Desperatly in need of help! I started this assignment and it got so out of whack i just started over and need help to see what im doing wrong. all parts if possible please. I got stuck somewhere i just cant tell where i went wrong. if possible, answer needed by 9/10/23. thank you!!!!!

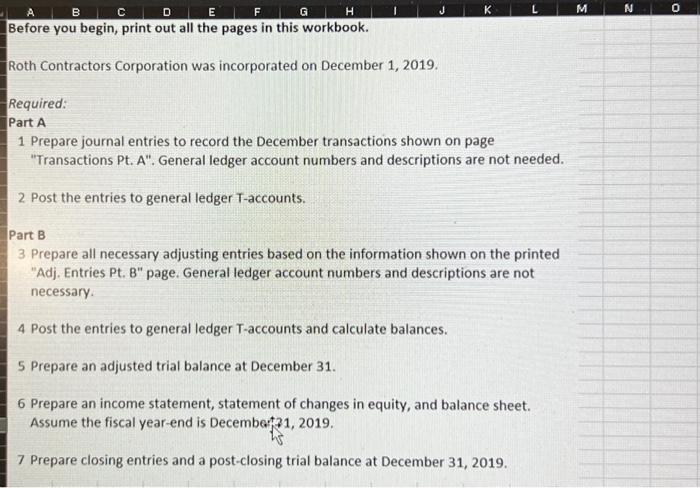

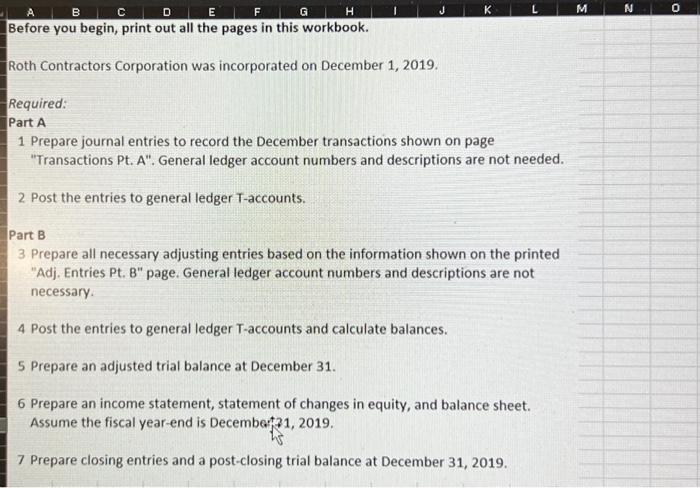

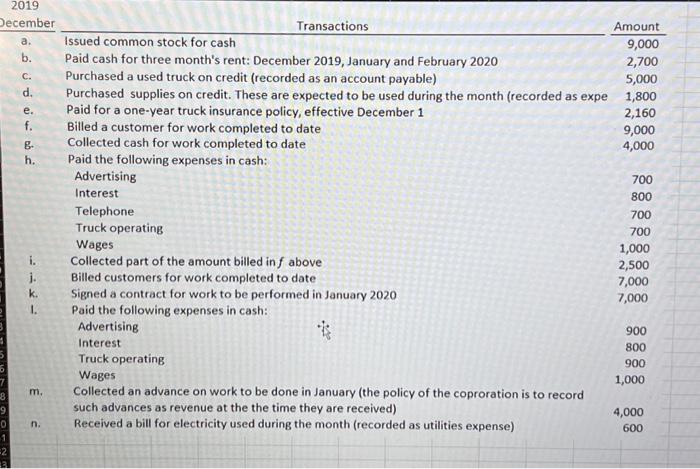

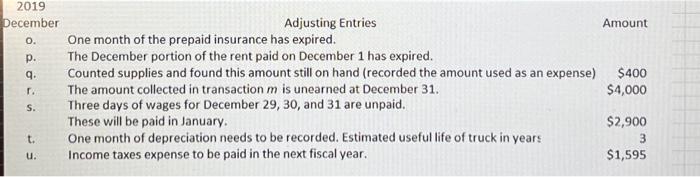

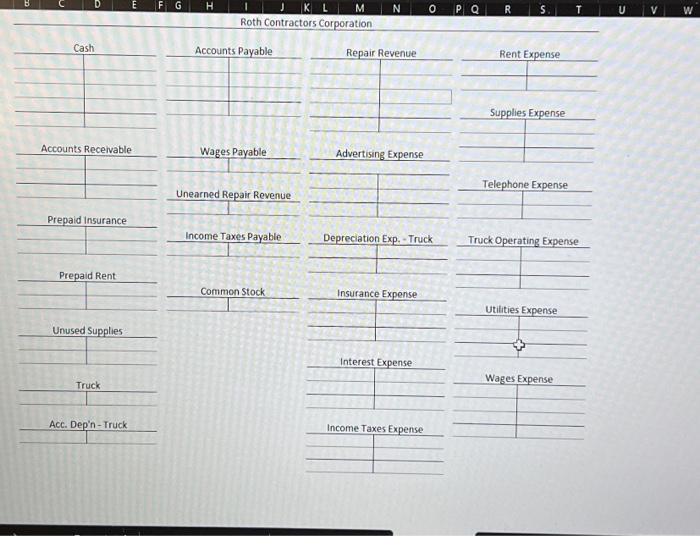

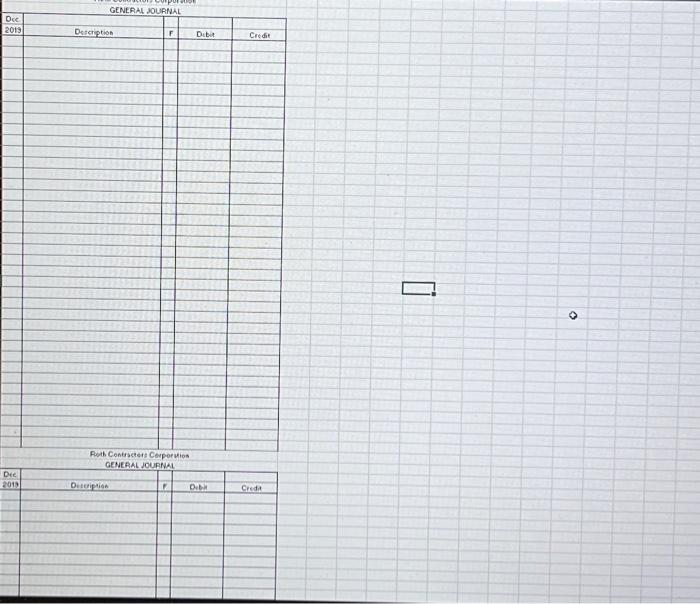

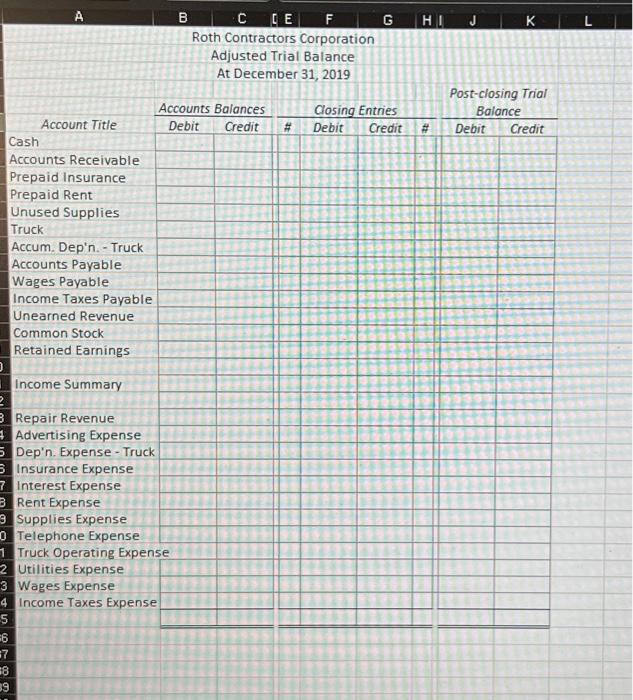

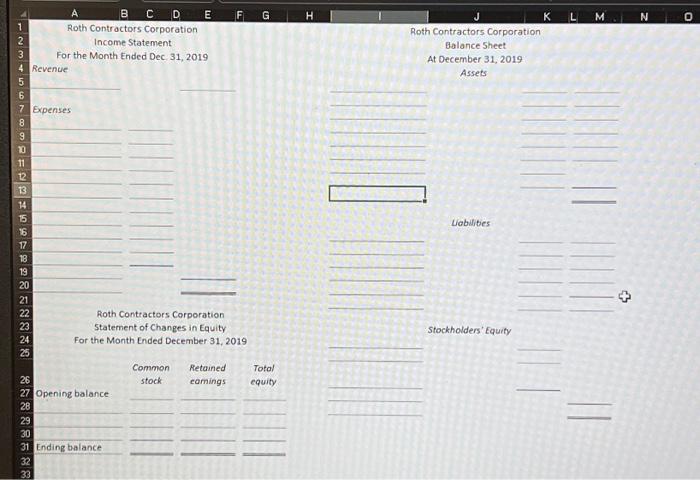

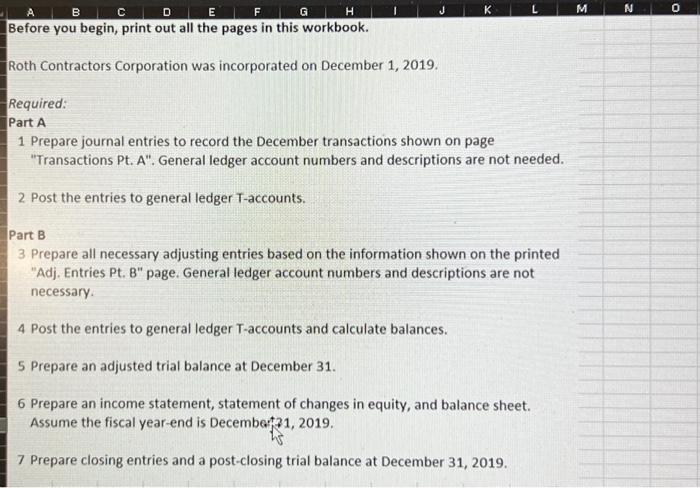

Adjusting Entries Amount o. One month of the prepaid insurance has expired. p. The December portion of the rent paid on December 1 has expired. q. Counted supplies and found this amount still on hand (recorded the amount used as an expense) $400 r. The amount collected in transaction m is unearned at December 31 . s. Three days of wages for December 29,30 , and 31 are unpaid. These will be paid in January. $4,000 These will be paid in January. t. One month of depreciation needs to be recorded. Estimated