Answered step by step

Verified Expert Solution

Question

1 Approved Answer

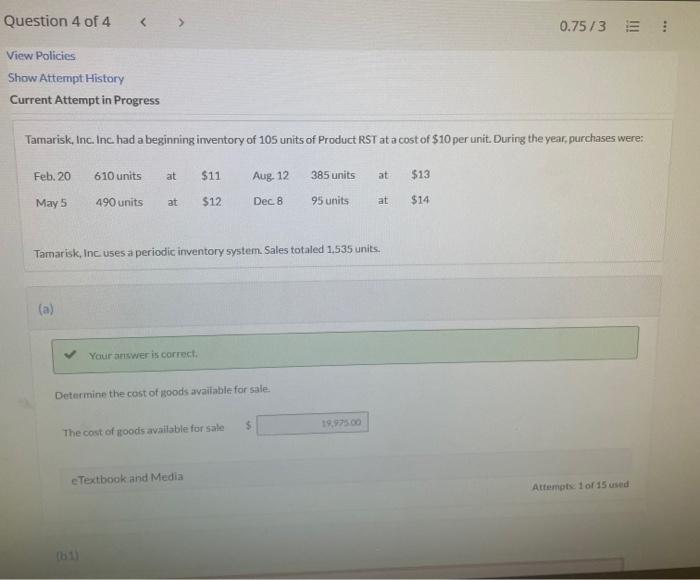

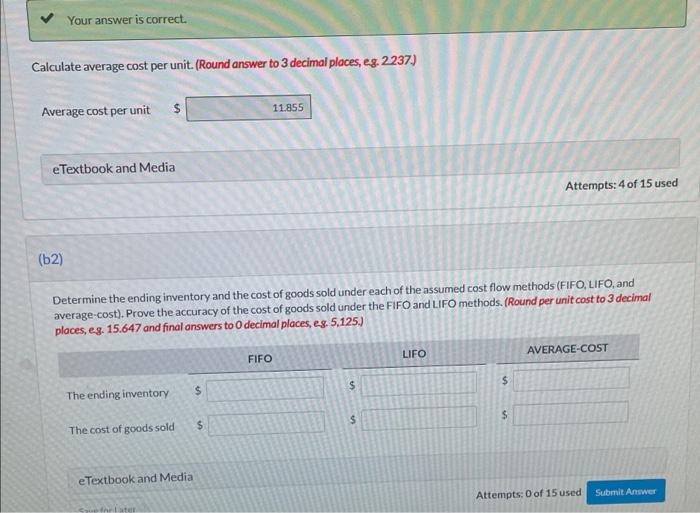

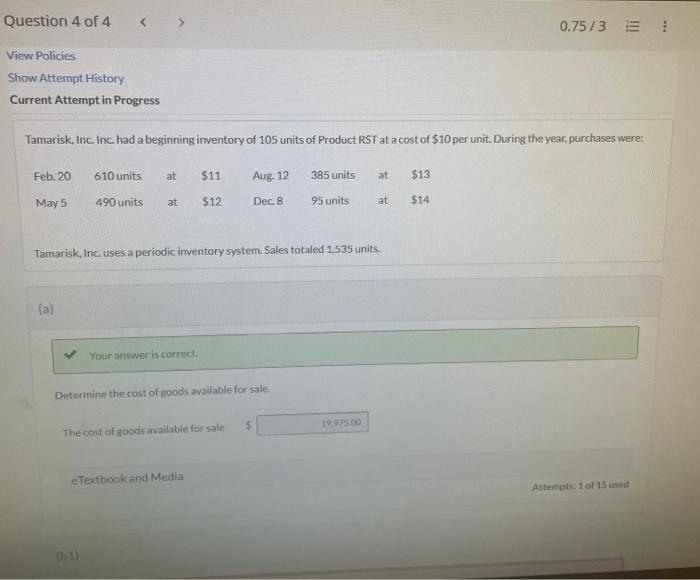

determine FIFO and LIFO and Average cost Question 4 of 4 0.75/3 View Policies Show Attempt History Current Attempt in Progress Tamarisk, Inc. Inc. had

