Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem #1 - On January 1, 2022, Ramos Enterprise acquired bonds of Amazing Widgets, Inc. Additional information concerning the bond investment follows. Par value

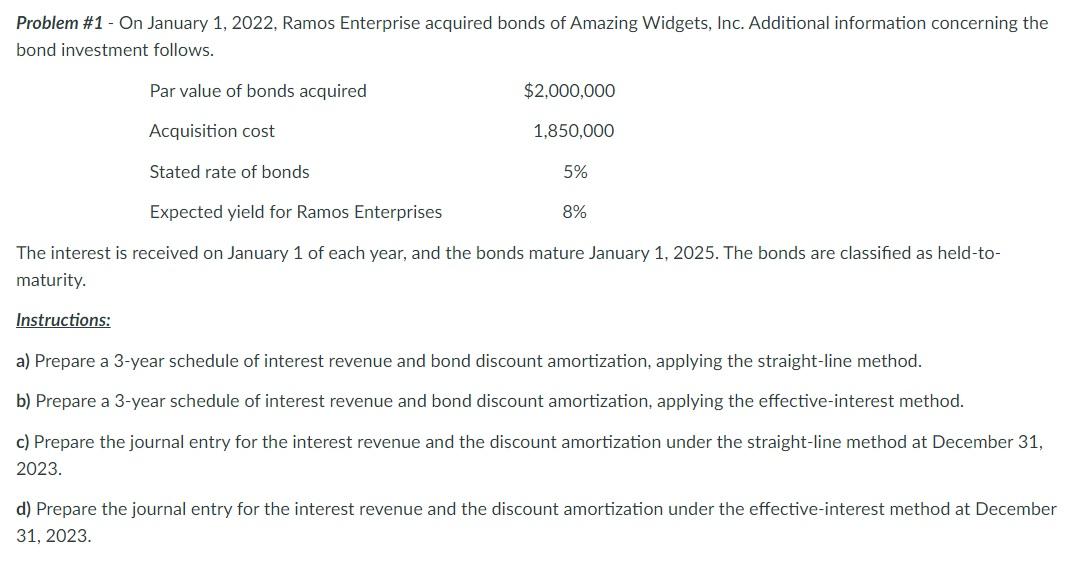

Problem #1 - On January 1, 2022, Ramos Enterprise acquired bonds of Amazing Widgets, Inc. Additional information concerning the bond investment follows. Par value of bonds acquired $2,000,000 Acquisition cost 1,850,000 Stated rate of bonds 5% Expected yield for Ramos Enterprises 8% The interest is received on January 1 of each year, and the bonds mature January 1, 2025. The bonds are classified as held-to- maturity. Instructions: a) Prepare a 3-year schedule of interest revenue and bond discount amortization, applying the straight-line method. b) Prepare a 3-year schedule of interest revenue and bond discount amortization, applying the effective-interest method. c) Prepare the journal entry for the interest revenue and the discount amortization under the straight-line method at December 31, 2023. d) Prepare the journal entry for the interest revenue and the discount amortization under the effective-interest method at December 31, 2023.

Step by Step Solution

★★★★★

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Answer a Amortization Table Date Cash int Recie Interest Revenue Amortization of di...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started