Question

Desert Company purchased machinery for $960,930 on January 1, 2017. Straight-line depreciation has been recorded based on a $60,330 salvage value and a 5-year

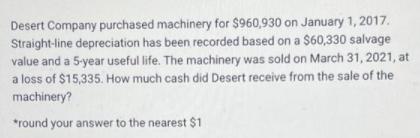

Desert Company purchased machinery for $960,930 on January 1, 2017. Straight-line depreciation has been recorded based on a $60,330 salvage value and a 5-year useful life. The machinery was sold on March 31, 2021, at a loss of $15,335. How much cash did Desert receive from the sale of the machinery? *round your answer to the nearest $1

Step by Step Solution

3.40 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Answer Solution Working A Cost 96093000 B Residual Va...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Using Financial Accounting Information The Alternative to Debits and Credits

Authors: Gary A. Porter, Curtis L. Norton

8th edition

1111534918, 978-1111534912

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App