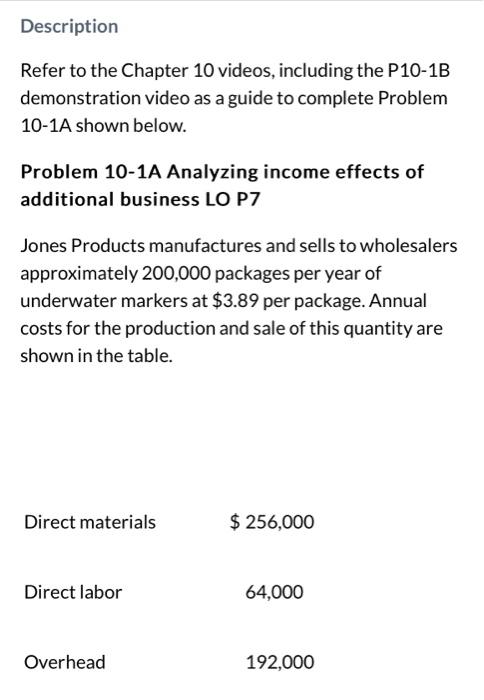

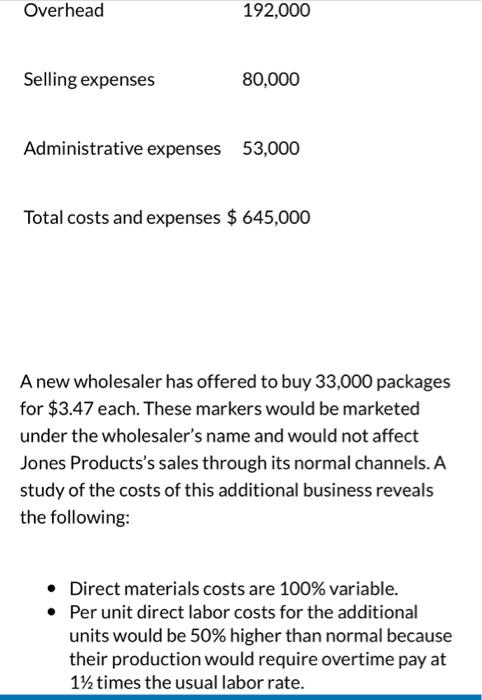

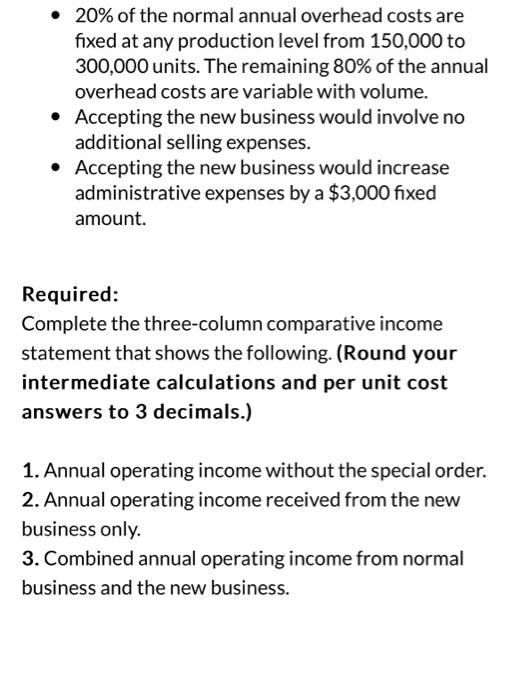

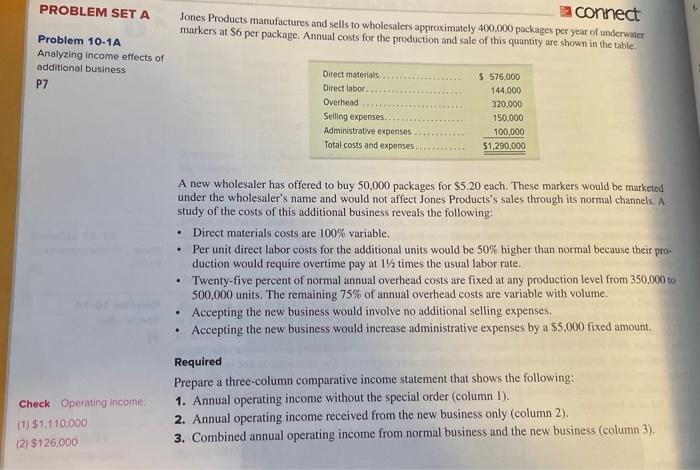

Description Refer to the Chapter 10 videos, including the P10-1B demonstration video as a guide to complete Problem 10-1A shown below. Problem 10-1A Analyzing income effects of additional business LO P7 Jones Products manufactures and sells to wholesalers approximately 200,000 packages per year of underwater markers at $3.89 per package. Annual costs for the production and sale of this quantity are shown in the table. Total costs and expenses $645,000 A new wholesaler has offered to buy 33,000 packages for $3.47 each. These markers would be marketed under the wholesaler's name and would not affect Jones Products's sales through its normal channels. A study of the costs of this additional business reveals the following: - Direct materials costs are 100% variable. - Per unit direct labor costs for the additional units would be 50% higher than normal because their production would require overtime pay at 121 times the usual labor rate. - 20% of the normal annual overhead costs are fixed at any production level from 150,000 to 300,000 units. The remaining 80% of the annual overhead costs are variable with volume. - Accepting the new business would involve no additional selling expenses. - Accepting the new business would increase administrative expenses by a $3,000 fixed amount. Required: Complete the three-column comparative income statement that shows the following. (Round your intermediate calculations and per unit cost answers to 3 decimals.) 1. Annual operating income without the special order. 2. Annual operating income received from the new business only. PROBLEM SET A Jones Products manufactures and sells to wholesalers approximately 400.000 packages per year of underwater Problem 10-1A markers at $6 per package. Annual costs for the production and sale of this quantity are shown in the table. Analyzing income effects of additional business P7 A new wholesaler has offered to buy 50,000 packages for $5.20 each. These markers would be marketed under the wholesaler's name and would not affect Jones Products's sales through its normal channels. A study of the costs of this additional business reveals the following: - Direct materials costs are 100% variable. - Per unit direct labor costs for the additional units would be 50% higher than normal because their production would require overtime pay at 11/2 times the usual labor rate. - Twenty-five percent of normal annual overhead costs are fixed at any production level from 350.000 to 500.000 units. The remaining 75% of annual overhead costs are variable with volume. - Accepting the new business would involve no additional selling expenses. - Accepting the new business would increase administrative expenses by a $5.000 fixed amount. Required Prepare a three-column comparative income statement that shows the following: 1. Annual operating income without the special order (column 1). 2. Annual operating income received from the new business only (column 2 ). $1,110,000 3. Combined annual operating income from normal business and the new business (column 3 )