useful life of truck in years u. Income taxes expense to be paid in the next fiscal year. $2,900 3 $1,595 Roth Contractors Corporation was incorporated on December 1, 2019. Required: Part A 1 Prepare journal entries to record the December transactions shown on page "Transactions Pt. A". General ledger account numbers and descriptions are not needed. 2 Post the entries to general ledger T-accounts. Part B 3 Prepare all necessary adjusting entries based on the information shown on the printed "Adj. Entries Pt. B" page. General ledger account numbers and descriptions are not necessary. 4 Post the entries to general ledger T-accounts and calculate balances. 5 Prepare an adjusted trial balance at December 31. 6 Prepare an income statement, statement of changes in equity, and balance sheet. Assume the fiscal year-end is December 21,2019. 7 Prepare closing entries and a post-closing trial balance at December 31, 2019. 2019 December Transactions a. Issued common stock for cash b. Paid cash for three month's rent: December 2019, January and February 2020 c. Purchased a used truck on credit (recorded as an account payable) d. Purchased supplies on credit. These are expected to be used during the month (recorded as expe e. Paid for a one-year truck insurance policy, effective December 1 f. Billed a customer for work completed to date g. Collected cash for work completed to date h. Paid the following expenses in cash: Advertising Interest Telephone Truck operating Wages i. Collected part of the amount billed in f above j. Billed customers for work completed to date k. Signed a contract for work to be performed in January 2020 I. Paid the following expenses in cash: Advertising Interest Truck operating Wages m. Collected an advance on work to be done in January (the policy of the coproration is to record such advances as revenue at the the time they are received) n. Received a bill for electricity used during the month (recorded as utilities expense) Amount 2,700 5,000 1,800 2,160 9,000 4,000 700 800 700 700 1,000 2,500 7,000 7,000 900 800 900 1,000 4,000 600 Roth Contractors Corporation Prepaid Rent Acc. Dep'n-Truck Common Stock Income Taxes Expense Telephone Expense Truck Operating Expense Utilities Expense Wages Expense Puth Contrseters Couporvios GENERAL JOURNAL Roth Contractors Corporation