Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Description Backed by the U . S . government, these financial instruments are fixed - rate debt securities Financial Instrument with a maturity of more

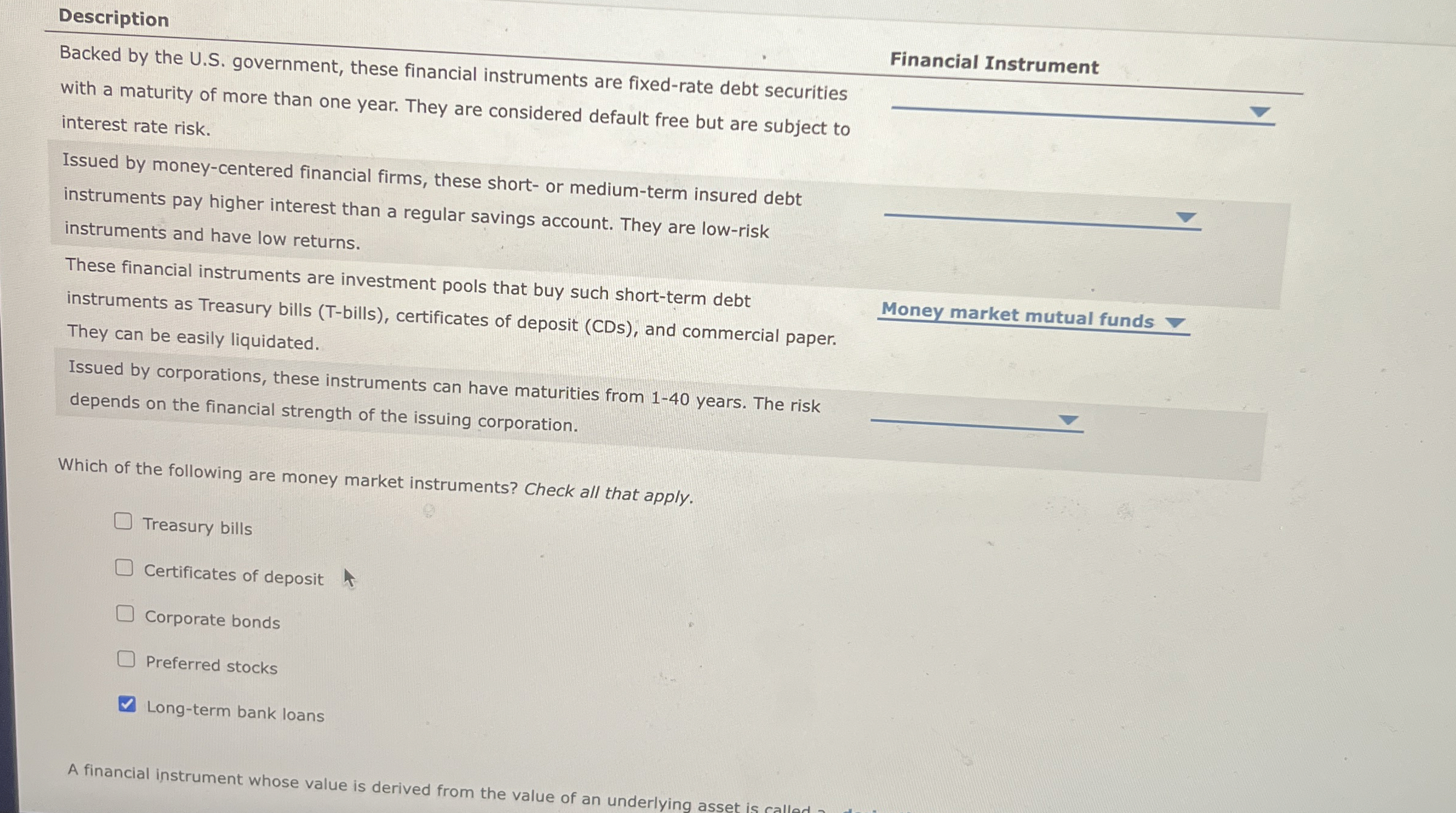

Description

Backed by the US government, these financial instruments are fixedrate debt securities

Financial Instrument with a maturity of more than one year. They are considered default free but are subject to interest rate risk.

Issued by moneycentered financial firms, these short or mediumterm insured debt instruments pay higher interest than a regular savings account. They are lowrisk instruments and have low returns.

These financial instruments are investment pools that buy such shortterm debt instruments as Treasury bills Tbills certificates of deposit CDs and commercial paper. They can be easily liquidated.

Money market mutual funds

Issued by corporations, these instruments can have maturities from years. The risk depends on the financial strength of the issuing corporation.

Which of the following are money market instruments? Check all that apply.

Treasury bills

Certificates of deposit

Corporate bonds

Preferred stocks

Longterm bank loans

A financial instrument whose value is derived from the value of anderlying asset is

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started