Question

Determine the amounts of the following accounts. Show your workings for each item. a)Bad debts expenses for the year ending 31 December 2018 b)Allowance for

Determine the amounts of the following accounts. Show your workings for each item.

a)Bad debts expenses for the year ending 31 December 2018

b)Allowance for doubtful debts at the end of year 2018

c)Bad expenses for the year ending 31 December 2019

d)Allowance for doubtful debts at the end of year 2019

B.Calculate the receivable turnover ratio for year 2019 and comment on the ratio.

C.Discuss the differences between ageing method and percentage of net credit sales method.

D.Using the information provided in the question and your calculation from requirement A, prepare the Current Assets section of the balance sheet as at 31 December 2019.

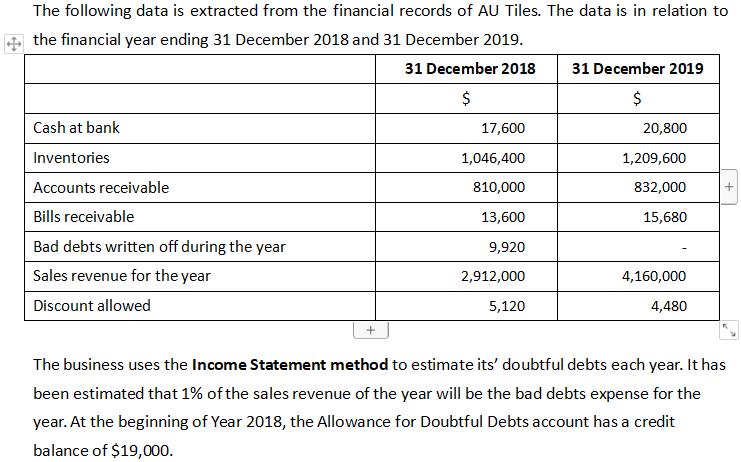

The following data is extracted from the financial records of AU Tiles. The data is in relation to the financial year ending 31 December 2018 and 31 December 2019. 31 December 2018 $ Cash at bank Inventories Accounts receivable Bills receivable Bad debts written off during the year Sales revenue for the year Discount allowed 17,600 1,046,400 810,000 13,600 9,920 2,912,000 5,120 31 December 2019 $ 20,800 1,209,600 832,000 15,680 4,160,000 4,480 The business uses the Income Statement method to estimate its' doubtful debts each year. It has been estimated that 1% of the sales revenue of the year will be the bad debts expense for the year. At the beginning of Year 2018, the Allowance for Doubtful Debts account has a credit balance of $19,000.

Step by Step Solution

3.46 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

a Bad debts expenses for the year ending 31 December 2018 Bad debts expenses for the year ending 31 December 2018 can be calculated using the Income Statement method Bad debts expenses Sales revenue b...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started