Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Determine Gross Annual Income Your budget will be based on what your adult salary would be in a starting position of a full-time career.

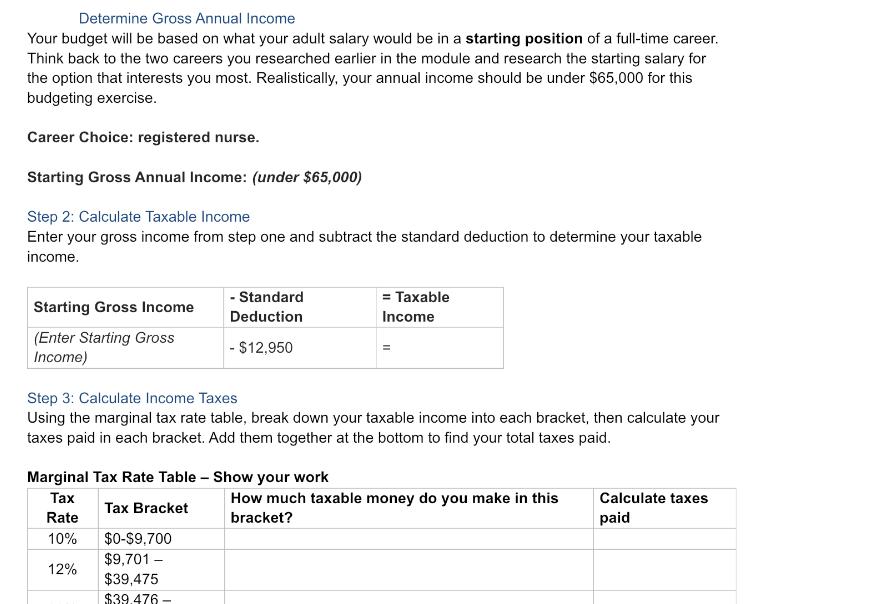

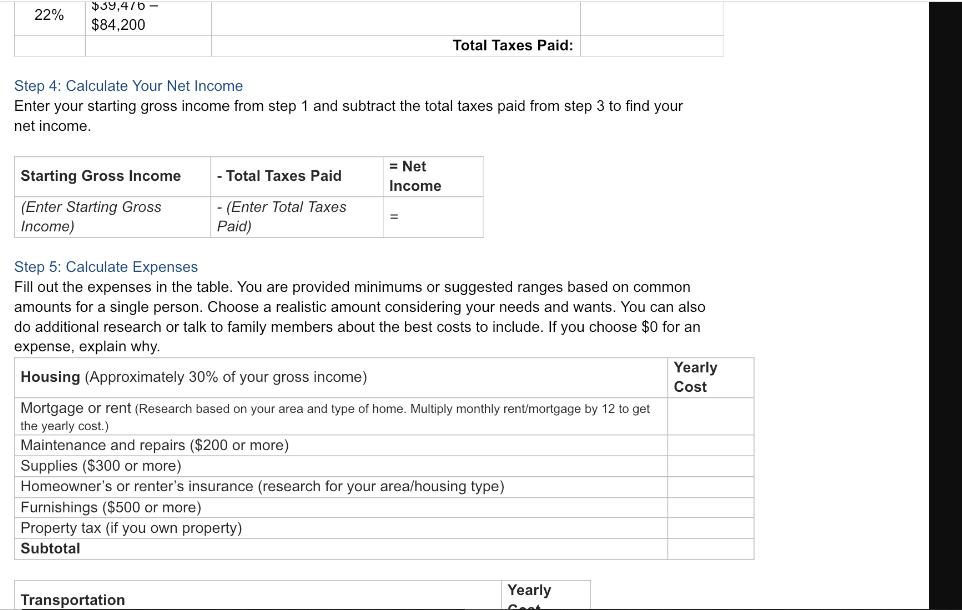

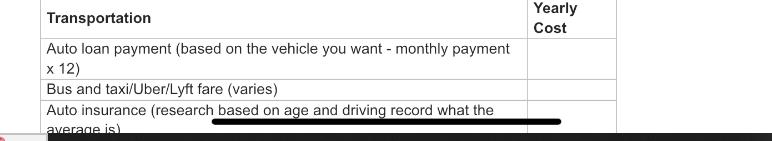

Determine Gross Annual Income Your budget will be based on what your adult salary would be in a starting position of a full-time career. Think back to the two careers you researched earlier in the module and research the starting salary for the option that interests you most. Realistically, your annual income should be under $65,000 for this budgeting exercise. Career Choice: registered nurse. Starting Gross Annual Income: (under $65,000) Step 2: Calculate Taxable Income Enter your gross income from step one and subtract the standard deduction to determine your taxable income. Starting Gross Income - Standard Deduction = Taxable Income (Enter Starting Gross Income) - $12,950 Step 3: Calculate Income Taxes Using the marginal tax rate table, break down your taxable income into each bracket, then calculate your taxes paid in each bracket. Add them together at the bottom to find your total taxes paid. Marginal Tax Rate Table - Show your work Tax Tax Bracket Rate 10% $0-$9,700 $9,701 - 12% $39,475 $39.476- How much taxable money do you make in this bracket? Calculate taxes paid 22% $39,476- $84,200 Total Taxes Paid: Step 4: Calculate Your Net Income Enter your starting gross income from step 1 and subtract the total taxes paid from step 3 to find your net income. Starting Gross Income - Total Taxes Paid = Net Income (Enter Starting Gross Income) - (Enter Total Taxes Paid) Step 5: Calculate Expenses Fill out the expenses in the table. You are provided minimums or suggested ranges based on common amounts for a single person. Choose a realistic amount considering your needs and wants. You can also do additional research or talk to family members about the best costs to include. If you choose $0 for an expense, explain why. Housing (Approximately 30% of your gross income) Mortgage or rent (Research based on your area and type of home. Multiply monthly rent/mortgage by 12 to get the yearly cost.) Maintenance