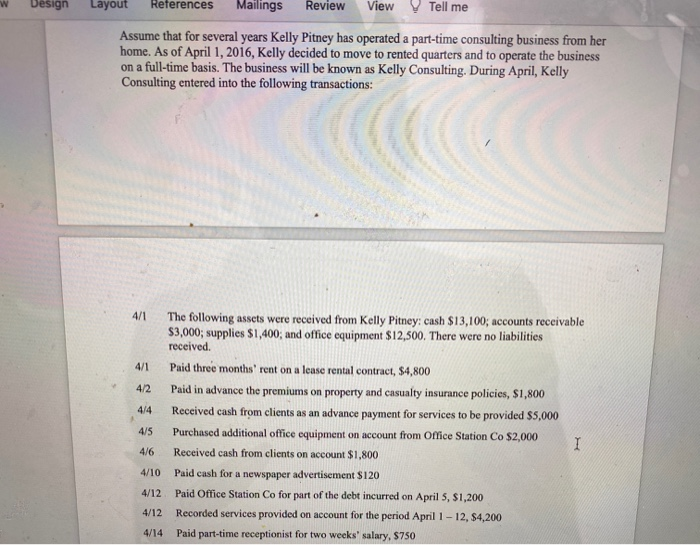

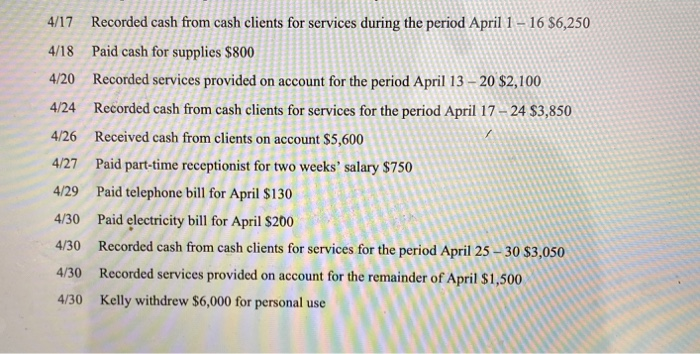

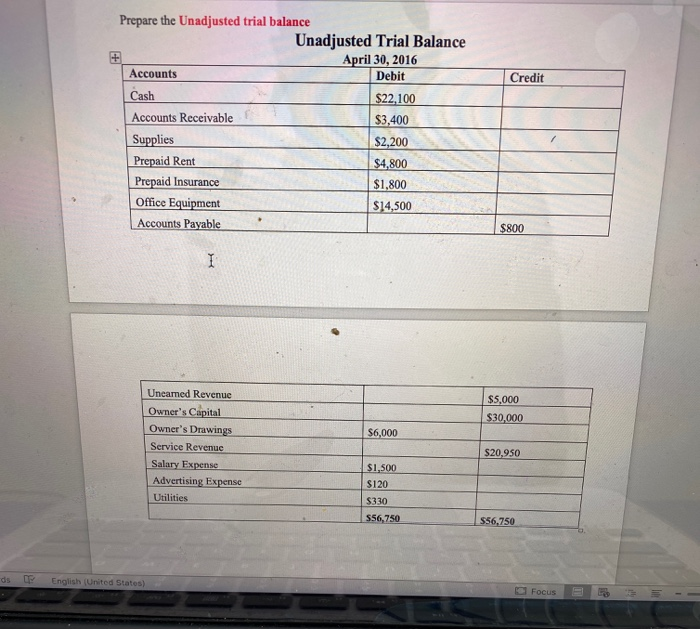

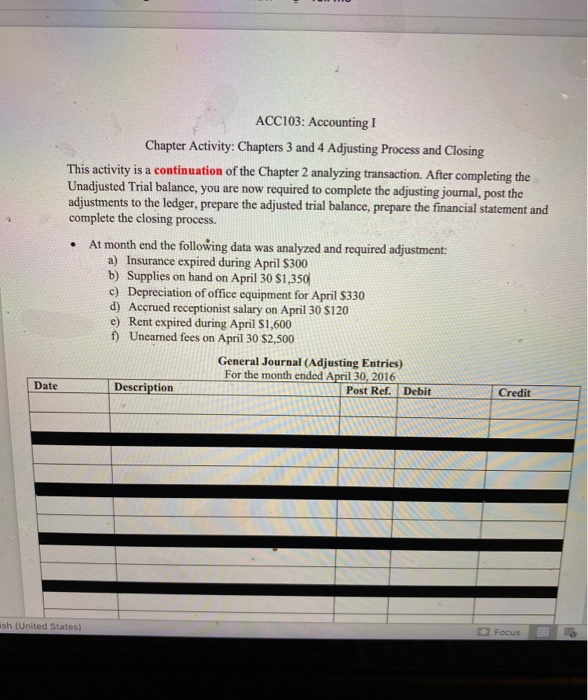

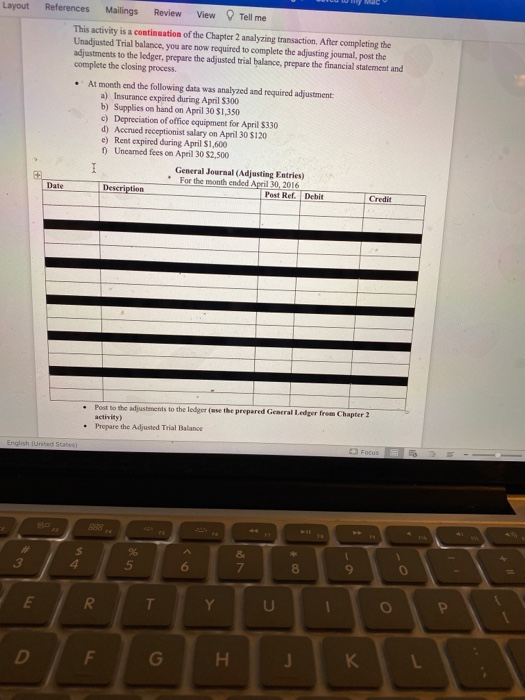

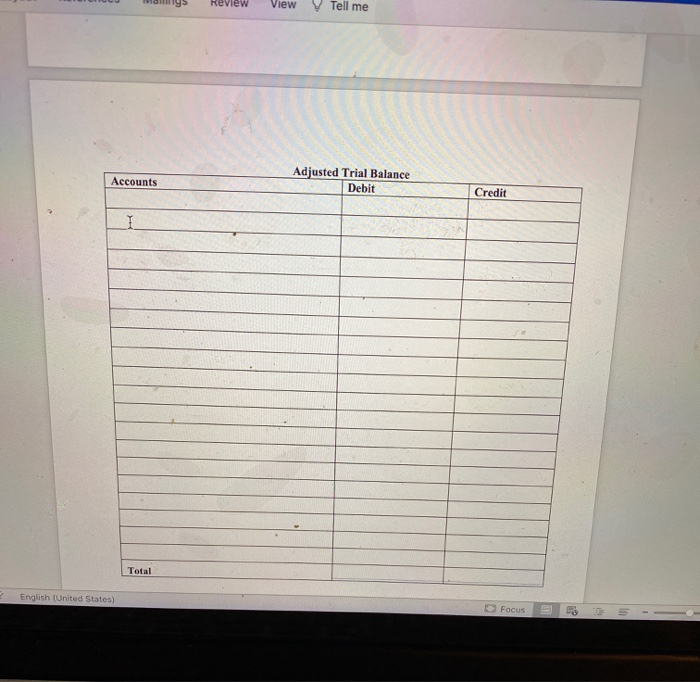

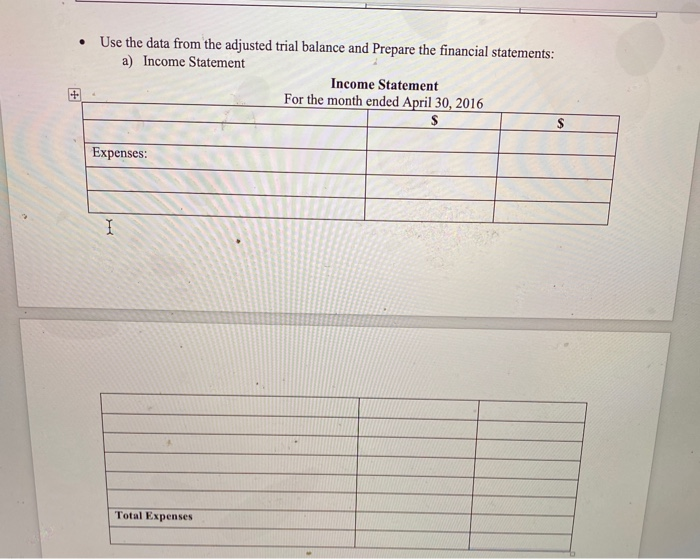

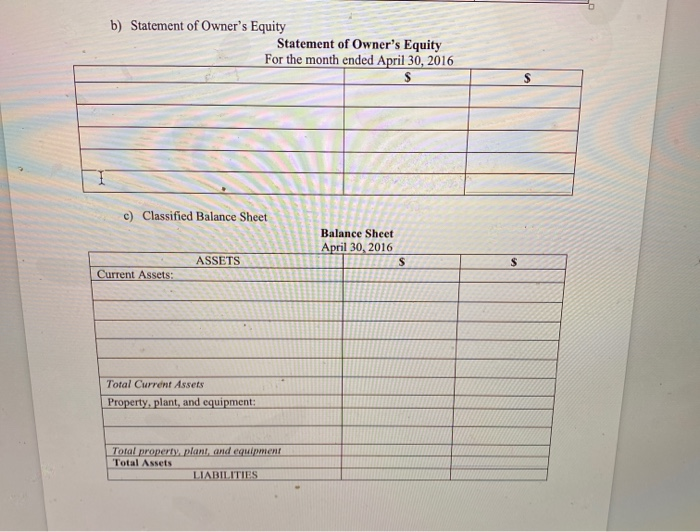

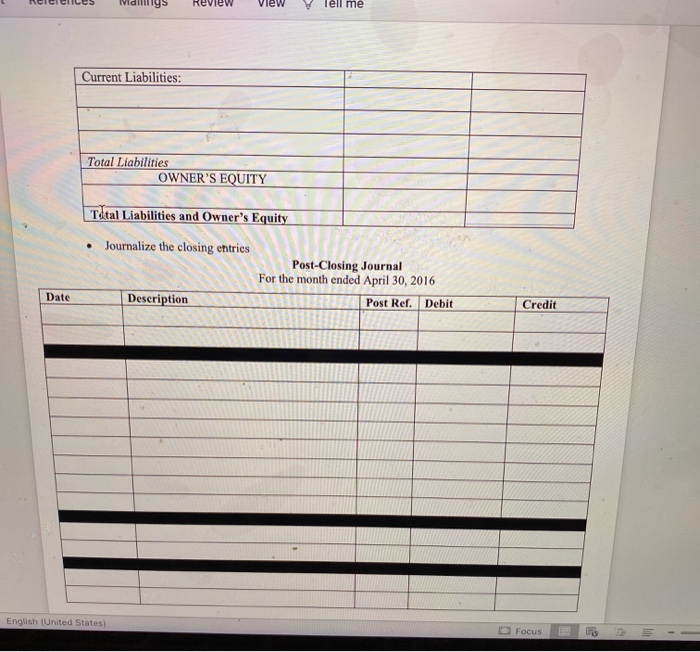

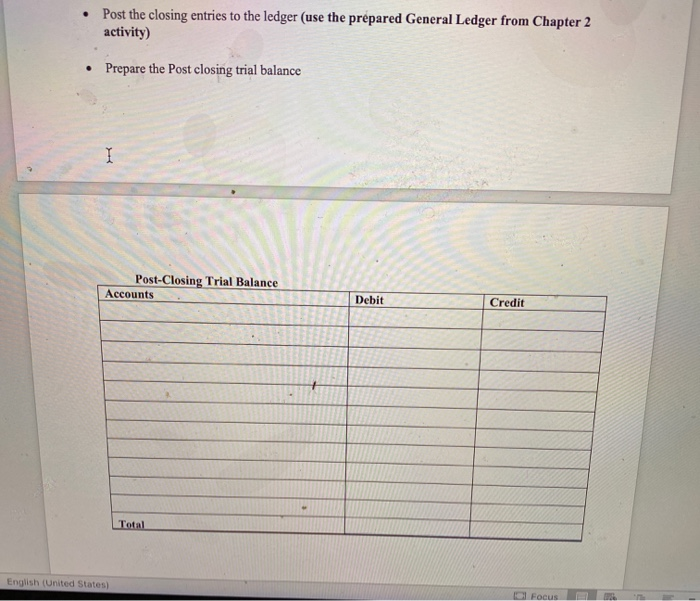

Design Layout References Mailings Review View Tell me Assume that for several years Kelly Pitney has operated a part-time consulting business from her home. As of April 1, 2016, Kelly decided to move to rented quarters and to operate the business on a full-time basis. The business will be known as Kelly Consulting. During April, Kelly Consulting entered into the following transactions: 4/1 The following assets were received from Kelly Pitney: cash $13,100; accounts receivable $3,000; supplies $1,400, and office equipment $12,500. There were no liabilities received. 4/1 Paid three months' rent on a lease rental contract, $4,800 4/2 Paid in advance the premiums on property and casualty insurance policies, $1,800 4/4 Received cash from clients as an advance payment for services to be provided $5,000 4/5 Purchased additional office equipment on account from Office Station Co $2,000 I 4/6 Received cash from clients on account $1,800 4/10 Paid cash for a newspaper advertisement $120 4/12 Paid Office