Answered step by step

Verified Expert Solution

Question

1 Approved Answer

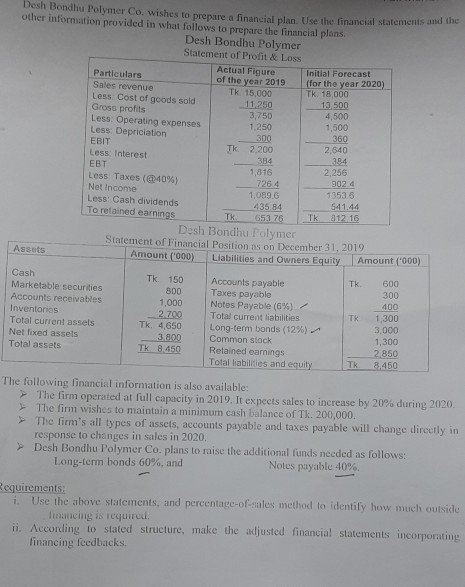

Desh Bondhu Polymer Co. wishes to renare other information provided in what follows to prepare the financial plans financial plan. Use the financial Statements Desh

Desh Bondhu Polymer Co. wishes to renare other information provided in what follows to prepare the financial plans financial plan. Use the financial Statements Desh Bondhu Polymer Statement of Profit & Loss Actual Figure Particulars Initial Forecast of the year 2019 for the year 2020) Sales revenue TK 15,000 TK 18 000 Less: Cost of goods sold 11250 13 500 Gross profils 3.750 4,500 Less: Operating expenses 1.250 1,500 Less: Depriciation 300 360 EBIT Tk 2.200 2,640 Less: Interest 384 EBT 2,256 Less Taxes (40%) 7264 9024 Net Income 1353 6 Less: Cash dividends 435 84 541.44 To retained earnings 653 76 Tk 212 16 Desh Bondhu Polymer Statement of Financial Position as on December 31, 2019 Assets Amount ('000) Liabilities and Owners Equity Amount ('000) 1,816 1,089 G Tk Cash Marketable securities Accounts receivables Inventories Total current assets Net fixed assets Total assets Tk. 150 800 1,000 2 700 Tk. 4,650 3 800 Tk 8.450 TK Accounts payable Taxes payable Notos Payable (6%) Total current liabilities Long-term bonds (12%) Common stock Retained earnings Total liabilities and equity 600 300 400 1.300 3,000 1,300 2,850 8.450 TK The following financial information is also available: The firm operated at full capacity in 2019. It expects sales to increase by 20% during 2020. The firm wishes to maintain a minimum cash balance of Tk. 200,000. The firm's all types of assets, accounts payable and taxes payable will change directly in response to changes in sales in 2020. Desh Bondhu Polymer Co. plans to raise the additional funds needed as follows: Long-term bonds 60%, and Notes payable 40% Requirements: i Use the above statements, and percentage-of-sales method to identify how much outside linuncing is required. ii. According to stated structure, make the adjusted financial statements incorporating financing feedbacks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started