and repairs ($200 or more) Supplies ($300 or more) Homeowner's or renter's insurance (research for your area/housing type) Furnishings ($500 or more) Property tax (if you own property) Subtotal Yearly Cost Transportation Yearly Transportation Auto loan payment (based on the vehicle you want - monthly payment x 12) Bus and taxi/Uber/Lyft fare (varies) Auto insurance (research based on age and driving record what the average is) Yearly Cost 10:33 AM Mon Jan 23 > Untitled document Utilities House Phone and/or cell phone ($600-$1,200) (You should include the monthly bill and the cost of the phone.) Cable or satellite and internet ($950-$2,000) Electric and gas ($1,200-$2,400) Water and sewer ($800-$1,000) Waste removal ($150-$250) Subtotal Yearly Cost Food Groceries ($2,500 or more) Dining out ($600 or more) Subtotal Yearly Cost Personal Care Health insurance ($3,000-$8,000) (You still have to pay for health insurance even if you get it through your job.) Other medical costs ($500 or more) Hair and nails ($120-$500) New Clothing/shopping and laundry costs ($500+) Health club or Gym ($300-$600) Children (If you plan on having a child when starting your career at about ages 18-24, add $14,000 for the year, per child) Subtotal Yearly Cost Entertainment Movies and streaming services ($120-$400) Vacation ($1,000-$2,000) Other (Specific hobby, weekends, etc. $500-$1,000) Subtotal Gifts and Donations Holidays and birthdays ($500+) Charity or religious donations (varies) Other Subtotal Pets Food ($250+) Medical ($200+) Grooming (varies by animal) Toys Other Subtotal Yearly Cost Yearly Cost Yearly Cost Savings and Investments (should total at least 10-20% of your net income split between the 3) Retirement account Investment account Emergency savings Subtotal Step 6: Balance Your Budget Yearly Cost Fill in the net income from step 4. Next, add up the subtotals from step 5 and fill the amount for total yearly expenses. Subtract the expenses from the net income. If you have a large surplus of money left, adjust your budget by adding to different expenses, savings, or investments. If your difference is a negative amount, adjust your expenses to balance your budget. +0 3%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started