Question

Design a step method to allocate and apportion hotel overheads between the cost centres and profit centres that more fairly reflects the use of overheads

Design a step method to allocate and apportion hotel overheads between the cost centres and profit centres that more fairly reflects the use of overheads by profit and cost centres. Furthermore, justify the bases (cost drivers) you have implemented so that the new system can be better sold to profit centre managers.

You have been asked to devise a more sophisticated and fairer method to allocate and apportion hotel overheads between the 4 cost centres and 4 profit centres. Furthermore, you have been asked to justify the bases you have implemented.

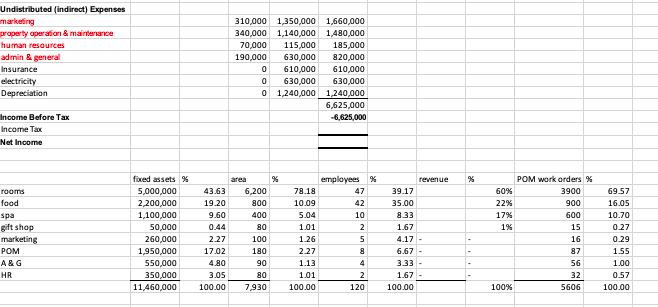

Below are extracts from the coming years projected Income Statement and data relating to the hotels profit and cost centres.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started