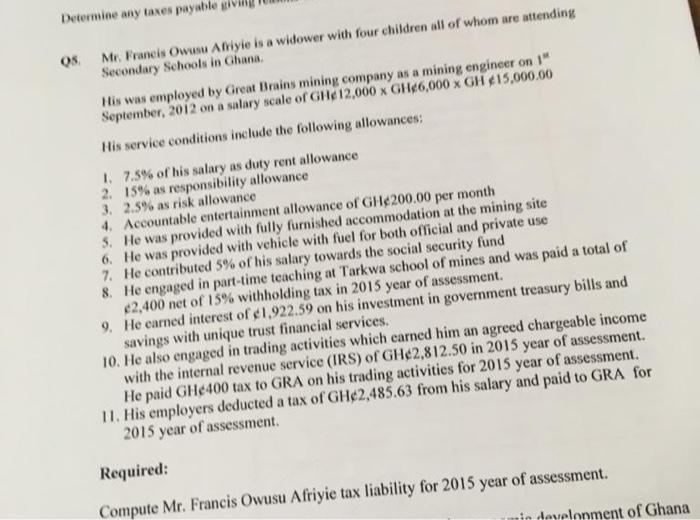

Determine any taxes payable IV OS Me. Francis Owusu Afriyie is a widower with four children all of whom are attending Secondary Schools in Ghana His was employed by Great Brains mining company as a mining engineer on 1" September, 2012 on a salary scale of GH12,000 GH6,000 GH15,000.00 His service conditions include the following allowances: 1.7.5% of his salary as duty rent allowance 2. 15% as responsibility allowance 3. 2.5% as risk allowance 4. Accountable entertainment allowance of GH 200.00 per month 5. He was provided with fully furnished accommodation at the mining site 6. He was provided with vehicle with fuel for both official and private use 7. He contributed 5% of his salary towards the social security fund 8. He engaged in part-time teaching at Tarkwa school of mines and was paid a total of 2,400 net of 15% withholding tax in 2015 year of assessment. 9. He earned interest of 1.922.59 on his investment in government treasury bills and savings with unique trust financial services. 10. He also engaged in trading activities which earned him an agreed chargeable income with the internal revenue service (IRS) of GH2,812.50 in 2015 year of assessment. He paid GH400 tax to GRA on his trading activities for 2015 year of assessment. 11. His employers deducted a tax of GH2,485.63 from his salary and paid to GRA for 2015 year of assessment. Required: Compute Mr. Francis Owusu Afriyie tax liability for 2015 year of assessment. min develonment of Ghana Determine any taxes payable IV OS Me. Francis Owusu Afriyie is a widower with four children all of whom are attending Secondary Schools in Ghana His was employed by Great Brains mining company as a mining engineer on 1" September, 2012 on a salary scale of GH12,000 GH6,000 GH15,000.00 His service conditions include the following allowances: 1.7.5% of his salary as duty rent allowance 2. 15% as responsibility allowance 3. 2.5% as risk allowance 4. Accountable entertainment allowance of GH 200.00 per month 5. He was provided with fully furnished accommodation at the mining site 6. He was provided with vehicle with fuel for both official and private use 7. He contributed 5% of his salary towards the social security fund 8. He engaged in part-time teaching at Tarkwa school of mines and was paid a total of 2,400 net of 15% withholding tax in 2015 year of assessment. 9. He earned interest of 1.922.59 on his investment in government treasury bills and savings with unique trust financial services. 10. He also engaged in trading activities which earned him an agreed chargeable income with the internal revenue service (IRS) of GH2,812.50 in 2015 year of assessment. He paid GH400 tax to GRA on his trading activities for 2015 year of assessment. 11. His employers deducted a tax of GH2,485.63 from his salary and paid to GRA for 2015 year of assessment. Required: Compute Mr. Francis Owusu Afriyie tax liability for 2015 year of assessment. min develonment of Ghana