Question

Designer Company issued 10-year bonds on January 1. The 6% bonds have a face value of $800,000 and pay interest every January 1 and July

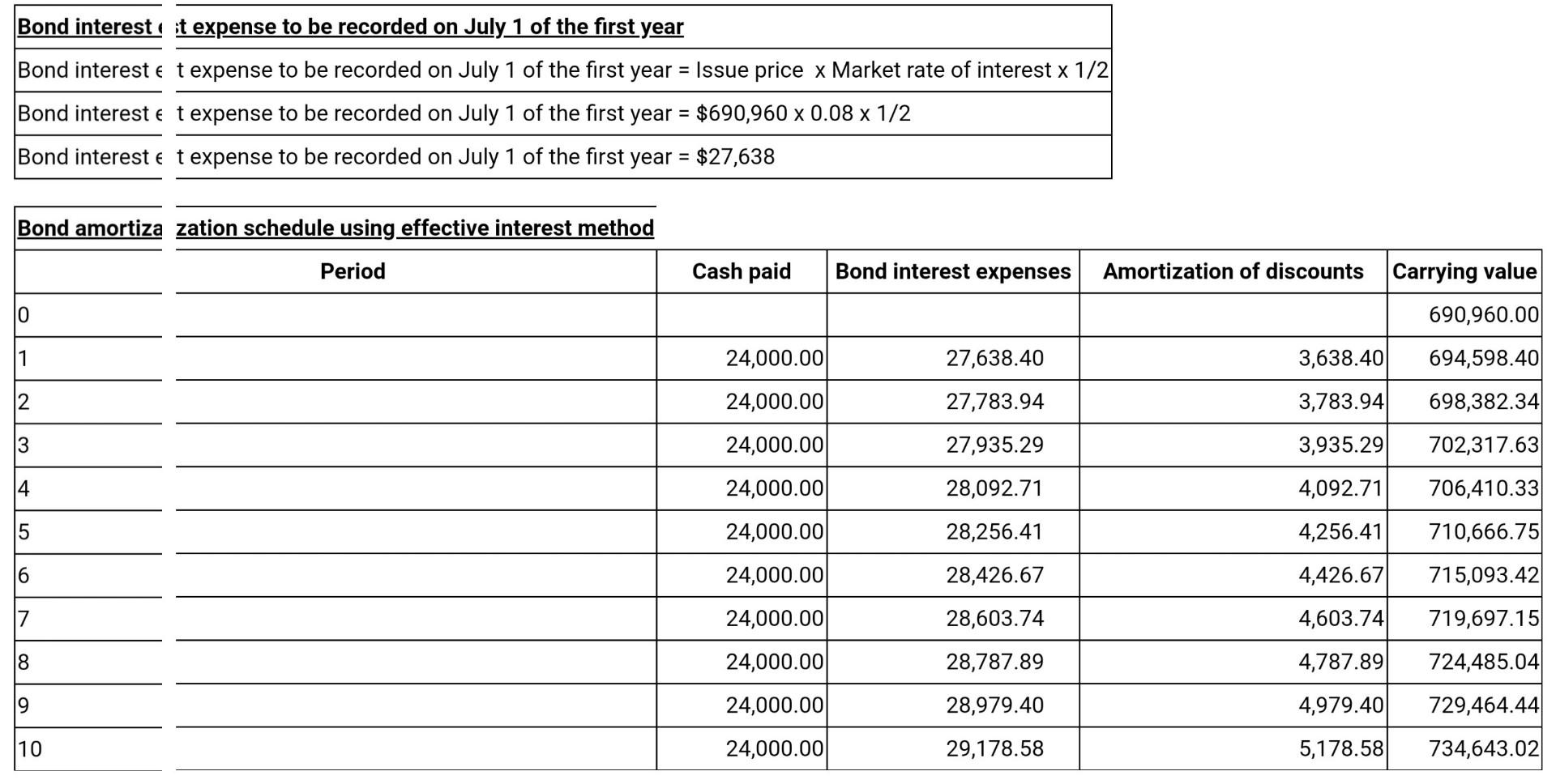

Designer Company issued 10-year bonds on January 1. The 6% bonds have a face value of $800,000 and pay interest every January 1 and July 1. The bonds were sold for $690,960 based on the market interest rate of 8%. Designer uses the effective interest method to amortize bond discounts and premiums. On July 1 of the first year, Designer should record an interest expense (round to the nearest dollar) of ? MAKE THE AMORTIZATION TABLE FOR 5 YEARS USING THE INTEREST RATE METHOD AND MAKE THE FIRST SEMI ANNUAL JOURNAL ENTRY.

QUESTION: Please make the first semiannual journal entry

Bond interest it expense to be recorded on July 1 of the first year Bond interest e t expense to be recorded on July 1 of the first year = Issue price x Market rate of interest x 1/2 Bond interest e t expense to be recorded on July 1 of the first year = $690,960 x 0.08 x 1/2 Bond intereste t expense to be recorded on July 1 of the first year = $27,638 Bond amortiza zation schedule using effective interest method Period Cash paid Bond interest expenses Amortization of discounts Carrying value 0 690,960.00 1 24,000.00 27,638.40 3,638.40 694,598.40 12 24,000.00 27,783.94 3,783.94 698,382.34 13 24,000.00 27,935.29 3,935.29 702,317.63 4 24,000.00 28,092.71 4,092.71 706,410.33 5 24,000.00 28,256.41 4,256.41 710,666.75 6 24,000.00 28,426.67 4,426.67 715,093.42 17 24,000.00 28,603.74 4,603.74 719,697.15 18 24,000.00 28,787.89 4,787.89 724,485.04 9 24,000.00 28,979.40 4,979.40 729,464.44 10 24,000.00 29,178.58 5,178.58 734,643.02Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started