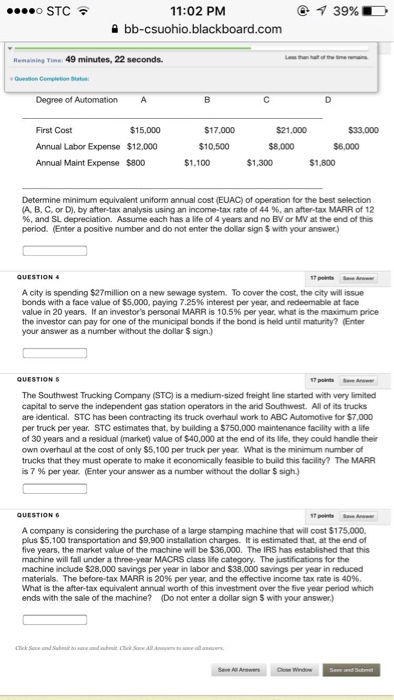

Determine minimum equivalent uniform annual cost (EUAC) of operation for the best selection (A, B, C, or D), by after-lax analysis using an income-tax rate of 44%, an after-tax MARR of 12%, and SL depreciation. Assume each has a life of 4 years and no BV or MV at the end of this period. (Enter a positive number and do not enter the dollar sign exist with your answer) A city is spending exist27 million on a new sewage system. To cover the cost, the city will issue bonds with a face value of exist5,000, paying 7.25% interest per year, and redeemable at face value in 20 years. If an investor's personal MARR is 10.5% per year, what is the maximum price the investor can pay for one of the municipal bonds if the bond is held unit maturity? (Enter your answer as a number without the dollar exist sign.) The Southwest Trucking Company (STC) is a medium-sized freight line started with very limited capital to serve the independent gas station operators in the and Southwest. All of its trucks are identical. STC has been contracting its truck overhaul work to ABC Automotive for exist7,000 per truck per year. STC estimates that, by building a exist750,000 maintenance facility with a life of 30 years and a residual (market) value of exist40,000 at the end of its life, they could handle their own overhaul at the cost of only exist5, 100 per truck per year What is the minimum number of trucks that they must operate to make it economically feasible to build this facility? The MARR is 7% per year. (Enter your answer as a number without the dollar exist sigh.) A company is considering the purchase of a large stamping machine that will cost exist175,000, plus exist5, 100 transportation and exist9, 900 installation charges. It is estimated that, at the end of five years, the market value of the machine will be exist36,000. The IRS has established that this machine will fall under a three-year MACRS Class He category. The justifications for the machine include exist28,000 savings per year in labor and exist38,000 savings per year in reduced materials. The before-tax MARR is 20% per year, and the effective income tax rate is 40%. What is the after-tax equivalent annual worth of this investment over the five year period which ends with the sale of the machine? (Do not enter a dollar sign exist with your answer.)