determine FIFO and LIFO and Average cost

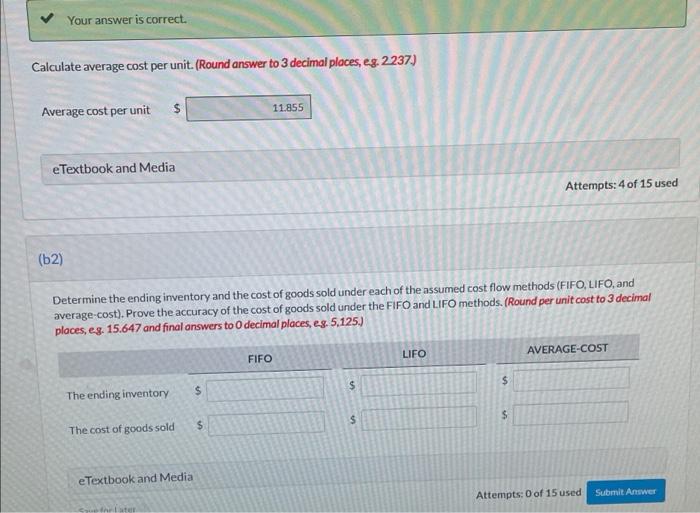

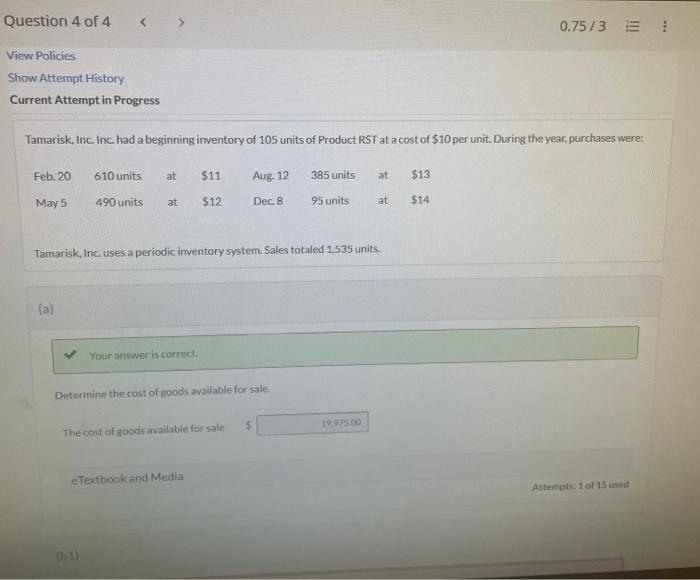

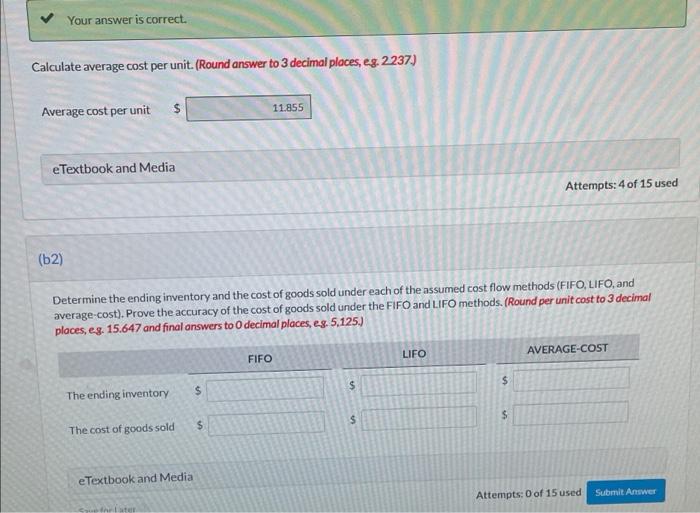

Question 4 of 4 0.75/3 View Policies Show Attempt History Current Attempt in Progress Tamarisk, Inc. Inc. had a beginning inventory of 105 units of Product RST at a cost of $10 per unit. During the year, purchases were: Feb. 20 610 units $11 385 units at $13 at at $12 Aug. 12 Dec. 8 May 5 490 units 95 units at $14 Tamarisk, Inc. uses a periodic inventory system. Sales totaled 1,535 units. (a) Your answer is correct. Determine the cost of goods available for sale. $ 19,975.00 The cost of goods available for sale eTextbook and Media Attempts: 1 of 15 used Your answer is correct. Calculate average cost per unit. (Round answer to 3 decimal places, eg. 2.237.) Average cost per unit 11.855 eTextbook and Media Attempts: 4 of 15 used (62) Determine the ending inventory and the cost of goods sold under each of the assumed cost flow methods (FIFO, LIFO, and average-cost). Prove the accuracy of the cost of goods sold under the FIFO and LIFO methods. (Round per unit cost to 3 decimal places, e.g. 15.647 and final answers to 0 decimal places, e.g. 5,125.) FIFO LIFO AVERAGE-COST The ending inventory $ $ The cost of goods sold $ eTextbook and Media forlater $ $ $ Attempts: 0 of 15 used Submit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started