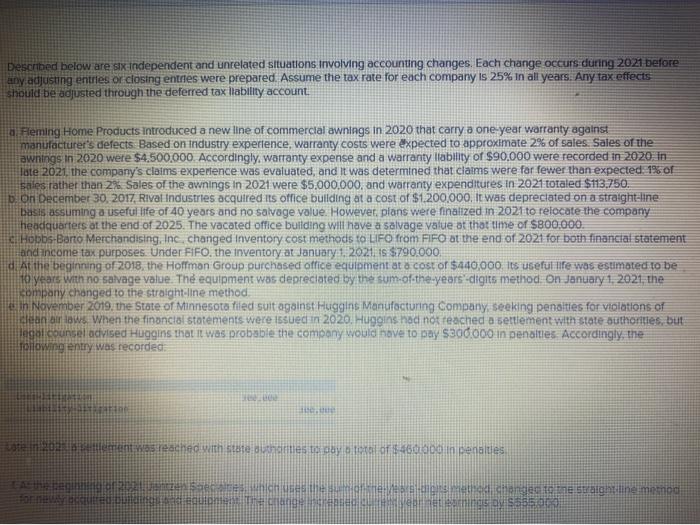

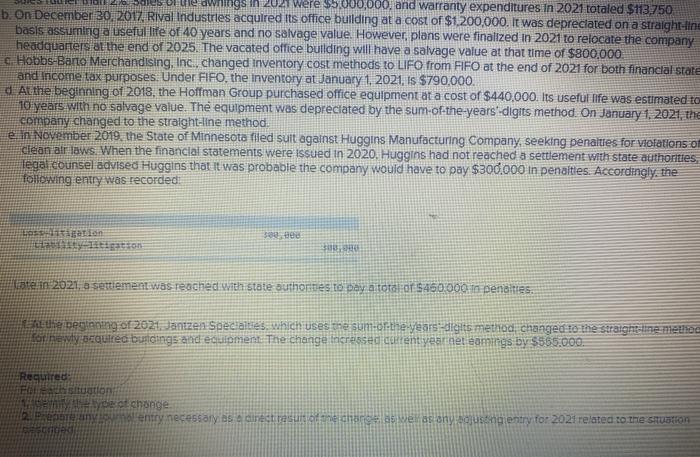

Described below are six independent and unrelated situations involving accounting changes. Each change occurs during 2021 before any adjusting entries or closing entries were prepared. Assume the tax rate for each company is 25% in all years. Any tax effects should be adjusted through the deferred tax liability account. a. Peming Home Products Introduced a new line of commercial awnings in 2020 that carry a one-year warranty against manufacturer's defects. Based on industry experience, warranty costs were expected to approximate 2% of sales. Sales of the awnings in 2020 were $4,500,000. Accordingly, warranty expense and a warranty liability of $90,000 were recorded in 2020, in late 2021, the company's claims experience was evaluated, and it was determined that claims were for fewer than expected 1% of sales rather than 2% Sales of the awnings In 2021 were $5.000.000, and warranty expenditures in 2021 totaled $113.750. B. on December 30, 2017, Rival Industries acquired its office building at a cost of $1.200.000. It was depreciated on a straight line basis assuming a useful iffe of 40 years and no salvage value. However, plans were finalized in 2021 to relocate the company headquarters at the end of 2025. The vacated office bullding will have a salvage value at that time of $800,000 ci Hobbs-Berto Merchandising, Inc. changed Inventory cost methods to LIFO from FIFO at the end of 2021 for both financial statement and income tax purposes. Under FIFO. the Inventory at January 1, 2021, ts $790.000. d. At the beginning of 2018, the Hoffman Group purchased office equipment at a cost of $440,000, los useful life was estimated to be 10 years with no salvage value. The equipment was depreciated by the sum-of-the-years-digits method on January 1 2021. the company changed to the straight line method In November 2019, the State of Minnesota filed suit against Huggins Manufacturing Company, seeking penalties for violations of dean air taw. When the financial statements were issued in 2020. Huggins had not reached a settlement with state suthorities, but legal counsel advised Huggins that it was probable the company would have to pay $300.000 in penalties. Accordingly, the Towing entry was recorded ate in menas reached with state utanes today at 4600 in penalties As the anges to the straight line mesind con le changes a $550 urule dwrlings in 202 were $5.000.000, and warranty expenditures in 2021 totaled $113,750 b. On December 30, 2017, Rival Industries acquired its office building at a cost of $1,200,000. It was depreciated on a straight-line basis assuming a useful life of 40 years and no salvage value. However, plans were finalized in 2021 to relocate the company headquarters at the end of 2025. The vacated office building will have a salvage value at that time of $800.000 c Hobbs-Barto Merchandising, Inc., changed Inventory cost methods to LIFO from FIFO at the end of 2021 for both financial state and income tax purposes. Under FIFO, the inventory at January 1, 2021, is $790,000. d At the beginning of 2018, the Hoffman Group purchased office equipment at a cost of $440,000. Its useful life was estimated to 10 years with no salvage value. The equipment was depreciated by the sum-of-the-years-digits method. On January 1, 2021, the company changed to the straight-line method. e in November 2019, the State of Minnesota filed suit against Huggins Manufacturing Company, seeking penalties for violations of clean air laws. When the financial statements were issued in 2020. Huggins had not reached a settlement with state authorities, legal counsel advised Huggins that it was probable the company would have to pay $300.000 in penalties. Accordingly, the following entry was recorded. Logan 30 de listen 2021, o settlement was reached with state authorities to pay a total of $450 000. In penalties. It the beginning of 2021. Jantzen Specialties, which uses the sum of the years-digits method changed to the straight line mesec onewly equired butings and equipment. The change ricressed rent year net eamings by $565.000 Required yot change 2 entry necessary as ainestres de la welas any sus ng entry for 2021 related to the situation