Station Co for part of the debt incurred on April 5, $1,200 4/12 Recorded services provided on account for the period April 1-12, $4,200 4/14 Paid part-time receptionist for two weeks' salary, $750 4/17 Recorded cash from cash clients for services during the period April 1 - 16 $6,250 4/18 Paid cash for supplies $800 4/20 Recorded services provided on account for the period April 13 - 20 $2,100 4/24 Recorded cash from cash clients for services for the period April 17 - 24 $3,850 4/26 Received cash from clients on account $5,600 4/27 Paid part-time receptionist for two weeks' salary $750 4/29 Paid telephone bill for April $130 4/30 Paid electricity bill for April $200 4/30 Recorded cash from cash clients for services for the period April 25 - 30 $3,050 4/30 Recorded services provided on account for the remainder of April $1,500 4/30 Kelly withdrew $6,000 for personal use Credit Prepare the Unadjusted trial balance Unadjusted Trial Balance April 30, 2016 Accounts Debit Cash $22,100 Accounts Receivable $3,400 Supplies $2,200 Prepaid Rent $4,800 Prepaid Insurance $1,800 Office Equipment $14,500 Accounts Payable $800 I $5,000 $30,000 $6,000 Uneamed Revenue Owner's Capital Owner's Drawings Service Revenue Salary Expense Advertising Expense Utilities $20.950 $1,500 $120 $330 556,750 S56,750 ds English (United States) Focus LE ACC103: Accounting 1 Chapter Activity: Chapters 3 and 4 Adjusting Process and