,000 Accordingly, warranty expense and a warranty liability of $105,000 were recorded in 2011. In late 2012, the company's claims exper ence was evaluated and it was determined that claims were far fewer than expected 2% of sales rather than 3% Sales of the awnings in 2012 were $4,000,000 and warranty expenditures in 2012 totaled $91,000 b. On December 30, 2008. Rival Industries acquired its office building at a cost of $1,000,000. lt was depreciated on a straight-line basis assuming a useful life of 40 years and no salvage value. However, plans were finalized in 2012 to relocate the company headquarters at the end of 2016. The vacated office building will have a salvage value at that time of $700,000 erchandising Ltd changed inventory cost methods to weighted-average cost from FIFO at i cumulative effects of the the end of 2012 for both financial statement and income tax purposes. The change on prior years cannot be determined Under FIFO, the inventory at January 1, 2013, is $690,000 d. At the beginning of 2009, the Hoffman Group purchased office equipment at a cost of $33 0,000. Its useful life was estimated to be 10 years with no salvage value. The equipment was depreciated by the double-declining balance method On January 1, 2012, the company changed to the straight-line method e. In November 2010, the State of National Environment Agency filed suit against Huggins Manufacturing Company, seeking penalties for violations of clean air laws When the financial statements were issued in 2011, Huggins had not reached a settlement with state authorities, but legal counsel advised Huggins that it was probable the company would have to pay $200,000 in penalties. Accordingy, the following entry was recorded 200,000 Liablity-litigation 200.000 Late in 2012, a settlement was reached with state authonities to pay a total of $350,000 in penalties 1. At the beginning of 2012, Jantzen Specialties, which uses the double-declining balance method changed to the straight-line method for newly acquired buildings and equipment which constitute a now class of assets. The change increased current year net earnings by $445,000 For each situation 1. Identify the type of change Change estmate resulting from a change in accounting principle a. To record the change No journal entry required No journal entry required 2012 adusting entry Warranty expense Estimated warranty liability 80000 80000 To record the change No journal entry required No pumal entry required b. l 2012 adjusting entry Depreciation expense Accumulated depreciation To record the ch C. No journal entry required No journal entry required 2012 adjusting entry No journal entry required No journal entry required To record the change d. No journal entry required No journal entry required 2012 adjusting entry Depreciation expense 24137 Accumulated depreciation 41 To revise the liability on the basis of the new estimate Loss -litigation Liability- litigation 2012 adjusting entry No journal entry required No journal entry required t To record the change No journal entry required No journal entry required