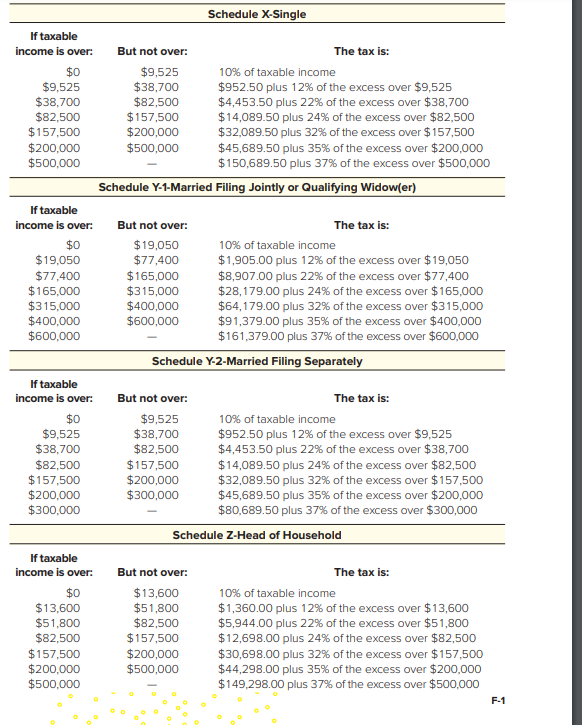

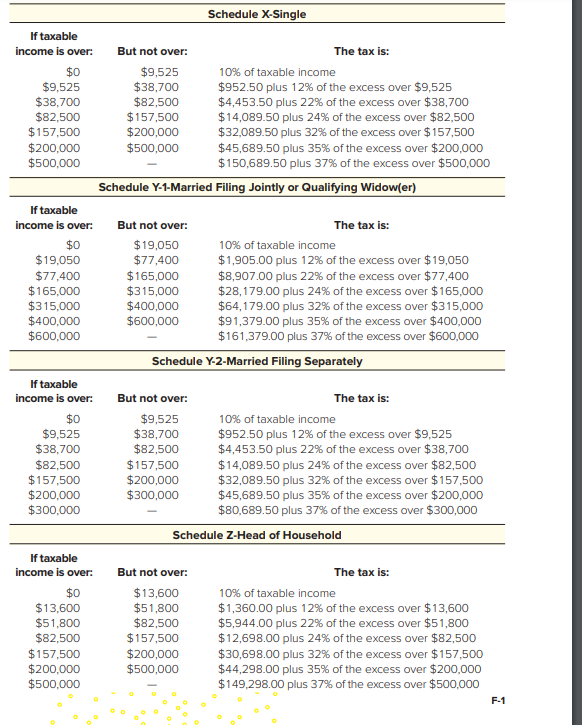

Determine the amount of tax liability in each of the following instances Use the appropriate Tax Tables and Tax Rate Schedules a. A married couple filing jointly with taxable income of $34,191. b. A married couple filing jointly with taxable income of $210,281. c. A married couple filing separately, one spouse with taxable income of $45,085 and the other with $57,418. d. A single person with taxable income of $80,636. e. A single person with taxable income of $324,676. f. A head of household with taxable income of $97,792. g. A qualifying widow with taxable income of $34,311. h. A married couple filing jointly with taxable income of $12,416. (For all requirements, use the Tax Tables for taxpayers with taxable income under $100,000 and the Tax Rate Schedules for those with taxable income above $100,000.) Complete this question by entering your answers in the tabs below. Req a and b Reqc Req d to h a. A married couple filing jointly with taxable income of $34,191. b. A married couple filing jointly with taxable income of $210,281. (Round your intermediate computations to 2 decimal places and final answer to the nearest dollar amount.) Show less Tax liability Req a and b Reqc Req d to h C. A married couple filing separately, one spouse with taxable income of $45,085 and the other with $57,418. Tax liability of spouse having taxable income of $45,085 Tax liability of spouse having taxable income of $57,418 Req a and b Reqc Reqd to h d. A single person with taxable income of $80,636. e. A single person with taxable income of $324,676. (Round your intermediate computations to 2 decimal places and final answer to the nearest dollar amount.) f. A head of household with taxable income of $97,792. g. A qualifying widow with taxable income of $34,311. h. A married couple filing jointly with taxable income of $12,416. Show less Tax liability Schedule X-Single If taxable income is over. $0 $9,525 $38,700 $82,500 $157,500 $200,000 $500,000 But not over: $9,525 $38,700 $82,500 $157,500 $200,000 $500,000 The tax is: 10% of taxable income $952.50 plus 12% of the excess over $9.525 $4,453.50 plus 22% of the excess over $38,700 $14,089.50 plus 24% of the excess over $82,500 $32,089.50 plus 32% of the excess over $157,500 $45,689.50 plus 35% of the excess over $200,000 $ 150,689.50 plus 37% of the excess over $500,000 Schedule Y-1-Married Filing Jointly or Qualifying Widow(er) If taxable income is over: $0 $ 19,050 $77,400 $165,000 $315,000 $400,000 $600,000 But not over: $19,050 $77,400 $ 165,000 $315,000 $400,000 $600,000 The tax is: 10% of taxable income $1,905.00 plus 12% of the excess over $19,050 $8.907.00 plus 22% of the excess over $77,400 $28, 179.00 plus 24% of the excess over $165,000 $64,179.00 plus 32% of the excess over $315,000 $91,379.00 plus 35% of the excess over $400,000 $161,379.00 plus 37% of the excess over $600,000 Schedule Y-2-Married Filing Separately The tax is: If taxable income is over. $0 $9,525 $38,700 $82,500 $157,500 $200,000 $300,000 But not over: $9,525 $38,700 $82,500 $157,500 $200,000 $300,000 10% of taxable income $952.50 plus 12% of the excess over $9,525 $4,453.50 plus 22% of the excess over $38,700 $14,089.50 plus 24% of the excess over $82,500 $32,089.50 plus 32% of the excess over $157,500 $45,689.50 plus 35% of the excess over $200,000 $80,689.50 plus 37% of the excess over $300,000 Schedule Z-Head of Household If taxable income is over. $0 $13,600 $51,800 $82,500 $157,500 $200,000 $500,000 But not over: $13,600 $51,800 $82,500 $157,500 $200,000 $500,000 The tax is: 10% of taxable income $1,360.00 plus 12% of the excess over $13,600 $5,944.00 plus 22% of the excess over $51,800 $12,698.00 plus 24% of the excess over $82,500 $30.698.00 plus 32% of the excess over $157,500 $44,298.00 plus 35% of the excess over $200,000 $149,298.00 plus 37% of the excess over $500,000