Closing This activity is a continuation of the Chapter 2 analyzing transaction. After completing the Unadjusted Trial balance, you are now required to complete the adjusting journal, post the adjustments to the ledger, prepare the adjusted trial balance, prepare the financial statement and complete the closing process. At month end the following data was analyzed and required adjustment: a) Insurance expired during April $300 b) Supplies on hand on April 30 $1,350 c) Depreciation of office equipment for April $330 d) Accrued receptionist salary on April 30 S120 e) Rent expired during April $1,600 f) Unearned fees on April 30 $2,500 General Journal (Adjusting Entries) For the month ended April 30, 2016 Description Post Ref. Debit Credit Date ish (United States) Focus Layout References Mailings Review View Tell me This activity is a continuation of the Chapter 2 analyzing transaction. After completing the Unadjusted Trial balance, you are now required to complete the adjusting journal, post the adjustments to the ledger, prepare the adjusted trial balance, prepare the financial statement and complete the closing process. . At month and the following data was analyzed and required adjustment a) Insurance expired during April $300 b) Supplies on hand on April 30 $1,350 c) Depreciation of office equipment for April 330 d) Accrued receptionist salary on April 30 $120 c) Rent expired during April 1,600 f) Uneamed fees on April 30 $2,500 I General Journal (Adjusting Entries) For the month ended April 30, 2016 Description Post Rel. Debit Credit Date Post to the adjustments to the lodger (use the prepared General Ledger from Chapter 1 activity) Prepare the Adjusted Trial Balance Focus English (United States $ 4 3 . 5 8 7 6 00+ 9 0 E R . Y U 1 P D F G . J . Review View Tell me Accounts Adjusted Trial Balance Debit Credit 1 Total English (United States) Focus . Use the data from the adjusted trial balance and Prepare the financial statements: a) Income Statement Income Statement For the month ended April 30, 2016 S + Expenses: 1 Total Expenses b) Statement of Owner's Equity Statement of Owner's Equity For the month ended April 30, 2016 1 c) Classified Balance Sheet Balance Sheet April 30, 2016 S ASSETS $ Current Assets: Total Current Assets Property, plant, and equipment: Total property, plant, and equipment Total Assets LIABILITIES Review view Tell me Current Liabilities: Total Liabilities OWNER'S EQUITY Total Liabilities and Owner's Equity Journalize the closing entries Post-Closing Journal For the month ended April 30, 2016 Description Post Rer. Debit Date Credit English (United States) O Focus Post the closing entries to the ledger (use the prepared General Ledger from Chapter 2 activity) Prepare the Post closing trial balance I Post-Closing Trial Balance Accounts Debit Credit Total English (United States) Focus